Platinum and Palladium prices have continued their record breaking run this week, with

· Platinum prices passing a historic $2,500 / oz,

· Palladium prices passing $2,000 / oz,

· Drivers include strong industrial demand, a sustained supply deficit, and investment and institutional buying

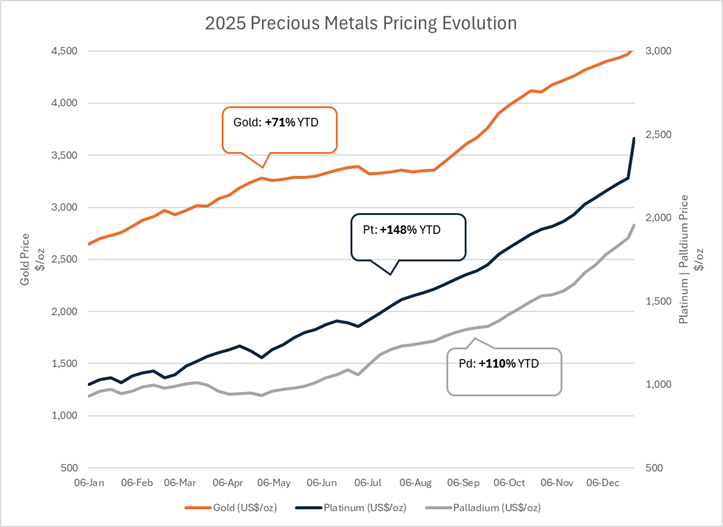

· With ~90% of the World’s platinum reserves located in South Africa, investors are seeking exposure to new potential sources of global Platinum Group Element (PGE) supply

· ValOre Metal’s Pedra Branca PGE Project, located in Brazil, offers a compelling investment case with a World-class, near surface deposit, a supportive local community and good access to infrastructure, and being developed by a highly experienced management team.

Precious Metals Markets:

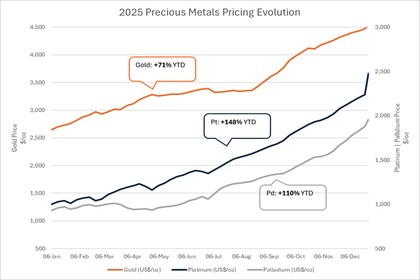

2025 has been a pivotal year for precious metals. Gold continued its well-documented, multi-year run and set new record highs, exceeding $4,400 /oz – driven by geopolitical tensions, US dollar weakness and interest rate cut expectations. Attracting fewer headlines, however, has been an even more dramatic reversal of fortunes for another group of precious metals, the Platinum Group Metals.

After years of depressed conditions, with prices of Platinum and Palladium hovering at or below $1,000/oz, both metals have staged a stunning breakout, with prices nearly doubling over the last 6 months of the year. The main drivers for this are outlined below.

Figure 1: 2025 Precious Metals Pricing - Source: https://tradingeconomics.com

Platinum Group Element (PGE) Demand Drivers:

i) Automotive demand:

Automotive catalysts continue to be a dominant driver of PGE demand, accounting for ~40% of total Platinum demand and ~80% of all Palladium and Rhodium demand[1]. PGE-loaded catalytic converters are used to control emissions in internal combustion engine (ICE) vehicles, and in hybrid (HEV) and plug-in hybrid vehicles (PHEV). Hybrid vehicles use 10 – 20% more PGEs[2] per vehicle than ICE vehicles, as the engines cycle on and off, running cooler and requiring a higher loading of precious metals for a given conversion efficiency.

Globally in 2025, approximately 55% of new vehicle sales were ICE vehicles, with 20% hybrids (HEV+PHEV) and 25% battery electric vehicles (BEV)[3]. In the US, where Federal EV incentives have been eliminated since the end of September, the percentage of new ICE vehicles sold was higher, at ~75%. While in China, over half of new vehicles sold are now electric.

Several major automakers including Ford[4], Honda[5], Volkswagen and Porsche[6], have announced they are scaling-back, or pivoting EV programme plans to increasingly focus on more profitable ICE and hybrid models, as they face changing consumer adoption trends and economic and infrastructure limitations.

