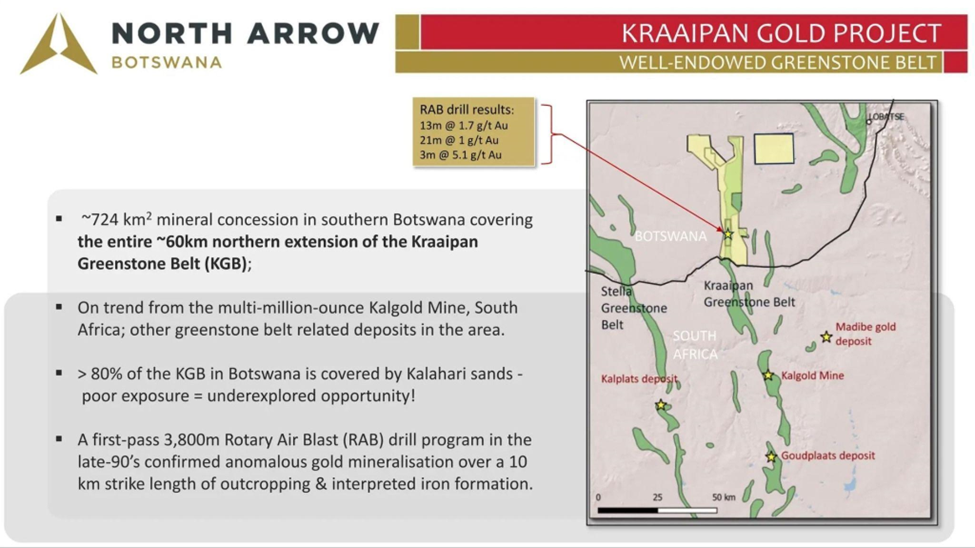

North Arrow Minerals TSX-V: $NAR recently commenced their inaugural drill program on the large Kraaipan gold project that makes up the entire Kraaipan Greenstone Belt on the Botswana side of the border.

● 60 km greenstone belt

● 220 RC holes planned*

● Geology proven to host multi million-ounce gold deposits

*Update: Rotation 1 of 3 was completed as of June 8th. 66 holes were completed in 22 field days covering 8 target areas. Samples are currently being prepped for shipping to a lab in South Africa with an estimated 6- to 8-week turnaround period. Rotation 2 of RC drilling is expected to commence testing targets in the last week of June.

Michael Switow

Welcome to Global Wide Media's Stocks to Watch. I'm Michael Switow. I'm speaking today with Eira Thomas. She's the CEO of North Arrow Minerals. They're exploring for gold in the Kalahari Desert of Botswana. Eira, welcome to the show.

Eira Thomas

Thank you, Michael. Pleasure to be here.

Michael Switow

Today, we travel to southern Africa, where Botswana and South Africa are neighbours and share similar geological potential, but Botswana has just one-fifth as many mines as its neighbour to the south. Up until now, the Kalahari sands have hidden the rocks and hindered exploration. I'm wondering what's changed?

Eira, tell us, how are you able to cost-effectively look beyond the sand to create those detailed geological maps that you need for mining?

Eira Thomas

Well, thank you for that question. That really is the strategy for North Arrow going forward. We really recognize that some of the best geological potential globally is the geology that is not easy to explore. And the Kraaipan belt in southern Botswana represents one of those geological terrains, which is covered by between 10 and 50 meters of Kalahari sands.

So we have to find ways and means to see below those sands to identify the most prospective areas. And we're doing that with a technology-driven strategy.

So we are using multiple techniques to try and enhance our ability to interpret geology that we can't see. And it's a combination of using very inexpensive but very highly effective airborne magnetic surveying. Which helps us to identify the structures that are critical for basically manifesting mineral deposits all around the world.

So we're really looking for structure and we can identify that through detailed magnetics. And in addition to that, we have added a very low-cost proprietary way of testing identified targets with our own drilling system. And that allows us to rapidly test targets across a broad area at a fraction of traditional drilling costs.

It's really the combination of magnetics and drilling that really gets us kind of our first pass look at this geological terrain.

And then in addition to that, we are working with a seasoned team in Southern Africa, a seasoned technical team and operators in that area. And they have been working on the development of machine learning models, which is another way that we can kind of fine tune our strategy and get to the most prospective areas quickly.

Michael Switow

Fantastic, so this combination of special drones, magnetic surveys, and you guys are surveying a big piece of property, more than 700 square kilometers in size.

I understand you're also embarking now on a three-month drill campaign.

