Toronto, Ontario--(Newsfile Corp. - December 22, 2025) - Royal Road Minerals Limited (TSXV: RYR) (OTCQB: RRDMF) ("Royal Road" or the "Company") is pleased to provide an exploration update for its activities in Colombia and the Kingdoms of Saudi Arabia and Morocco.

Colombia

In Colombia, work is advancing on finalizing drill locations and preparing for the upcoming drilling program at the Company's Guintar-Aleman-Margaritas ("GAM") project. A drone-borne magnetic survey is nearing completion and is being used to refine geological interpretation and focus drill-targeting across the project area.

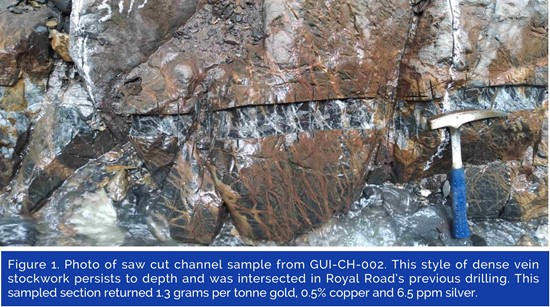

Initial drill pads have been positioned on surface-exposed porphyry-style vein stockworks located approximately 100 meters from previous drilling (see Figure 1). These areas have returned continuous (saw-cut) channel sample results including 24.2 meters at 0.9 grams per tonne gold, 16.2 grams per tonne silver and 0.3% copper, and 15.7 meters at 0.9 grams per tonne gold, 9 grams per tonne silver and 0.5% copper (see press release September 29, 2025).

Figure 1

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/4008/278818_figure_1.jpg

Following initial drilling, the program is expected to expand into new, previously undrilled targets within the contiguous Guintar North porphyry area and into sheeted gold veins at El Aleman, where historical drilling intersected 80.5 meters at 1.0 grams per tonne gold, including 18 meters at 3.0 grams per tonne gold (see press release June 28, 2022).

Final drill collar verification is scheduled for early January. A drill contract has been executed, and drilling is expected to commence before the end of the month.

Saudi Arabia

Royal Road conducts its exploration activities in Saudi Arabia through its local subsidiary, Royal Road Arabia ("RRA"), a joint-venture company owned on a 50:50 basis by Royal Road and MIDU Company Limited ("MIDU"). MIDU is a Saudi Arabian investment holding company headquartered in Jeddah, with interests spanning mining, industrial, real estate development and utilities.

At the Company's Jabal Sahabiyah project, reverse circulation drilling is currently underway testing sheeted gold-vein and gold-mineralized vein-breccia systems at the Al Habah and Ash Shajjah prospects. Both systems have returned positive rock-chip channel results, including 10 meters at 2.2 grams per tonne gold and 6 meters at 15.0 grams per tonne gold from Ash Shajjah (see press release November 17, 2025). The mineralized systems extend over kilometer-scale strike lengths and, in the case of Al Habah, achieve aggregate sheeted vein thicknesses exceeding 30 meters.

Royal Road Arabia has been awarded seven additional exploration licenses as part of the Ministry of Industry and Mineral Resources' Round 9 tender process. The licenses cover three areas (As Saq'ah, Jabal Musamah and Al Neqrah) and carry an initial five-year term, renewable for additional five-year periods to a maximum of fifteen years. Each license carries a minimum expenditure commitment of SAR 225,000 (approximately US$65,000) over the first two years and requires the lodgement of a Performance Financial Guarantee equal to 15% of the minimum expenditure commitment, either in cash or by bank guarantee. Grant of full title to the licenses is conditional upon submission and approval of detailed work programs together with environmental and social management plans by the Ministry of Industry and Mineral Resources. This approval process is expected to be completed in early 2026.

The newly awarded licenses are located within the Nabitah Mobile Belt, a highly prospective geological corridor that also hosts the Company's Jabal Sahabiyah project. The belt is characterized by numerous gold, copper and zinc occurrences hosted in greenschist- to amphibolite-facies metasedimentary and granitoid rocks and includes the Bulghah Gold Mine operated by Ma'aden, which reports a current mineral resource of 54.5 Mt at 1.0 gram per tonne gold.

At As Saq'ah, preliminary reconnaissance sampling returned rock-chip assays of up to 51.0 grams per tonne gold and 2.41% copper (gold range: 0.01-51.0 grams per tonne, mean: 6.2 grams per tonne, copper range: 8-24,100 ppm, mean: 4,009 ppm). Mineralization is associated with a northeast-trending fault zone developed along the contact between metavolcanic and metasedimentary units, locally marked by visible copper oxides.

The co-joining Jabal Musamah licenses are prospective for gold mineralization in two distinct settings. In the northwest, mineralization appears structurally controlled along folded shear zones, with preliminary sampling returning assays up to 3.3 grams per tonne gold (range: 0.01-3.3 grams per tonne, mean: 1.39 grams per tonne). In the southeast, gold mineralization is interpreted to be intrusion-related, hosted in folded quartz veins that returned values up to 6.3 grams per tonne gold (range: 0.01-6.3 grams per tonne, mean: 1.19 grams per tonne).

