Today is the “Super Bowl of jobs reports” given the intense focus on the numbers. The latest jobs data will shed fresh light on the first year of President Trump's term, offering a clearer picture of the U.S. labor market over the past year.

The report was originally scheduled for release last Friday but was delayed due to a brief government shutdown. Now, it promises to pull back the curtain on the labor market, highlighting a period when hiring in America appeared to slow.

So, what does a typical jobs report include? The U.S. Bureau of Labor Statistics (BLS) publishes the Employment Situation Summary every month. The report estimates the number of jobs added nationwide, as well as the average weekly hours worked and average hourly earnings. Economists regard it as the gold standard for measuring the health of the labor market — and, by extension, the broader U.S. economy.

The data also plays a key role in shaping the Federal Reserve policy. The Fed held its key interest rate steady last month after cutting rates in each of its three previous policy meetings citing concerns about labor market weakness. The upcoming report will factor into decisions about whether further rate cuts may be necessary.

Economists had expected January’s nonfarm payrolls report to show little or no growth. They were surprised: the U.S. economy added 130,000 jobs in January, exceeding expectations, and the unemployment rate fell to 4.3% — marking the strongest monthly employment gain since December 2024.

Yet when looking at 2025 as a whole, the job gains were much lower than initially reported. Revised figures show that the U.S. economy added just 181,000 jobs in 2025, compared with the previously estimated 584,000. This made 2025 the weakest year of employment gains outside of a recession since 2003.

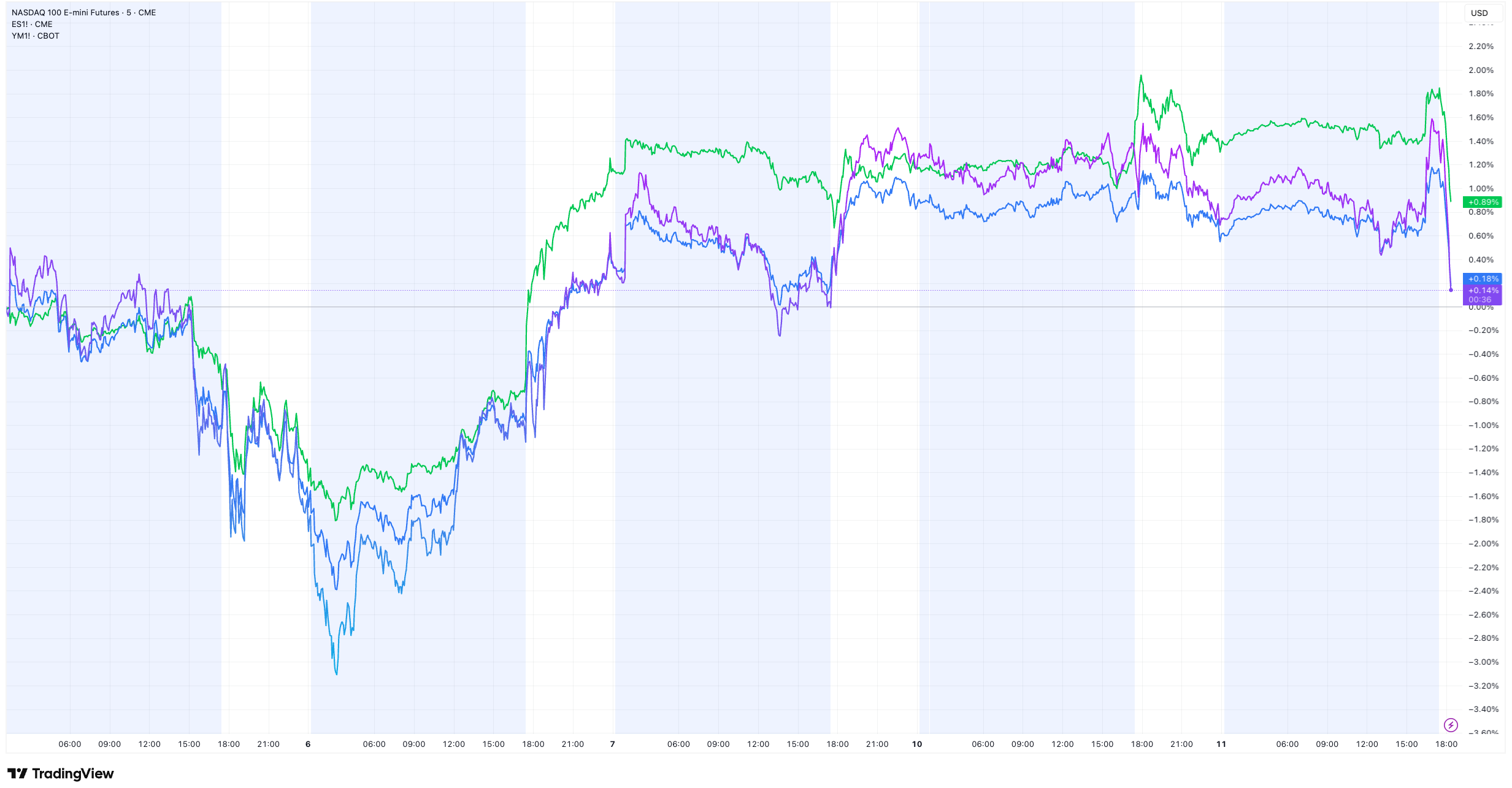

Markets responded positively to the latest data. S&P 500, Dow Jones, and Nasdaq futures all ticked higher, while Treasury yields also rose.

