Vancouver, British Columbia--(Newsfile Corp. - October 12, 2021) - Silver Sands Resources Corp. (CSE: SAND) (OTCQB: SSRSF) ("Silver Sands" or the "Company") is pleased to report the commencement of its fully funded $US900k Phase III exploration program at its Virginia Silver Project in Santa Cruz Province, Argentina.

Following up on a highly successful Phase I and Phase II program, Phase III comprises a total of 2685 metres in 16 holes targeting 7 different silver vein structures, plus the Santa Rita silver-gold prospect. Phase III drilling will continue to focus on gaps and extensions of principal veins and also includes testing some deeper vein extensions. Previous drilling has tested mineralization at depths from surface to only 150 meters deep. Phase I and Phase II drilling completed in 2020/2021 demonstrated the existence of significant silver mineralization that has not out cropped on the surface especially in the south and the south-east areas of the property.

Drilling will focus on expanding high grade silver mineralization open along strike, and at depth, within the Ely, Martina and Julia vein structures that currently host conceptual open pits at Ely North, Ely Central, Martina and Julia South. The program will also include testing vein structures or mineralization at four other targets plus the Santa Rita silver-gold prospect 15 km to the north of the Virginia discovery. Santa Rita was previously explored by Mirasol in 2005-2007 including 2,048m of drilling. Surface sampling highlights included 340 g/t silver and 1.23 g/t gold and channel sample highlights included 309 g/t silver and 0.63 g/t gold over 4m. New drill targets have been developed at Santa Rita based on a reinterpretation of the exploration and drilling data and structure.

In addition, the next block to the northeast of the Virginia Vein Field will be the focus of the extremely successful Pole Dipole Induced Polarization (PDP IP) survey. The PDP IP follows up the earlier gradient array IP to define and sharpen the linear chargeability anomalies that are yielding responses similar to the known vein structures within the Virginia Vein Field.

Phase III Virginia Vein Field Drill Plan

Ely Central

Ely Central hosts a 580m gap between the Ely South and Ely North conceptual pits. Drilling along a 200m section of this during Phase I and Phase II delivered silver mineralization in all four holes. Two holes will be directed at testing the mineralization: one to depth and one along strike.

Highlights of previous drilling include:

- 639 g/t Ag over 9.60m

- 625 g/t Ag over 10.80m, including 1,110 g/t Ag over 5.70m

- 560 g/t Ag over 9.98m, including 1,578 g/t Ag over 2.87m

- 233.54 g/t Ag over 9.25m, including 441.71 g/t Ag over 4.5m

Ely North

Ely North Extension hosts a 400m gap to the north of the Ely North conceptual pit. Widely spaced drilling in Phase I and Phase II hit silver mineralization in two holes 350m apart. The discovery of strong veining and silver mineralization in previously untested lower intensity IP chargeability at Ely North Extension opens numerous possibilities within the current mineral resource area. Two holes will test the mineralization at depth and beneath the Phase I and Phase II holes.

Previous drill intercepts included:

- 476 g/t Ag over 4.0m, including 929 g/t Ag over 1.85m

- 91 g/t Ag over 7.5m

Julia South

Phase I and Phase II drilling at Julia South / Julia South Extension has a identified a potential 400m shoot of silver mineralization to the south of the Julia South conceptual pit. One hole will test mineralization to depth.

Previous drill intercepts include:

- 360 g/t silver over 0.4m

- 259 g/t silver over 0.7m

- 192 g/t silver over 5.5m, including 372 g/t silver over 1.6m

- 140.27 g/t silver over 4.2m, including 483 g/t silver over 0.35m

- 123.43 g/t silver over 8.5m, including 168.34 g/t silver over 3.9m

Martina

Three vein segments have been identified at Martina: NW, SE and SW. Martina NW is a 200m gap to the north of the existing Martina conceptual pit. Phase II drilling returned 190 g/t silver of 5.9 metres. One hole will test below this drill intersection. The geological evidence, as interpreted by the Mirasol team, indicates the Virginia Vein Field is tilted to the east, meaning the silver mineralized shoots will be deeper on the eastern side of the field.

Martina SE lies in a 450m gap to the south of the Martina conceptual pit. Shallower Phase I drilling returned values of 198 g/t silver over 33.5m and 63.97 g/t silver over 16.05m. One hole will test below these drill intersections. Martina SW is a northeast trending structure, parallel to the Ely Vein. Limited Phase I and Phase II drilling located 30 to 85 g/t silver over narrow widths. One hole will test the vein.

