(TheNewswire)

| |||||||||

CALGARY / TheNewswire / August 06, 2025 / San Lorenzo Gold Corp. ("San Lorenzo" or the "Company") (TSXV: SLG) is pleased to announce that results from the recently completed induced polarization (“IP”) geophysical survey yielded multiple high-chargeability anomalies representing compelling drill targets for a follow-up drill program on the Cerro Blanco and Arco de Oro targets within San Lorenzo’s flagship Salvadora property in north-central Chile.

1. Cerro Blanco Drilling

Locations for the drilling of three follow-up holes on the Cerro Blanco target have been finalized with a possible fourth location pending results of geological modelling which is currently underway.

The maiden drilling program previously conducted on Cerro Blanco confirmed that Induced Polarization (“IP”) chargeability data correlates well with areas of alteration and increased sulphide content that host gold mineralization at Salvadora. This is borne out by the results of the initial three-hole reconnaissance drill program. All three widely spaced holes in that maiden drill program, targeting IP chargeability anomalies, reported good gold intercepts in porphyry style alteration, including 153 metres grading 1.04 g/t gold in hole SAL-01-24 and 85.7 metres grading 1.02 g/t gold in hole SAL-02-24. (see San Lorenzo news releases dated March 3rd and March 17th, 2025,)

The results of the latest IP program, completed in June 2025, yielded additional geophysical anomalies, equal to or stronger in chargeability and resistivity than those encountered in the initial IP program. The three upcoming diamond drill holes are planned to test the exciting new IP anomalies described below.

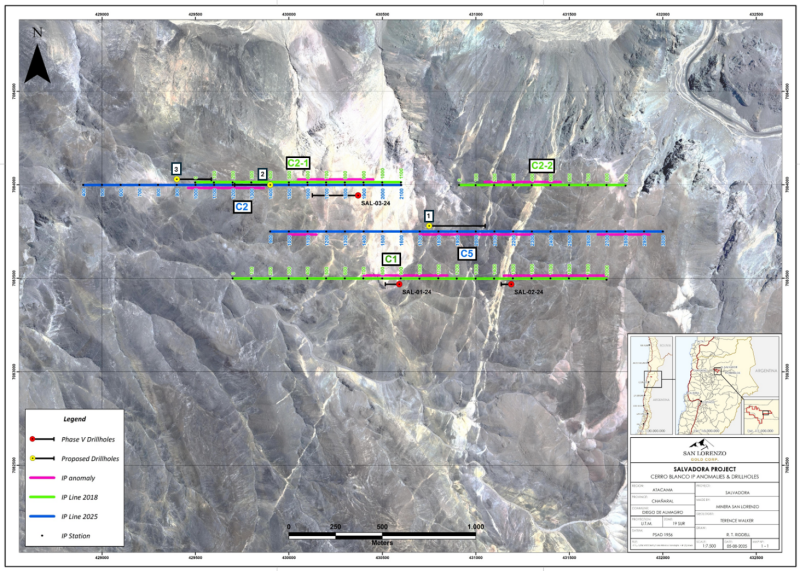

Figure 1 below is a composite map of the Cerro Blanco target illustrating the location of San Lorenzo’s historical and new IP lines. Strong chargeability anomalies on those lines are highlighted in pink. Figure 1 shows the locations of the previously drilled three holes (red) and shows the proposed locations soon to be drilled (yellow). It should be noted that the IP stations shown are at 100-metre intervals and the IP lines are spaced 250 metres apart.

Figure 1 – Cerro Blanco IP Compilation

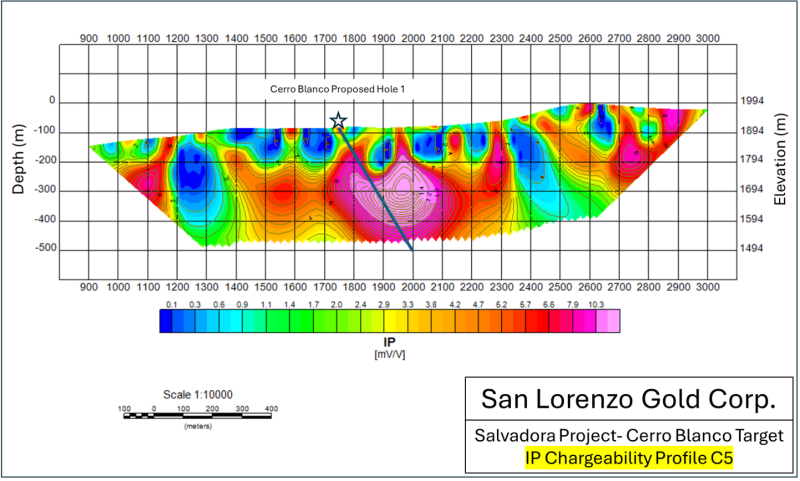

Figure 2 below is the recently obtained IP chargeability profile C5. It is located midway between San Lorenzo’s previous two IP lines. Superimposed on the chargeability profile is an illustration of the first follow-up hole to be drilled at Cerro Blanco. The illustration includes the collar location, inclination and azimuth of the proposed hole noting that the final depth of the hole will be determined during drilling.

