The following Dolly Varden Silver (TSX-v: DV) / (NYSE American: DVS) CEO interview is part of a paid advertising campaign, please see details at bottom of page.

As of November 10th, silver (“Ag“) & gold (“Au“) recaptured their mojo, possibly causing fomo, after refreshing -16.4% (Ag) & -10.8% (Au) pullbacks from all-time-highs. Investors are adjusting to the new normal of Ag/Au at or above $50/$4,000.

Several financial institutions are calling for $5,000/oz Au next year, and Ag at $55-$60/oz. Bank of America sees a peak of $65/oz. BNP Paribas tabled a 10% probability of US$100/oz, while UBS points to a possible US$70/oz scenario.

Some readers understandably hesitate before embracing $60+ Ag, but consider that silver’s ATH (adj. for inflation) is ~$210/oz vs. today’s $51.60. YTD, Ag/Au are +77%/+57%, climbing another +20-25% in 2026 is hardly a stretch.

Last week, Ag was (finally) deemed a critical material in the U.S., making demand for it even more pressing. It doesn’t get any better than Canada for a reliable, long-term, sustainable source of critical materials.

Approximately 75% of mined Ag is a by-product of Au, lead, zinc, copper mines. Therefore, mined Ag supply is highly inelastic. Even if Ag soared to $100+/oz, there might not be a substantial increase in Ag production before next decade.

According to S&P Global, it takes 15-20 years from discovery to commercial production, yet the world needs a lot more Ag, (for industrial, jewelry, high-tech, monetary, and investment uses), sooner rather than later.

There are only about 10 primary Ag producers, and some derive well under 50% of their economics from Ag, or have significant revenue from lead, zinc and/or copper (non pure-play precious metal exposure).

Once Ag-heavy producers averaging 37.6% Ag (as % of revenue)

While Ag used in solar panels drove Ag consumption in the past decade, and will continue to be important, high-tech electronics for EVs, AI/quantum computing, semiconductors, etc. will turbocharge demand going forward.

Given long lead times to bring on new production, and demand growing at a CAGR up to twice that of Cu, primary Ag/Au projects in safe, prolific, western-friendly jurisdictions are increasingly scarce & valuable.

Dolly Varden Silver (NYSE American: DVS) / (TSX-v: DV) is one of the world’s best early-stage Ag/Au juniors. It has a large, 100%-owned land package in the southern portion of B.C.’s Golden Triangle. From 15K hectares, management has grown the portfolio to 100K ha in and around the flagship Kitsault Valley project.

Kitsault Valley contains the Dolly Varden property with Ag resources, the Homestake Ridge property with Au, Ag, Cu & lead resources, and the Big Bulk property, a Cu-Au porphyry system.

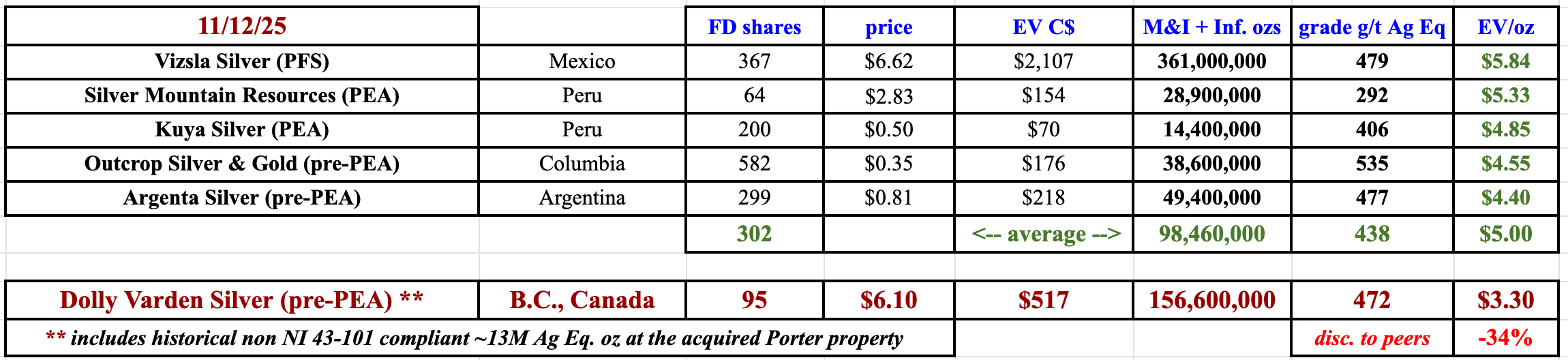

The Company enjoys BOTH strong Ag/Au grades, AND excellent interval widths — {see the following table}.

On November 10th, CEO Shawn Khunkhun announced additional blockbuster results highlighted by 33.8 m of 12.1 g/t Au, incl. 26.7 g/t / 14.8 m, incl. 122 g/t / 2.9 m. In my view, this moderately wide interval is 5th best on the list.

The figures in green boxes denote wide widths or high grades. A third of the Top-24 have over 400 g/t Ag, and a quarter are > 12 g/t Au, (#9 has BOTH high-grade Ag & Au).

