It's time — monsters, come out to play. Halloween delivered a killer session on Wall Street, with a packed earnings calendar and strong tech results pushing stocks higher Friday. Investors cheered upbeat quarterly reports from Amazon and Apple, lifting major indexes into positive territory.

Amazon jumped more than 12% after reporting that revenue from its cloud-computing business increased 20% in the third quarter, beating Wall Street expectations. Apple also impressed, rising roughly 3% in pre-market trading after posting record sales and issuing its most optimistic holiday forecast in years.

Chief Financial Officer Kevan Parekh projected total company revenue will grow 10% to 12% in the December quarter — comfortably above analysts’ 6% estimate. Fueling that confidence: a “double-digit” jump in iPhone demand, as customers rush to upgrade to the new iPhone 17. Early data suggests the model is performing strongly across global markets.

For the September quarter, Apple reported revenue of $102.5 billion, up 8% year over year and slightly ahead of forecasts. iPhone sales totaled $49 billion — just shy of expectations but marking a healthy rebound after several slower upgrade cycles. The one weak spot was China, where revenue slipped amid intensifying competition from local smartphone makers.

Apple’s services division — spanning subscriptions, the App Store, and iCloud — crossed a major milestone, topping $100 billion in annual revenue for the first time. With two consecutive quarters of iPhone growth and early iPhone 17 sales tracking 14% above last year’s model, Apple appears poised for a blockbuster holiday season.

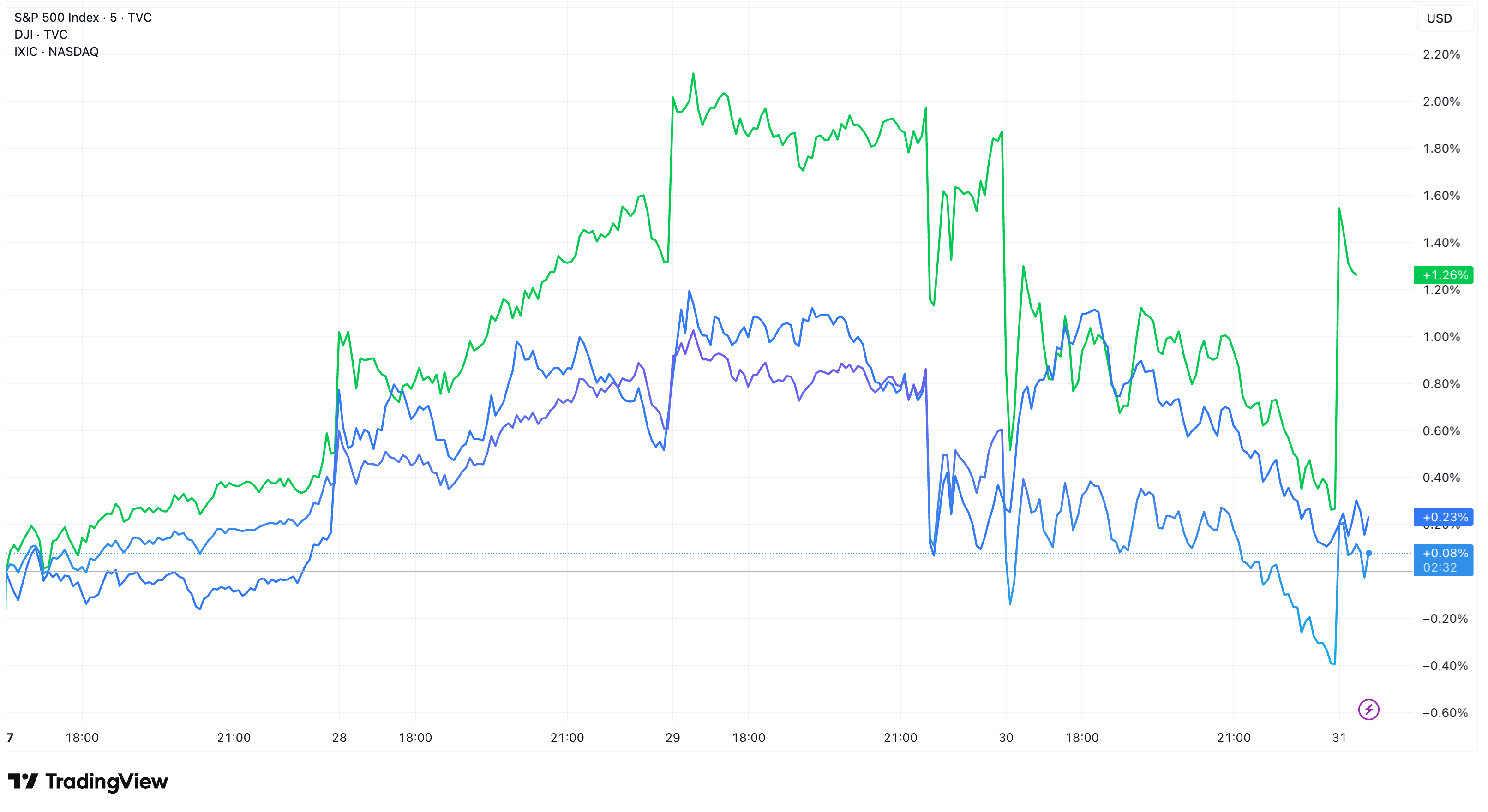

Broader markets reflected the upbeat mood: the S&P 500 gained 0.7%, the Nasdaq Composite rose 1.5%, and the Dow Jones added 83 points, or 0.2%, capping a winning week and month for U.S. equities.

The latest results underscore a market leaning back toward growth — powered not just by hype, but by real demand and improving fundamentals at the world’s most influential tech companies. If this earnings season is any indication, the final months of the year could keep delivering treats for bullish traders — no tricks required.