On Thursday, after the market closed, Netflix reported first-quarter earnings that topped expectations on both revenue and profits, while also reiterating its full-year revenue guidance.

The streaming giant is showing resilience in the face of ongoing economic uncertainty. Among the major tech companies, Netflix is currently in one of the strongest positions.

Netflix reported revenue of $10.54 billion in the first quarter — a 13% increase year over year — beating Bloomberg analyst forecasts of $10.50 billion. Earnings per share came in at $6.61, also surpassing estimates of $5.68.

More notably, Netflix raised its full-year revenue forecast to between $43.5 billion and $44.5 billion.

If you're looking for subscriber numbers, don’t bother. As of last quarter, Netflix announced it would no longer report subscriber figures every quarter. Instead, the company is shifting focus to what it considers more meaningful metrics: revenue, operating margin, and ad-supported growth. This was the first earnings report without subscriber data.

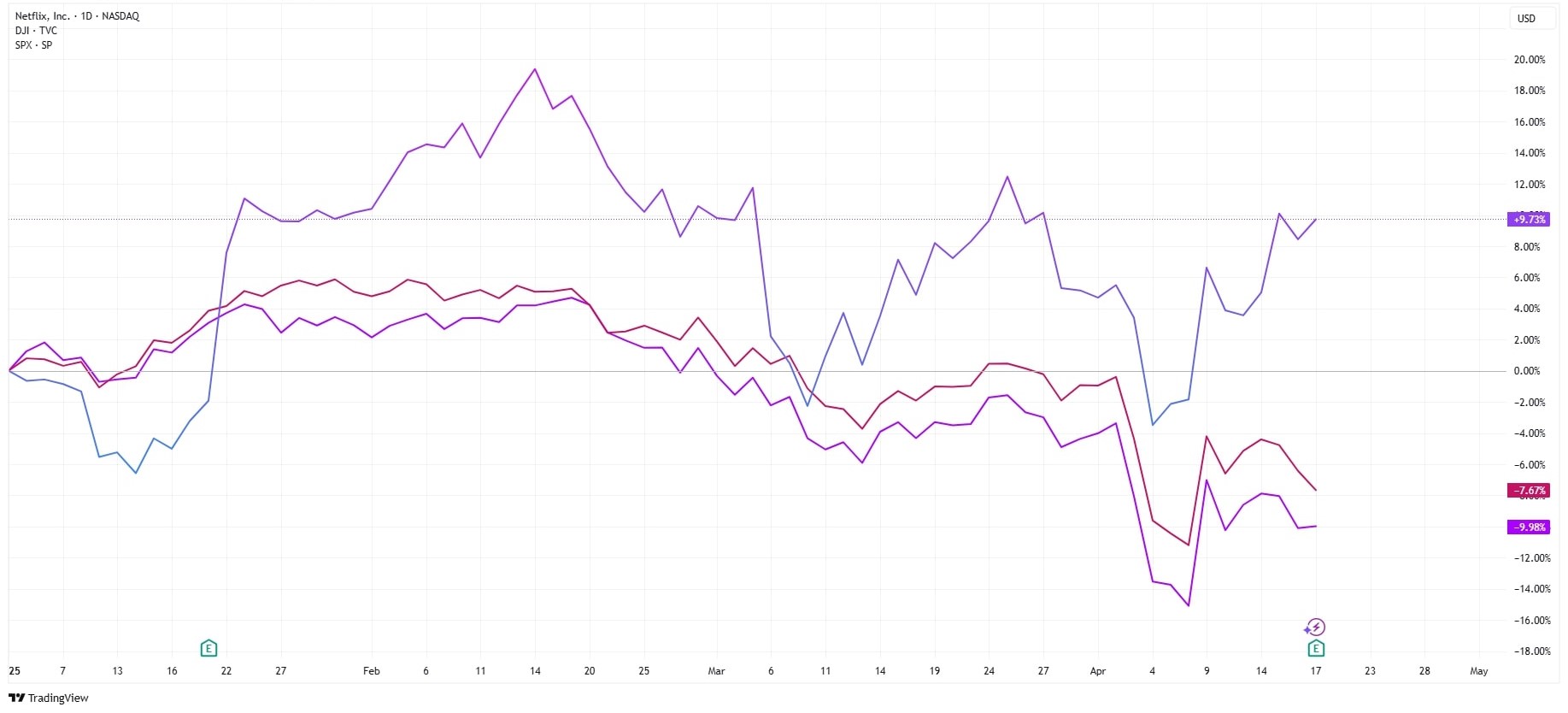

So far in 2025, Netflix shares are up 10%, standing out in a market where the S&P 500 and Dow Jones have fallen 16% and 8%, respectively.

With interest rates higher than four years ago, consumers feeling the pinch, and geopolitical tensions rising, Netflix Co-CEO Greg Peters had to address the big question on everyone’s mind: What if people cut back on spending?

His answer? Streaming will weather the storm. “Entertainment has historically been pretty resilient in tougher economic times,” Peters said. Executives also pointed out that during downturns, people often look for value, and Netflix, with its vast library and affordable pricing, fits the bill as a go-to budget-friendly escape.

For now, the streaming entertainment service company hasn't seen any noticeable impact from the economic headwinds. While Netflix has largely avoided the fallout from renewed trade tensions — most of its costs are tied to content, not commodities — it’s not completely shielded from broader market effects. Tariffs could still spook advertisers, especially if they lead to inflation, economic slowdowns, or market jitters.