Carson Block, founder of Muddy Waters Capital joins Monetary Matters to discuss why they aren’t rushing to short AI pretenders and fakers until more supply of speculative companies hits the market from big IPOs. They also discuss the increasing dominance of flows over fundamentals in US markets and abroad and Muddy Waters expanding investment focus including: metals and mining stocks, Vietnam, and momentum strategies.

In particular, I found Block’s mining sector commentary to be noteworthy. Around the 32:00 mark Block states:

“The reason that we were drawn to mining, we have had no view on the underlying metals, but there’s tremendous edge available there.

So number one, in junior mining you can get venture capital type returns but you have much more data upon which to base your decisions than you do with venture. Now the other thing is that there’s been a significant under-allocation of human and financial capital to mining since 2000ish. Your smart university graduates have gone into tech, have gone into finance, they have not gone into mining and not even on the capital allocation side.

So we’ve seen a lot of people in the space, I know Darren (Darren McLean) especially has seen a lot of people in the space who have good deposits, but they’re just bad operators. They’re not good business people. When the bar is low basically in terms of the people against whom you’re competing…but when you consider how much talent you’re competing against if you’re investing in software, there’s so much more edge available in mining, especially junior mining.

So that’s been our macro thesis. It’s really been about an under-allocation of human capital, and the complexity of going through the data, but again the rewards for those who do the work and know how to interpret the data.”

On taking highly concentrated positions and the kinds of returns he’s looking for in mining:

“We’re very long-term focused here. So, our fund has a three-year hard lock. So, we’re basically telling investors, look, it’s going to be volatile……A lot of the positions will be highly concentrated. I think we own 16% of Mayfair Gold (NYSE:MINE, TSX:MFG). Now we own it across a few funds but that’s obviously a highly concentrated position for us in the resource fund. So you know, we’re generally looking at something that we believe can be a multi-bagger, and you know that’s even using conservative assumptions on the metal price. And we don’t do only gold and silver, we’ve also done a decent amount of copper…… despite the name GT Gold was a copper miner.”

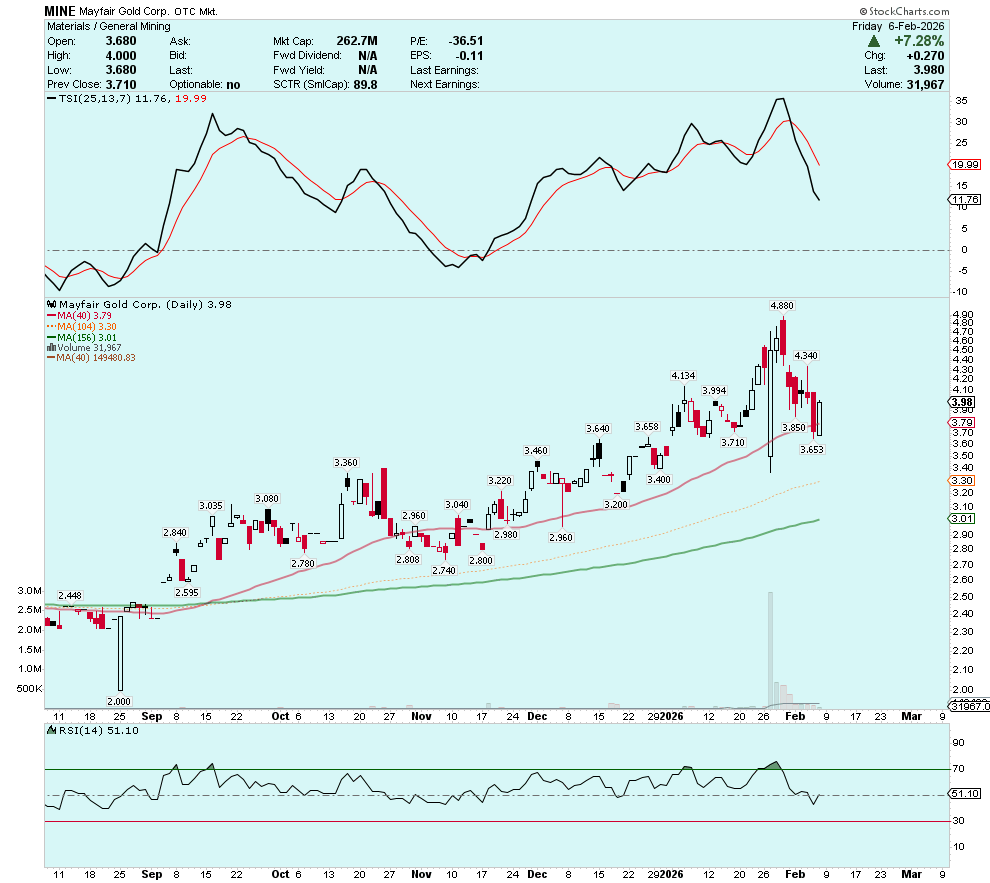

MINE (Daily)

