Another rollercoaster weekend demanding an answer to an evergreen question: Are tariffs on or off again?

Friday’s chaos began when Trump threatened to impose an additional 100% tariff on all Chinese imports, responding to Beijing’s move to restrict exports of rare earth minerals — critical components in EVs and chips.

On Sunday, however, the tone shifted drastically. Trump hinted at a possible de-escalation of tariff and trade tensions between the U.S. and China, while simultaneously issuing a veiled threat to China's President Xi Jinping.

“Don’t worry about China, it will all be fine! Highly respected President Xi just had a bad moment. He doesn’t want Depression for his country, and neither do I. The U.S.A. wants to help China, not hurt it!!!” he wrote on Truth Social.

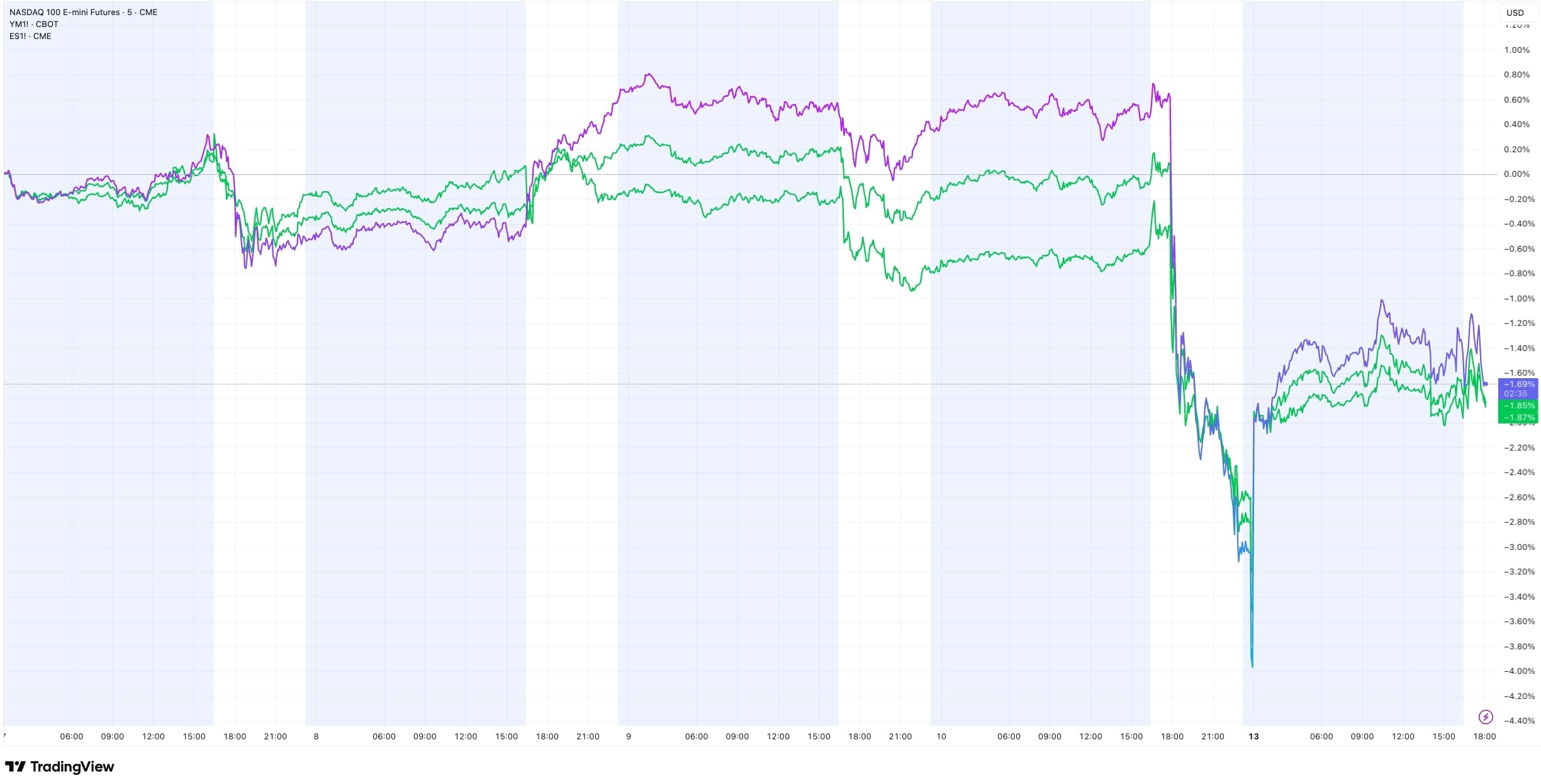

Yet the markets proved hard to stop. U.S. stock futures suffered a brutal selloff on Friday, only to roar back on Monday following a softer tone from Washington. S&P 500 futures rose 1.2%, Dow futures climbed 0.8%, and Nasdaq futures gained 1.7%. The rebound followed Friday’s meltdown, when the Dow Jones plunged nearly 900 points, the S&P 500 dropped 2.7% and the Nasdaq tumbled 3.6%.

