Less than two weeks ago, Rick Rule got up on a stage in Vancouver and said the following:

"I think we're heading into the goofiest M&A cycle of my career."

Then on Monday morning, we learned that Eldorado Gold (NYSE:EGO, TSX:ELD) is acquiring Foran Mining (TSX:FOM). The Eldorado deal for Foran is an all-stock deal valued at nearly US$3 billion that awards a super-premium valuation to the 72.8 million tonnes in total reserves & resources (Reserves: 29.7 Mt at 2.51% CuEq, Indicated: 38.6 Mt at 2.02% CuEq, Inferred: 4.5 Mt at 1.71% CuEq) at McIlvenna Bay.

The price tag is high enough that most analysts believe other potential suitors such as Agnico Eagle (13.5% Foran shareholder) won’t try to come over the top of Eldorado. It’s clear that Eldorado sees significant exploration growth potential at the Tesla Zone at McIlvenna Bay. In addition, the near-term production profile (first production in 2026) in tier-1 Saskatchewan with embedded copper production growth likely made Foran an attractive generational asset that Eldorado felt it simply had to have.

McIlvenna Bay, Saskatchewan

Still, the price tag is nothing to sneeze at and suddenly makes a lot of other VMS deposits across Canada look much more attractive. Paying nearly US$1 per copper-equivalent pound is absolutely unheard of in the mining sector, and that’s what Eldorado just did in the Foran deal.

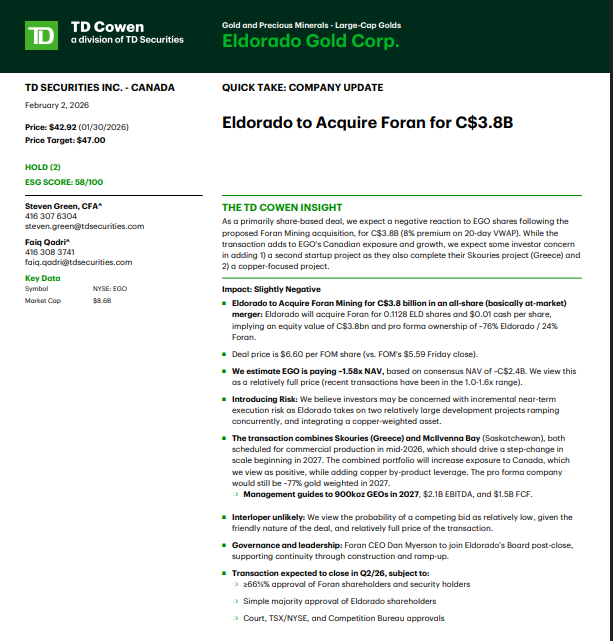

TD Securities noted that according to its estimates, EGO is paying 1.58x NAV for Foran:

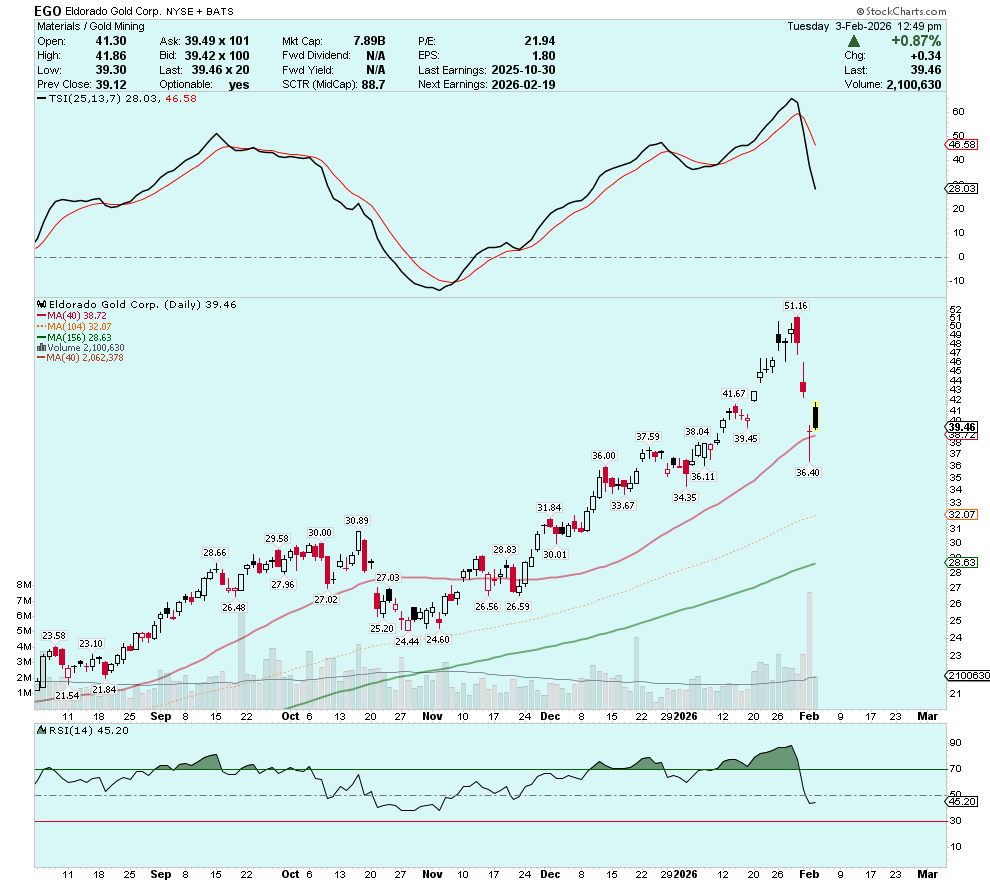

Overall, the market didn’t like the Eldorado side of this deal with multiple bank analysts reducing their price targets for EGO shares. Canaccord Genuity’s Carey MacRury cut his Eldorado target to C$62 from C$70, while maintaining a buy rating. Meanwhile, ATB Capital Markets’ Stefan Ioannou reduced his Eldorado price target to C$89 from C$100 with an outperform rating to “reflect the increased execution risk in the short-term with two mines now in the queue for initial production in 2026.”

Eldorado Gold (Daily)

In multiple recent conversations with investor and Aurion Resources Chairman David Lotan, David has repeatedly stated that the “middle market” mid-tier gold producers are the key to seeing a real M&A cycle unfold across the gold mining sector. Eldorado firmly fits into the mid-tier camp, and EGO’s aggressive move for Foran may have just kicked off an epic gold mining M&A cycle.

As the Foran deal demonstrates, this cycle won’t just be limited to gold. Other strategic metals such as copper, nickel, and silver will play integral roles in mining company production growth over the next decade.

Simply stated, gold producers like Agnico Eagle (NYSE: AEM), Newmont (NYSE: NEM), Barrick (NYSE: B), and Kinross (NYSE: KGC) are going to become increasingly involved in copper—whether they like it or not. As investors, our focus should be on large, long-lived copper deposits in tier-1 jurisdictions. Better yet, projects with substantial district- or belt-scale exploration upside are far more likely to attract major producers.

One of the attractive features of VMS and porphyry deposits is that, in addition to being copper-rich, they often carry a meaningful precious-metals component, particularly gold and silver. Think of porphyry and VMS belts and camps in Idaho, Newfoundland, Saskatchewan, and across South America.

DISCLAIMER: The work included in this article is based on current events, technical charts, company news releases, corporate presentations and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. This article is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SedarPlus.ca for important risk disclosures. It’s your money and your responsibility.