And finally why Muddy Waters is so confident in the potential upside that is still available in Snowline Gold (TSX:SGD):

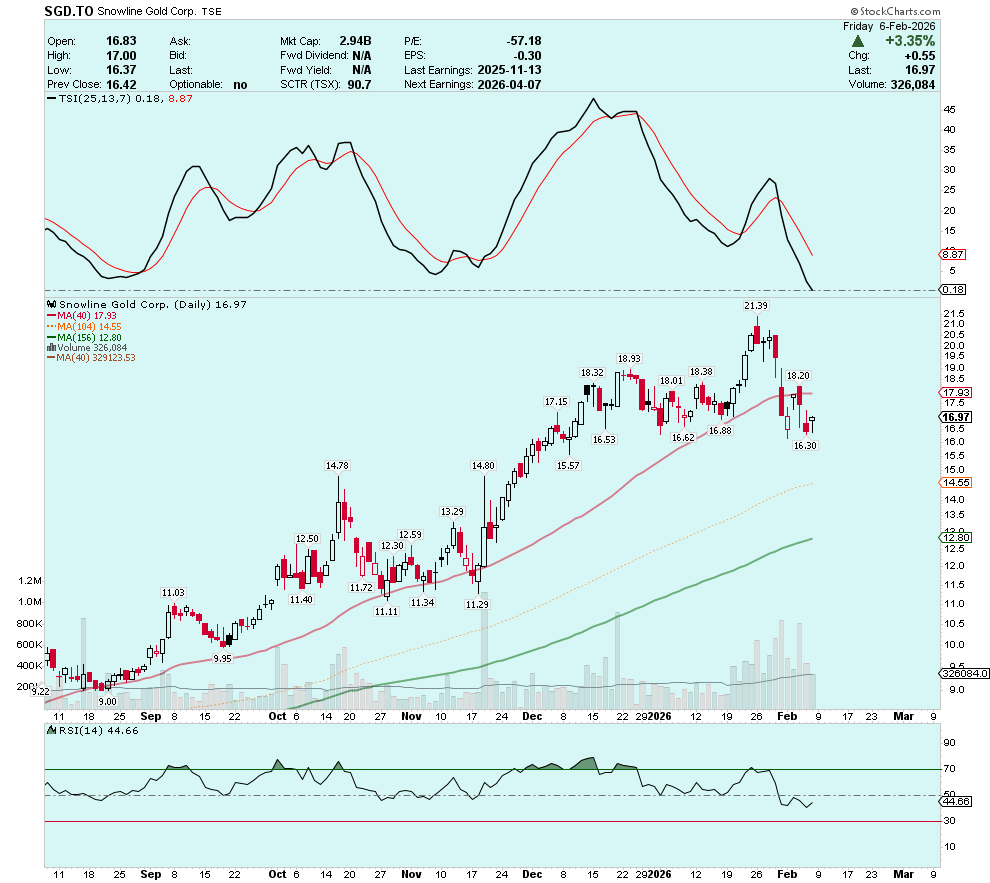

“With Snowline you’ve got a lot of near surface mineralization. It’s going to be an open pit mine, they’re going to be able to cash flow significantly at the beginning. So, that really impacts positively the NPV. So, we believe Snowline will support this becoming a mining district (Selwyn Basin region of eastern Yukon including Fireweed’s MacPass Project), so that it’s economic to make this investment into Snowline to create the additional infrastructure needed, and that it will then unlock a lot of the value in that district. Right now, we think Valley is the most compelling significant greenfield deposit that a major can acquire in the world…..we don’t think it (Valley Deposit) sits around that much longer especially with the price of gold anywhere close to where it is right now.”

Snowline Gold (Daily)

There is no doubt that there are large investment edges available in the junior mining sector, but this sector also contains some of the largest pitfalls that an investor can fall into. It’s more important than ever to develop a trusted network of fellow investors, and to construct an investment process that focuses on your strengths while simultaneously acknowledging weaknesses and limitations.

DISCLAIMER: The work included in this article is based on current events, technical charts, company news releases, corporate presentations and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. This article is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SedarPlus.ca for important risk disclosures. It’s your money and your responsibility.