How big is the scope of this drilling and what are you hoping to find?

Eira Thomas

Yeah, what's exciting about this is that, when you've got cover, as I mentioned, the trick is, how do you find the most prospective areas quickly?

And magnetic surveying over 724 square kilometers has really been kind of the key tool for us. And the game changer there, as you mentioned, is that we're using drones to collect this information.

And when you think about a traditional magnetic survey that has been done in the business for 50 years, it's usually from a plane or from a helicopter, and that adds dramatically to the cost. So a traditional survey would cost somewhere in the order of $15 to $40 per line kilometer.

We're able to do that for dollars rather than 10s of dollars. And so that allows us to cover the terrain very inexpensively. And that has led to the development of some exciting targets.

We've got 16 areas that we're now currently testing with this drill campaign, and we are expecting to drill up to 220 holes.

So that in itself is a game changer. Normally, when you're going in for an early stage exploration drill campaign, you're lucky if you can manage 40 to 60 holes in a single campaign. The strategy here is to drill shallow holes all across the project area, both to collect the base of the Kalahari sand samples and as well as testing actual bedrock targets that we've identified from the geological and structural interpretation.

So it's kind of a two-fold ambition, this campaign. It allows us to collect regional geochemical information at the base of the Kalahari, which helps us to identify alteration and areas of prospectivity.

At the same time, we're testing bedrock targets that we believe have the potential to host mineralization.

Michael Switow

And that's an interesting strategy, right? So many holes over such a broad area of land. I don't hear that many companies doing that, so that's really interesting. Now, I'm not really a geologist, but I just want to share something that I was reading up.

This area where you're drilling, the Kraaipan, it's a so-called greenstone belt. It's formed

from some of the earliest pieces of the Earth's surface, rocks that are billions of years old. And for the investors out there and the geologists, greenstone belts are more importantly known as places that often contain rich deposits of gold, nickel, copper, and zinc.

I want to talk a bit more now about the drill program that you're undergoing. You're using something called reverse circulation. Essentially, you pump compressed air down one pipe, it's an outer pipe, and that goes into the earth, and then rock cuttings are then blown back upwards through an inner tube.

For those of us who aren't that familiar with it, why did you choose this approach instead of something else, like using a diamond drill?

Eira Thomas

That's a great question. I mean, for us, it's really about balancing off cost and what kind of geological information we can generate. Diamond drilling is a lot more expensive, but it does give you more detailed information about the rock you're drilling into.

Because this is a regional program where, you know, we're collecting both sand samples and rock samples, we felt that this would be a good tool for a first pass.

This is a very novel truck mounted drilling system that has been developed by our partners in Botswana. It is, you know, a system that is very mobile.

So we are aiming to get between two and four holes a day. At the moment, as we've started up the program, we have managed to get four holes a day and in many cases we'll get at least two to three. That allows us to test large areas. And, it's a drill that is powerful enough to get through the sand and rock, which is really important.

There are lighter weight drills that, arguably could cost less. But this is for us about striking the right balance between being able to properly test an area and at the same time give us enough information at the earliest stage to determine whether this is a place that we need to come back to.

And ultimately, once we've identified anomalous areas, we probably would come back with a diamond drilling rig to properly understand the geology itself.

And I guess since we're getting into a bit of the technology here, the RC, as you said, really sort of spits up cuttings or pieces of rock, whereas with the diamond drill, you're actually getting a single tube of rock, which gives you a lot more kind of information around structure and orientation and geology that's easier to interpret.

So, you know, the two tools are important, but right now RC is absolutely key for covering a broad area rapidly, quickly and cost effectively.

Michael Switow

Okay, and RC, that's the reverse circulation.

Eira Thomas

Yes.

Michael Switow

Right, let's take a look now at the samples you all have so far. I think there have been about 80 bedrock samples. Of the top 11, there's been a range of 1.2 grams of gold per ton of rock to more than 10 grams.

Eira, how do these results measure up to your expectations? Do they validate the model?

Eira Thomas

Yeah, absolutely.

I mean, we think about it that 25% or so of the samples that we collected from a very limited portion of the belt. This is the belt where we actually have outcrop exposed.

Keep in mind that the vast majority of the belt is covered in sand. So this is just where we have exposure. 25% of those samples came back anomalous in gold and some of them highly anomalous in gold. Certainly anything over a gram and up to 10 grams we consider highly anomalous is extremely encouraging, and it really confirms that there is good gold endowment in this belt.