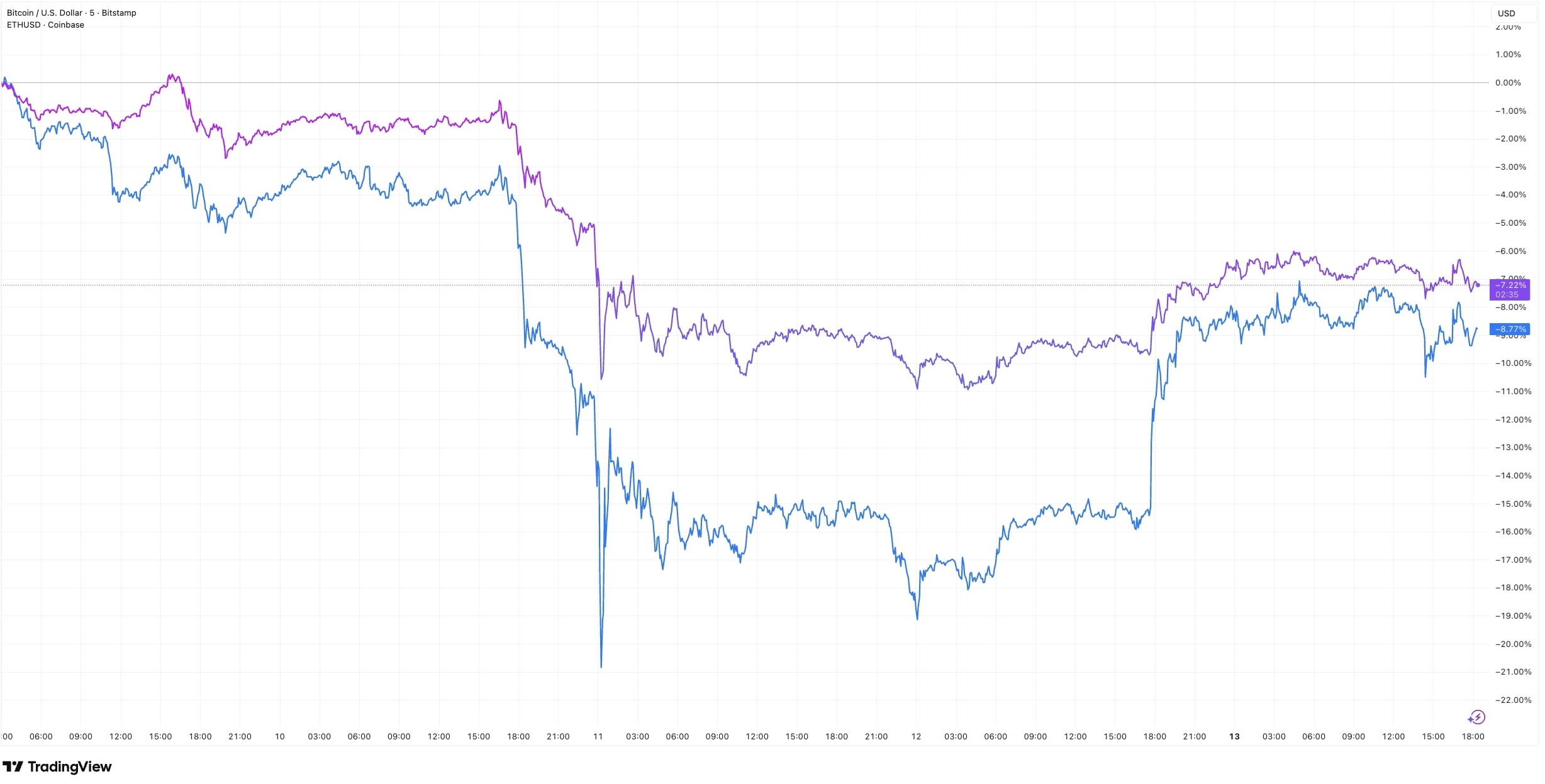

The crypto market also witnessed one of its worst-ever liquidations on Friday, as $19 billion in leveraged positions were wiped out. More than 1.6 million traders got margin-called in a single trading day.

Within 30 minutes, BTCUSD plunged more than 10%, falling below $105,000, while ETHUSD dropped more than 12% to around $3,500. By Monday morning, Bitcoin had rebounded 6% to trade near $115,000, while Ethereum surged 20% to $4,200.