This trend is likely to drive sustained demand for Platinum group metals for the foreseeable future.

ii) Jewelry demand

Record-high gold prices may create windfalls for investors, but headaches for jewelers and jewelry-buyers, who experience issues with affordability and inventory overhead as their raw input costs soar. Due to its precious nature, rarity and resilience, Platinum is viewed as an increasingly attractive alternative to white gold for many types of jewelry. Platinum demand for jewelry is forecast to rise from between 5 – 9% for 2025[7], with China being a particularly strong area of growth.

Globally, jewelry production accounts for nearly 2,000 metric tonnes (70M oz) of gold and up to 60 metric tonnes (~2M oz) of Platinum annually[8], and is the second largest demand driver for Platinum after auto catalysts. Due to the far larger scale of gold use in jewelry relative to Platinum, switching just 1% of the total current gold jewelry demand to Platinum would be enough to double the annual supply deficit for platinum of ~700k oz. This factor is expected to continue to grow Platinum demand.

iii) Investment demand

The third major category that has been driving recent PGE price movements is investment demand. As a precious metal, like gold, platinum has benefited from increased investor interest due to US Federal Reserve rate cuts and inflationary pressures. In China, the launch of physically settled platinum futures on the Guangzhou Futures Exchange has boosted confidence, and demand for physical platinum bar and coin in China has grown from nearly zero in 2019 to over 400k oz in 2025[9].

Platinum Group Element (PGE) Supply:

On the supply side, the market has recorded three consecutive annual deficits, with the 2025 shortfall estimated at 692,000 ounces. This has cut above-ground stocks by 42%, leaving less than five months of coverage[10].

Finding and bringing into production new sources of PGE supply is exceedingly difficult, with only one major greenfield mine, Ivanhoe’s Platreef mine, in South Africa, entering production in recent years. This is due to a number of unique challenges that make economic PGE deposits so rare:

The first is the geological rarity of concentrated ore grades. Although the presence of platinum as an element in the Earth’s crust is not excessively rare (on average being similar to gold at few parts per billion) – finding a concentration of the metal in the parts per million range needed for an economic deposit, is far more difficult. These tend to be tied to ancient mafic–ultramafic intrusions with a very specific set of magmatic and geochemical conditions needed to efficiently mobilise and concentrate PGEs. This goes some way to explaining why 90% of the World’s platinum reserves are found in a single country, South Africa, and why over 100 M oz of gold are mined every year, while only 5 – 6 M oz of primary Platinum is produced each year.

After finding an economic PGE deposit, the second major challenge lies in developing it. PGE deposits are often buried deep underneath hundreds of meters of overburden, requiring years of development and massive capital investment to access. Ivanhoe’s Platreef mine for instance has been in development for decades, with a Capex cost for Phase I in the many hundreds of millions of dollars. Infrastructure and stable electricity supply in South Africa present further challenges. All of which contribute structural limitations to how much new PGE supply can be brought on and on what timeframe.

Figure 2 :Source: https://natural-resources.canada.ca/minerals-mining/mining-data-statistics-analysis/minerals-metals-facts/platinum-facts

ValOre’s Pedra Branca PGE project in Brazil:

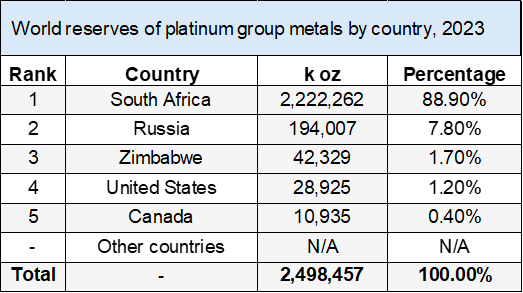

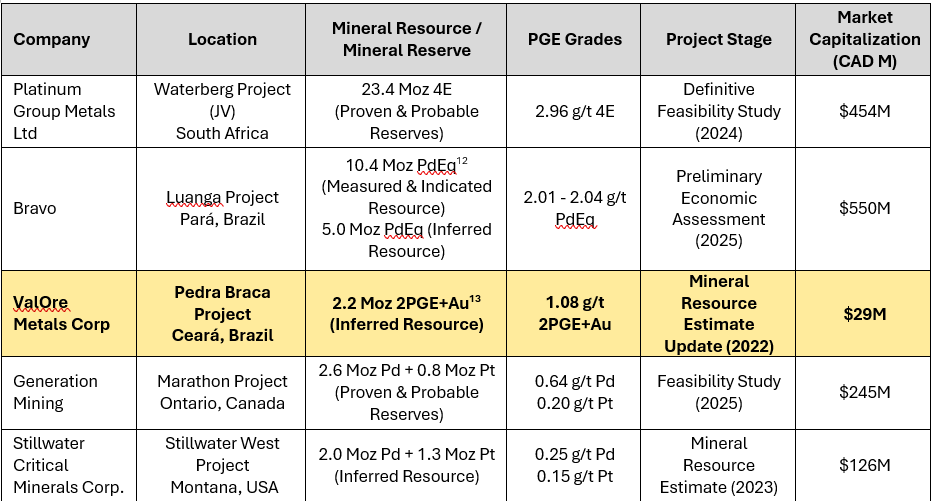

Among the limited number of PGE projects under development globally, ValOre’s Pedra Branca project in Brazil offers a number of significant advantages:

The first is location. Brazil, where mining is one of the pillars of the economy, has made a priority of streamlining the licencing and permitting process[11], and our location in Brazil’s Ceará State has excellent access to transport and electrical infrastructure.

Secondly, unlike the majority of PGE deposits around the world, the mineral resource at ValOre’s Pedra Branca deposit is near-surface, minimising the amount of development capital required to access the deposit and allowing low-cost open-cast mining to be the preferred method of extraction.

Our final advantage lies in our capable and committed team, with a depth of experience covering exploration and discovery, financing and corporate development, community engagement, permitting and major capital project delivery – all 100% focused on delivering this world-class project.

Figure 3: Comparison of Junior development-stage PGE projects.

Sources - All information presented in this table has been derived exclusively from publicly available NI 43-101 technical reports and associated issuer disclosures for the referenced projects. Readers are cautioned to refer to and rely upon each project’s respective technical report for full details, assumptions, and qualifications: Waterberg Project; Luanga Project; Pedra Branca Project; Marathon Project; Stillwater West Project.

Qualified Person

The scientific and technical information in this letter has been prepared in accordance with Canadian regulatory requirements set out in NI 43-101 and has been reviewed and approved by Thiago Diniz, P.Geo., ValOre’s Qualified Person and Vice President of Exploration.

[1] World Platinum Investment Council

[2] Platinum for Palladium Substitution in 2023

[3] Electric Vehicle Outlook 2025

[4] Ford retreats from EVs and takes big financial hit as Trump policies grip industry

[5] Japan's Honda to scale back on electric vehicles, focus on hybrids

[6] Porsche and VW dial back EV ambitions as market shifts and costs mount

[7] Platinum’s discount to gold is driving a return to platinum jewellery demand growth

[8] 2024 - World Gold Council Data

[9] Platinum Futures Near Record High

[10] Platinum Futures Near Record High

[11] Regulators align efforts to speed up mining permitting in Brazil

[12] PdEq: Palladium equivalent grade or ounces calculated using issuer-specific assumptions disclosed in the relevant technical reports.

[13] Independent Technical Report – Mineral Resource Update on the Pedra Branca PGE Project, Ceará State, Brazil (Effective date: March 8, 2022)

[1] World Platinum Investment Council

[1] Platinum for Palladium Substitution in 2023

[1] Electric Vehicle Outlook 2025

[1] Ford retreats from EVs and takes big financial hit as Trump policies grip industry

[1] Japan's Honda to scale back on electric vehicles, focus on hybrids

[1] Porsche and VW dial back EV ambitions as market shifts and costs mount

[1] Platinum’s discount to gold is driving a return to platinum jewellery demand growth

[1] 2024 - World Gold Council Data

[1] Platinum Futures Near Record High

[1] Platinum Futures Near Record High

[1] Regulators align efforts to speed up mining permitting in Brazil

[1] PdEq: Palladium equivalent grade or ounces calculated using issuer-specific assumptions disclosed in the relevant technical reports.

[1] Independent Technical Report – Mineral Resource Update on the Pedra Branca PGE Project, Ceará State, Brazil (Effective date: March 8, 2022)