Magi

Magi has been traced intermittently for 770m on the east side of the Virginia Vein Field. Limited drilling has returned highlights of 40.73 g/t silver over 16.7m. One hole will test the vein along strike.

Margarita

Margarita is a 500m long vein in the south of the Virginia Vein Field. Historic channel sampling returned highlights of 1,486 g/t silver over 1.4m with samples ranging from 3,170 g/t silver to 67 g.t silver. A Phase I drill hole appears to have been drilled into the footwall of the vein, so one hole will test the vein from the hanging wall side.

Roxanne

Roxanne remains an enigma as drilling to date has been unable to locate the elusive source of a 590m linear series of surface float samples that averaged 1,039 g/t silver, ranging from 2,880 g/t silver to 103 g/t silver. Corresponding high chargeability suggests a linear structure. One hole will test below a drill intersection of 21.84 g/t silver over 2.6m.

Maos

Maos has been traced intermittently 200m along strike in the northeast of the vein field. Historic sampling returned anomalous silver values in linear subcrop and angular float. With the vein field dipping to the east, the favourable silver mineralization is expected to lie at depth beneath surface. Two drill holes will trace the vein down dip toward the high-grade silver mineralization.

Phase III Santa Rita Silver/Gold Targets

The gold rich Santa Rita zones lie 15km to the north of the Virginia Vein Field. Early exploration located three zones, Santa Rita Main, Santa Rita Central and Santa Rita East. Exploration largely focussed on Santa Rita Main, an open ended 3500m long by 500m wide NW trend containing mapped veins of multi‐ounce silver epithermal mineralisation generally less than 10m wide. Surface sampling highlights include 340 g/t silver and 1.23 g/t gold and channel sample highlights include 309 g/t silver and 0.63 g/t gold over 4m. Subsequent limited diamond drilling returned highlights of 86.3 g/t silver over 3.4m, within the upper levels of the epithermal system.

Santa Rita East forms a 2.7 km long zone of intermittently outcropping veins occurring along an 8 km NW orientated major fault within the same EW orientated structural corridor as Santa Rita Main. Santa Rita Central and Santa Rita East show a marked increase in gold results with associated high silver hosted within well-formed epithermal veins. Santa Rita Central highlight values range from 1.77 to 0.12 g/t gold and 158 to 18 g/t silver, while Santa Rita East highlight values range from 5.86 to 2.57 to g/t gold and 91 to 21 g/t silver, indicating gold values are increasing to the east.

Reinterpretation of the geophysics and drilling suggests that 40% of the 2,048m drilled at Santa Rita Main was drilled into the footwall and failed to intersect the main structure. Vein quartz and alteration suggest the drill holes targeted the upper levels of epithermal veining, with the high-grade gold and silver values expected to be deeper within the vein. Three drill holes are planned to cross the vein structure from the hanging wall and test the structure at depth.

"With two highly successful drill programs already completed, Phase III drilling has the potential to significantly expand on our previous discoveries and build on the known silver resource at the Virginia Vein Field, " commented Silver Sands CEO Keith Anderson. "Much of this program is designed to test extensions and gaps in areas where we have already encountered high grade silver mineralization along strike from known conceptual open pits. Other targets have the potential to develop new conceptual open pits by expanding on previous drilling and sampling. As well we're extremely excited to test new high priority silver/gold targets at Santa Rita based on a reinterpretation of previous exploration and drilling data. This will be the first time we've drilled a target where there has been significant gold mineralization."

To view an enhanced version of Figure 1, please visit:

https://orders.newsfilecorp.com/files/6972/99247_8eb8bc3634efd9ed_001full.jpg

Ely Central Target

To view an enhanced version of this graphic, please visit:

https://orders.newsfilecorp.com/files/6972/99247_8eb8bc3634efd9ed_002full.jpg

Ely North Target

To view an enhanced version of this graphic, please visit:

https://orders.newsfilecorp.com/files/6972/99247_8eb8bc3634efd9ed_003full.jpg

Martina NW Target

To view an enhanced version of this graphic, please visit:

https://orders.newsfilecorp.com/files/6972/99247_8eb8bc3634efd9ed_004full.jpg

Martina SW Target

To view an enhanced version of this graphic, please visit:

https://orders.newsfilecorp.com/files/6972/99247_8eb8bc3634efd9ed_005full.jpg

Julia South Extension Target

To view an enhanced version of this graphic, please visit:

https://orders.newsfilecorp.com/files/6972/99247_8eb8bc3634efd9ed_006full.jpg

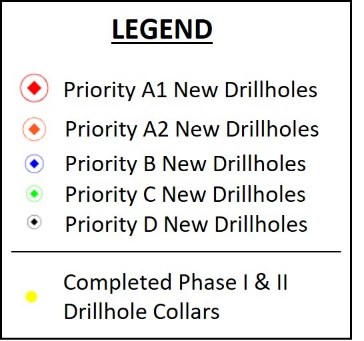

Legend

To view an enhanced version of this graphic, please visit:

https://orders.newsfilecorp.com/files/6972/99247_8eb8bc3634efd9ed_007full.jpg

Figure 2. Highlighted New Zones from Phase I and Phase II Programs

To view an enhanced version of Figure 2, please visit:

https://orders.newsfilecorp.com/files/6972/99247_8eb8bc3634efd9ed_008full.jpg

About Virginia

The Virginia Project is an advanced exploration stage project. Located in the mineral-rich Deseado massif, lying within the mining-friendly state of Santa Cruz in the Patagonia region of Argentina. Virginia is a low to intermediate sulphidation epithermal silver deposit. Through initial discovery in 2009 to four drill programs between 2010 and 2012, Mirasol Resources was able to define an initial indicated mineral resource of 11.9 million ounces of silver at 310 g/t Ag and a further inferred 3.1 million ounces of silver at 207 g/t Ag within seven outcropping bodies. The mineral resources are contained within seven conceptual open pits - Naty, Julia North, Julia Central, Julia South, Ely North, Ely South and Martina. Phase I and II drilling identified the potential for four additional conceptual open pits - Ely Central, Ely North Extension, Julia South Extension and Martina NW.

The resource estimate is documented in a Mirasol Resources technical report entitled: "Amended Technical Report, Virginia Project, Santa Cruz Province, Argentina -- Initial Silver Mineral Resource Estimate" with an effective date of Oct. 24, 2014, and a report date of Feb. 29, 2016.

Several additional vein structures within the property package remain highly prospective, as Mirasol concentrated the bulk of its earlier exploration effort on the resource area at the expense of continuing exploration on the underexplored additional veins. Several of these structures have highlight silver values in excess of 1,000 g/t Ag and have a high probability of hosting additional silver resources.

Silver Sands has the option to earn-in 100% of the Virginia Project. Upon completion of the option Mirasol Resources will retain a 3% NSR royalty, of which 1% can be bought back by Silver Sands for US$ 2 million.

About Silver Sands Resources Corp.

Silver Sands is a well-financed, Canada-based company engaged in the business of mineral exploration and the acquisition of mineral property assets in mining-friendly jurisdictions. Its objective is to locate and develop economic precious and base metal properties of merit. Its key asset is the Virginia silver project, located in the mining-friendly Santa Cruz state of Argentina.

On Behalf of the Board of Directors

Keith Anderson

Chief Executive Officer, Director

For further information, please contact:

Keith Anderson

Chief Executive Officer, Director (604) 786-7774

Qualified Person Statement: Silver Sand's disclosure of technical and scientific information in this press release has been reviewed and approved by R. Tim Henneberry, P.Eng., a director of the Company, who serves as a Qualified Person under the definition of National Instrument 43-101.

QAQC: Silver Sands applies industry standard exploration sampling methodologies and techniques. All geochemical rock and drill samples are collected under the supervision of the company's geologists in accordance with industry practice. Geochemical assays are obtained and reported under a quality assurance and quality control (QA/QC) program. Samples are dispatched to an ISO 9001:2008 accredited laboratory in Argentina for analysis. Assay results from channel, trench, and drill core samples may be higher, lower or similar to results obtained from surface samples due to surficial oxidation and enrichment processes or due to natural geological grade variations in the primary mineralization.

Forward-Looking Statements: The information in this news release contains forward-looking statements that are subject to a number of known and unknown risks, uncertainties and other factors that may cause actual results to differ materially from those anticipated in our forward-looking statements. Factors that could cause such differences include: changes in world commodity markets, equity markets, costs and supply of materials relevant to the mining industry, change in government and changes to regulations affecting the mining industry and to policies linked to pandemics, social and environmental related matters. Forward-looking statements in this release include statements regarding future exploration programs, operation plans, geological interpretations, mineral tenure issues and mineral recovery processes. Although we believe the expectations reflected in our forward-looking statements are reasonable, results may vary, and we cannot guarantee future results, levels of activity, performance or achievements. Silver Sands disclaims any obligations to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as may be required by applicable law.

Neither the Canadian Securities Exchange ("CSE") nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/99247