Now, this is something that we always suspected and obviously hoped for, given that the same belt of rocks across the border in South Africa hosts the multi-million ounce KalGold mine currently in operation by Harmony.

So that was an important step in our thesis about the prospectivity of this whole belt and further confirmed that we were on the right track and chasing mineralization similar to what KalGold observes in its own mining operations in South Africa.

Michael Switow

Fantastic. I want to look a bit at the business model now. Your company doesn't own the project outright. You're investing in it through a partnership with an Africa-based company called Rockman Resources. They hold the licenses. Tell us a bit more about how this works.

Eira Thomas

Yeah, you know, Rockman has been working on this project as a concept for several years. And as we looked around, kind of thinking about opportunities for North Arrow, going forward, we knew we wanted to obviously target, as a first priority, those opportunities that had the highest geological potential.

And what we really liked about this opportunity is that it represented this completely unexplored greenstone belt. And as you mentioned earlier, you know, greenstone terrains around the world have delivered a huge amount of economic opportunity in the form of multiple multi-commodity deposits, whether it be precious metals or nickel and copper. So to have an entire greenstone belt that had yet to be really properly looked at was something that was very compelling.

At the same time, the approach is very novel. So we felt that it made sense to structure this as a joint venture opportunity.

We ultimately have to spend $5 million to earn a majority interest, but our first commitment is $1,000,000 US, and that's what we're on track to spend this year.

And what really appealed to us is that with $1,000,000 of US, we can get a very good first look across the entire belt to really understand and justify spending additional capital going forward to become the majority owner of this asset.

I would point out too that this is a group that we've known and worked with over more than 25 years. So there are people that are very capable, people that we trust, that are geologically driven and have a tremendous amount of field experience in this part of the world. So it was a really obvious opportunity for us because we are Canadian-based to have a really solid operator in Botswana itself to carry out the work program.

Michael Switow

Makes a lot of sense. I want to take a look now at the investment side of the equation. Shares your company, they're trading a bit below the midpoint of their 52-week range. Aside from the fact that you've just taken over the helm of the company,

Why should investors take a fresh look at it? Why is North Arrow Minerals a stock to watch?

Eira Thomas

Well, I think it's about, first and foremost, the people.

This is a company and a group that's been around a very long time. It has a strong track record of value creation for shareholders. We've recognized it's been a pretty challenging junior market.

This company has been largely focused on diamonds in the past. That is an area that I've spent a big part of my career.

But I've also been involved in important gold projects that have ultimately made it through to feasibility and created a lot of value for shareholders. So, we recognize with gold kind of really, gold prices are really kind of taking off in the last 18 months that this was an area that made sense for North Arrow to get exposure to.

We went to our shareholder base and our big shareholders and with this new strategy and concept, they were very supportive. We have a strong shareholder base based in Canada with some that have been shareholders for a very long time, including Ross Beatty.

So we did clean up the company with the rollback late last year. And that in turn has really positioned the company with a really tight share structure and a great new opportunity in front of us with Kraaipan.

It's earlier stage, but my view is that we've seen senior gold companies and mid-cap gold companies really take off in the last year as gold prices have trended up north of $3,000 an ounce. And what we have not seen is that kind of enthusiasm trickle down into the junior explorers yet, but that will come.

And I think that in itself is a good reason to own this story. We have a great opportunity and an underexplored, virtually unexplored greenstone belt.

We've got a strong management group that has done it before, and we've got loyal shareholders that are supporting us with this new strategy in Southern Africa.

Perhaps most importantly, we've got a program right now which is going to generate results imminently. There's not too many junior gold explorers that are drilling up to 220 holes with a program that costs a million dollars US.

We think there's good value here and we're excited about where this can go.

Michael Switow

Fantastic. I mean, you mentioned the price of gold. I was just looking at the charts. It's up 40% over the past 12 months. That is a huge jump.

And I know that's driving a lot of companies that want to find more of it. So Eira, we wish you luck there in Botswana. And thanks so much for walking us through the project.

Thank you very much for your time.

We've been speaking with North Arrow Minerals CEO, Eira Thomas, and you've been watching Global One Media Stocks to Watch.

I'm Michael Switow.

For more information about North Arrow Minerals, click here to view the presentation

Disclaimer: The content posted here is provided by a third party and does not represent the views, opinions, or official stance of CEO.CA. This content is not endorsed, verified, or approved by CEO.CA in any way. CEO.CA is not responsible for the accuracy, completeness, or reliability of the information provided. Viewer discretion is advised.