I recently caught up with Mr. Khunkhun to discuss drill results, which will continue coming out every 2-3 weeks into 1Q/26, and other topics of interest. Shawn is a young, vibrant, aggressive, well-connected CEO with BIG plans for Dolly Varden Silver.

Note, true widths of the following intervals are estimated at 55-75%

How were today’s (November 10th PR) drill results compared to expectations? How many more meters/holes to report?

We are very happy with the initial assays and hope to continue receiving strong results as we report on > 80 holes over the next 2-3 months. High grades & wide widths are great, but the de-risking of the resource is even better.

Having BOTH high-grade silver & gold is exciting in a robust bull market. This year’s drilling should lead to a meaningful improvement in our next resource estimate planned for early 2Q/26.

Thank you. Speaking of that resource, what’s the goal for the 2Q update?

Right now we have nearly a million ounces of gold and 64M ounces of silver. We believe we will reach or surpass 100M ounces of silver, roughly a +50% increase. On the gold side, the increase will be far less, but a goal is to upgrade the 83% Inferred portion to > 50% Indicated.

Please note that the Indicated ounces at Homestake Ridge are very high grade at 7.0 g/t vs. the Inferred ounces at ~4.6 g/t. We expect the newly converted Indicated ounces to be much closer to that 7.0 g/t level.

We have a growing high-grade, high-quality resource in a Tier-1 jurisdiction, open for expansion, and to new discoveries.

Can you discuss/explain the latest developments at nearby Ascot Resources? Might Dolly Varden gain access to Ascot’s valuable 2,500 tpd Premier mill?

Yes, we get asked about Ascot a lot. Look, the Mill is in good shape, is large and valuable. It’s on care & maintenance while Ascot recapitalizes. Over the past 12-18 months we were encouraged to make a bid for Ascot.

In addition to the Mill there are over 3M Au Eq. ounces at roughly the same 7 g/t Au Eq. as Homestake Ridge. We know the projects and the Mill well. We did not make a bid as it does not align with our near-term goals, but we continue to watch developments closely.

No matter who ends up operating the assets, there will always be a case for Dolly Varden’s high-grade Homestake Ridge ore to be shipped to the Premier Mill.

Once challenges at Ascot are resolved, we can revisit opportunities to collaborate. Until then, we have more compelling initiatives well underway. The Premier mill remains a great opportunity under the right conditions.

You have said that Dolly is pursuing additional tuck-in acquisitions, but also larger “transformational” opportunities. What are the latest thoughts on M&A?

We are in a bull market for precious metals and our valuation has grown nicely. As can be seen by several deals we made earlier this year, and the acquisition of Homestake Ridge, M&A is in our DNA.

We are ALWAYS looking at projects, properties, companies to buy. We have a highly skilled technical & financial team evaluating opportunities, but due diligence takes months, even years. We are patient, willing to wait to get deals done on our terms.

One thing we’re interested in is acquiring a mine or a company that’s already in production and generating cash flow. The idea is that the cash flow would reduce or possibly eliminate the need to continually tap the equity markets.

We have over C$62M in cash, so we’re fully-funded for quite some time. I should note that our team is looking at numerous options. For example, we could secure a strategic partner if the right company were to come forward at an appropriate time.

We’re talking with larger & small companies, but our focus will remain on Ag/Au, probably in Canada. The most exotic thing we might do is acquire something in the U.S.

What are your views regarding ongoing M&A activity among Ag/Au producers in the next 2-3 years?

Like many management teams, investment banks & pundits, we think M&A activity will only grow for the foreseeable future. Increased M&A is good for Dolly Varden. It drives valuations higher and makes our promising assets even more scarce.

Dolly’s Kitsault Valley Project in safe B.C., Canada

I strongly believe our Kitsault Valley Project is a Top-4 or 5 undeveloped primary Ag asset (with a strong Au component) not owned by a producer. We’re not in South America or Africa (DRC, Zambia, Mali), but in safe B.C., Canada.

Due to a number of mining mishaps and government interference around the globe, producers are circling back to Canada. And, Mexico’s giant Fresnillo just made its first move into Canada by proposing to acquire Quebec’s Probe Gold.

The Golden Triangle’s Kitsault Valley project is in the right place at the right time with the right metals, and the right team.

Thank you Shawn for a compelling interview in which you make a strong case for Ag/Au in Canada, in B.C., in the Golden Triangle –> and for Dolly Varden Silver. I look forward to ongoing drill results and potential M&A. ‘

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER] ) about Dolly Varden Silver, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market-making activities. [ER] is not directly employed by any company, group, organization, party, or person. The shares of Dolly Varden are highly speculative, and not suitable for all investors. Readers understand and agree that investments in small-cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Dolly Varden was an advertiser on [ER] and Peter Epstein owned shares in the company, acquired in the open market.

Readers understand and agree that they must conduct due diligence above and beyond reading this article. While the author believes he’s diligent in screening out companies that, for any reason whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector, or investment topic.