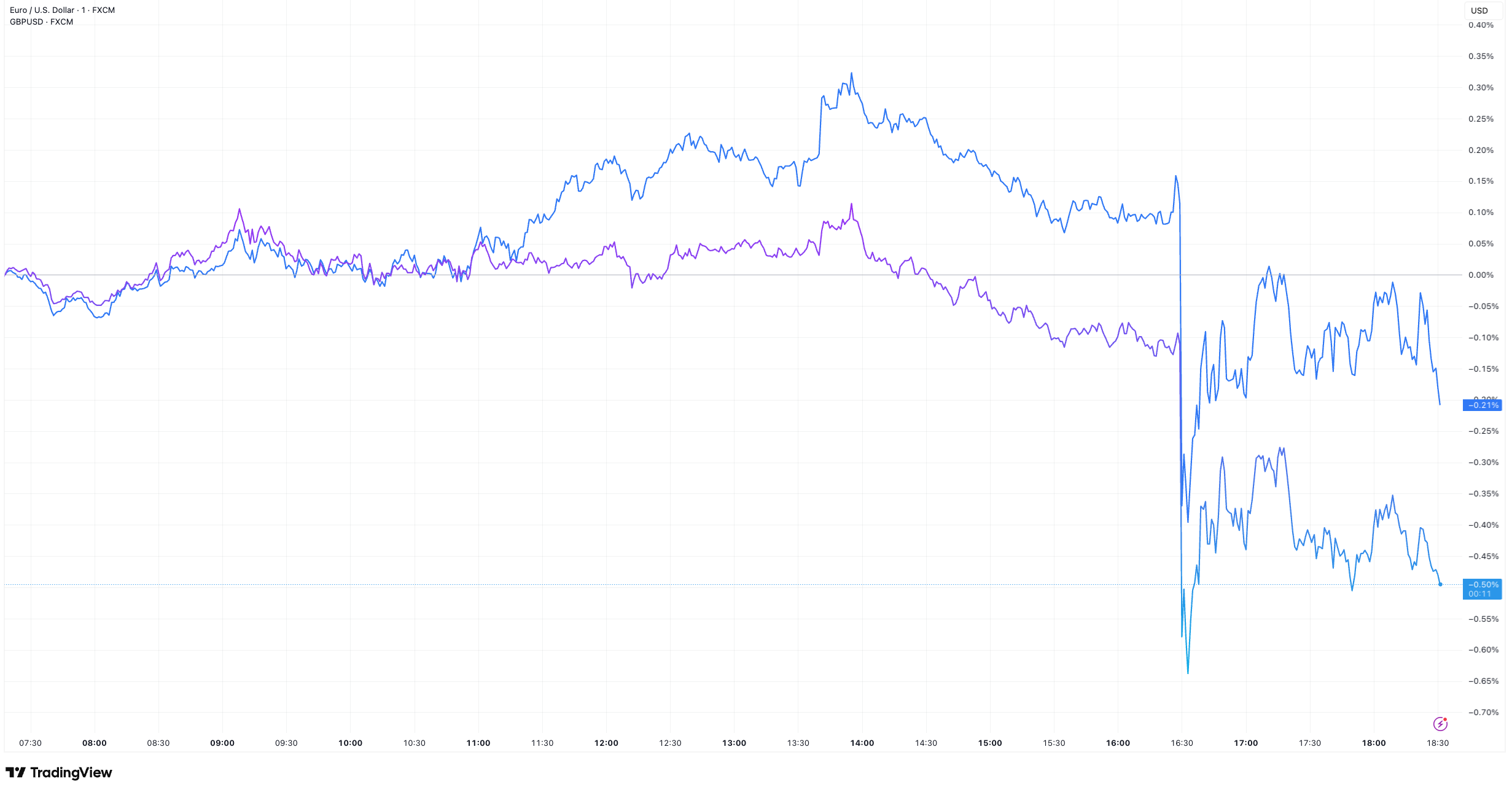

The dollar, meanwhile, had been losing ground against other major currencies ahead of the report. The euro and the pound extending early-week gains, with EUR/USD trading in a narrow $1.19–$1.1910 range Tuesday after Monday’s 0.9% pop. Analysts attribute the euro’s gains more to a softer dollar than to euro strength.

The broader dollar retreat also supported sterling, with GBP/USD holding near $1.3670 despite ongoing political uncertainty in the UK — noise that traders largely chose to overlook.

Looking ahead, Friday will bring the delayed U.S. Consumer Price Index (CPI) report, another key piece of the economic puzzle. Inflation data helps traders anticipate the Fed’s next moves, which in turn can have a significant impact on currency valuations.