The bruising slump and subsequent rebound highlight just how sensitive the crypto market remains to macroeconomic headlines — especially when those headlines come from the U.S. President’s social media account.

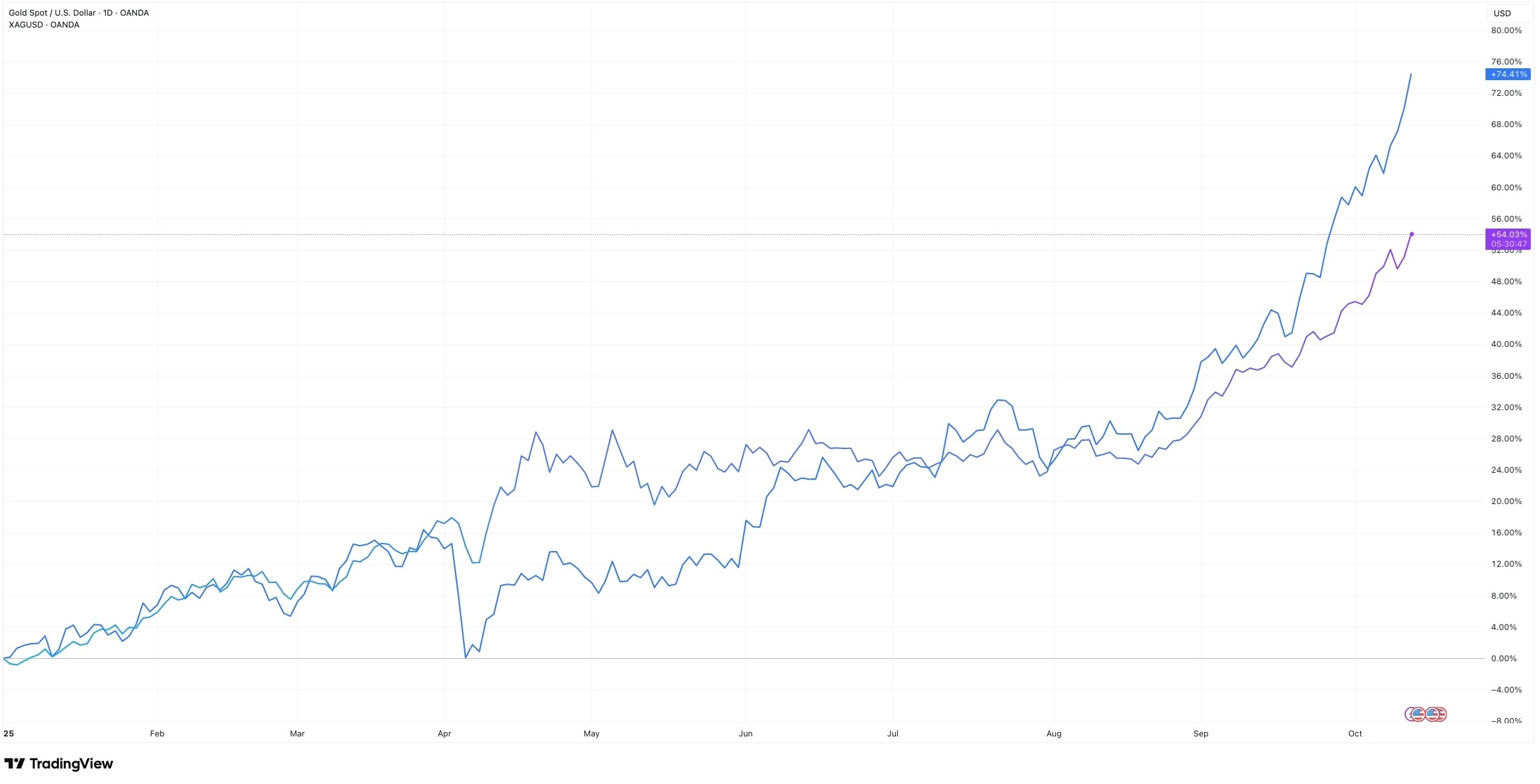

Amid continuing uncertainty, the only clear winners are precious metals. Institutions, retail traders, consumers, central banks — everyone’s buying gold. Prices rocketed past $4,080 per ounce on Monday, setting yet another record as investors worldwide piled into the storied safe-haven asset. Silver followed suit, hitting an all-time high above $51.50 earlier today.

Year-to-date, gold has gained 54%, fueled by central bank buying, ETF inflows, and economic turbulence.

The ongoing U.S. government shutdown — now in its 13th day — has delayed key economic data, adding to the uncertainty with each passing day. With no hard numbers to guide markets, the safe-haven trade looks like the best place to wait for daylight to break again.