The Al Neqrah licenses represent a significant greenfields exploration opportunity and encompass areas of strong geochemical and geophysical prospectivity, including zones with elevated gold, arsenic, copper and molybdenum values and a broad low-magnetic response interpreted to represent the same geological sequence that hosts the Bulghah Gold Mine approximately 40 kilometers to the south.

Royal Road plans an initial, aggressive "drill or drop" exploration campaign across the three project areas, combining license-scale geological mapping and prospecting with systematic sampling, trenching, soil geochemistry and drone-based magnetic surveys to rapidly delineate priority drill targets.

The Company continues to evaluate additional exploration opportunities in the Kingdom, including those expected to be offered in the forthcoming Tender Round 10.

Morocco

In Morocco, work remains focused on the Company's option agreement over the Lalla Aziza project (see press release July 14, 2025) and the transfer of the Lalla Aziza copper mining license to Royal Road's wholly owned Moroccan subsidiary, Mineraux Chemin Réel. Activities are centred on title consolidation and advancing the project toward the next phase of exploration.

"We end 2025 with a strong sense of momentum," said Tim Coughlin, Royal Road's President and CEO. "Drilling at GAM in Colombia is now imminent and represents a pivotal moment for the Company, while our growing project portfolio in Saudi Arabia and the advancement of the Lalla Aziza copper license in Morocco provide meaningful opportunity and valuable diversity across our exploration pipeline. We believe these programs have the potential to deliver valuable results in the year ahead."

About Royal Road Minerals:

Royal Road Minerals is a mineral exploration and development company with its head office and technical-operations center located in Jersey, Channel Islands. The Company is listed on the TSX Venture Exchange under the ticker RYR, on the OTCQB under the ticker RRDMF and on the Frankfurt Stock Exchange under the ticker RLU. The Company's mission is to apply expert skills and innovative technologies to the process of discovering and developing copper and gold deposits of a scale large enough to benefit future generations and modern enough to ensure minimum impact on the environment and no net loss of biodiversity. The Company currently explores in Colombia, the Kingdoms of Saudi Arabia and Morocco. More information can be found on the Company's website www.royalroadminerals.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

The scientific and technical information contained in this news release has been prepared, reviewed and approved by Dr. Tim Coughlin, BSc (Geology), MSc (Exploration and Mining Geology), PhD, FAusIMM, President and Chief Executive Officer of Royal Road Minerals Limited and a Qualified Person as defined under National Instrument 43-101.

Cautionary statement:

This news release contains certain statements that constitute forward-looking information and forward-looking statements within the meaning of applicable securities laws (collectively, "forward-looking statements") describing the Company's future plans and the expectations of its management that a stated result or condition will occur. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the Company, or developments in the Company's business or in the mineral resources industry, to differ materially from the anticipated results, performance, achievements or developments expressed or implied by such forward-looking statements. Forward-looking statements include all disclosure regarding possible events, conditions or results of operations that is based on assumptions about, among other things, future economic conditions and courses of action, and assumptions related to government approvals, and anticipated costs and expenditures. The words "plans", "prospective", "expect", "intend", "intends to" and similar expressions identify forward looking statements, which may also include, without limitation, any statement relating to future events, conditions or circumstances. Forward-looking statements of the Company contained in this news release, which may prove to be incorrect, include, but are not limited to the Company's exploration plans.

The Company cautions you not to place undue reliance upon any such forward-looking statements, which speak only on the date they are made. There is no guarantee that the anticipated benefits of the Company's business plans or operations will be achieved. The risks and uncertainties that may affect forward-looking statements include, among others: economic market conditions, anticipated costs and expenditures, government approvals, and other risks detailed from time to time in the Company's filings with Canadian provincial securities regulators or other applicable regulatory authorities. Forward-looking statements included herein are based on the current plans, estimates, projections, beliefs and opinions of the Company management and the Company does not undertake any obligation to update forward-looking statements should assumptions related to these plans, estimates, projections, beliefs and opinions change.

Quality Assurance and Quality Control

Sample preparation and analyses in Colombia are conducted according to standard industry procedures. Drill core and saw-cut channel samples are crushed, split and pulverized prior to analysis of Gold by fire assay and Atomic Absorption and multi-elements by ICP-AES and ICP-MS after four acid digestion. Soil samples are sieved to -200 mesh and analyzed for Gold by fire assay and ICP AES and multi-elements by ICP-AES and ICP-MS after aqua regia digestion. Analytical performance is monitored by means of certified reference materials (CRMs), coarse blanks, coarse and pulp duplicate samples. Surface samples have been prepared in ALS Chemex preparation lab in Colombia and analyses have been completed in ALS Chemex Lima.

Chip-Channel samples in Saudi Arabia were collected on continuous 1 meter intervals across exposed sheeted veins and surrounding host rock. Samples of between 1 to 2kg were collected along the sampling interval using a hammer and chisel. All rock-chip samples were bagged in the field and sent to ALS Jeddah for gold and multi-elements analysis (Gold-ICP22 and ME-MS61. Select samples were also analyzed using a screen analysis technique to account for coarse gold (method Gold-SCR24). QAQC materials including CRMs, Blanks, and Duplicates were inserted into the sample batch on a ratio of 1:20.

Contact

Tim Coughlin

Royal Road Minerals Limited

info@royalroadminerals.com

+44 1534 887166

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/278818