Figure 2: IP Chargeability Profile C5

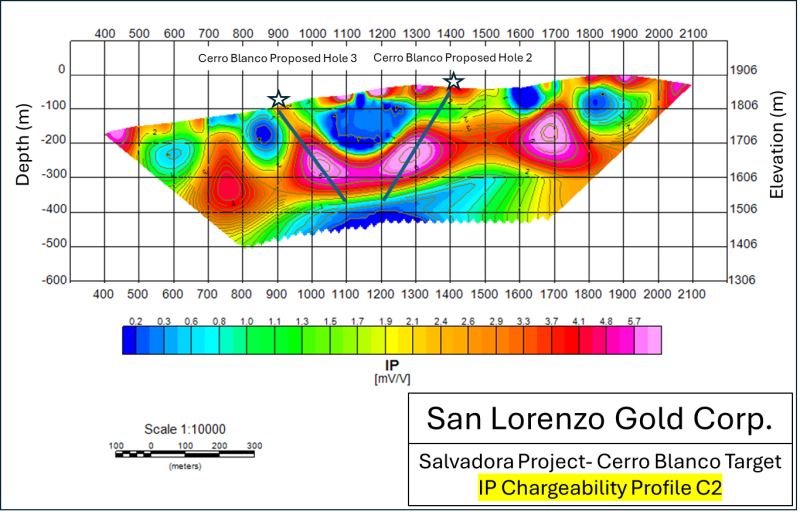

Figure 3 below is IP chargeability profile C2 over a western extension to the northernmost previously existing IP line. Superimposed on the profile is an illustration of the second and third follow-up holes to be drilled at Cerro Blanco shortly. The illustrations include collar locations, inclinations and azimuths of the proposed holes with the final hole depths to be determined during drilling.

Figure 3: IP Chargeability Profile C2

Commenting on the IP results shown above on lines C2 and C5, Terry Walker, San Lorenzo’s VP of Exploration commented: “We are thrilled that the western extension to line C2 exhibits such a wide anomaly. With SAL 03-24 having already penetrated the other anomaly 300 metres east of our upcoming locations on line C2; having obtained significant gold intercepts from all holes drilled at Cerro Blanco, we have increased confidence that exciting results will be returned from these holes”.

Mr. Walker continued: “However, the anomaly visible on line C5 is particularly gratifying in that it is the strongest anomaly we observed from our initial IP program which was located just south of the break in the northernmost line; a break that we could not fill in due to topography. Drilling on that line was a high priority, but access issues made drilling there difficult. Having its existence reconfirmed with the very strong, in fact the strongest yet, anomaly on the middle IP line and the fact that it is in an area where access is simpler means that we are now able to drill that feature. We are excited to get drilling on Cerro Blanco soon”.

2. Arco De Oro Drilling

Following receipt of the new IP data in late May, San Lorenzo commenced an additional geo-chem sampling program at Arco de Oro. The survey, completed on June 28, 2025, involved regolith and rock sampling over a systematic grid that included taking 135 samples.

Drilling of several new holes at Arco de Oro is planned for the upcoming program. While preliminary drill hole locations have been field checked for accessibility, San Lorenzo will incorporate the surface sampling results into its exploration model before committing to final drill locations at Arco de Oro.

San Lorenzo expects surface sample assays to be received shortly and looks forward to providing further details regarding Arco de Oro drilling plans thereafter.

Credit Facility Increase

San Lorenzo is pleased to report that it has increased the availability of funds to conduct the upcoming drill program at Salvadora via a second convertible credit facility which provides for additional advances up to $1,000,000 (the “Second Credit Facility”), subject to the approval of the TSX Venture Exchange. The Second Credit Facility will be provided by the same company that provided the initial credit facility (the “Initial Credit Facility”) which is a company related to a director of San Lorenzo (see San Lorenzo news release dated November 19, 2024).

Background: As a result of increased meterage having been drilled during the last drilling campaign completed during February 2025 - together with more recent expenditures related to follow-up IP and surface sampling at Salvadora and the payment of annual claim fees, the Initial Credit Facility will not provide sufficient funds for the anticipated costs to complete the desired drilling program at Salvadora. As at June 30, 2025, amounts advanced by the related company exceeded the $1,000,000 amount authorized under the Initial Credit Facility (which has been converted into a term note). While San Lorenzo currently has sufficient funds on hand to repay those excess advances from the proceeds of the warrants exercised during March 2025, San Lorenzo would not then have sufficient funds to complete the upcoming drilling program. Hence, the amounts advanced by the related company that are in excess of $1,000,000 have not been repaid. The board of directors of San Lorenzo have unanimously determined that the implementation of the Second Credit Facility, that has a conversion price equal to 150% of San Lorenzo’s recent trading price, is more beneficial to stakeholders than completing a private placement at a discount to the recent trading price. No warrants will be granted in respect of the Second Credit Facility.

Details: The Second Credit Facility provides that advances can be drawn by San Lorenzo up to $1,000,000. Once drawn, advances under the Second Credit Facility will be converted into a term loan maturing on July 31, 2027. The Second Credit Facility bears interest at a rate of 8% and is convertible at the option of the lender into common shares of the Company at a price of $0.35 per common share until maturity. If converted, the lender has agreed to a contractual hold period such that the share certificate representing the common shares will bear a legend restricting the trading of such shares for a period of 1 year from the date of their issuance.

MI 61-101 Considerations: As a company related to an insider of the Company is participating in this transaction, it is deemed to be a “related party transaction” as defined under Multilateral Instrument 61-101-Protection of Minority Security Holders in Special Transactions (“MI 61-101”). Neither the Company, nor to the knowledge of the Company after reasonable inquiry, a related party has had knowledge of any material information concerning the Company or its securities that has not been generally disclosed. The Second Credit Facility is exempt from the formal valuation and minority shareholder approval requirements of MI 61-101 (pursuant to subsections 5.5(c) and 5.7(1)(b)) as it was a distribution of securities for cash and neither the fair market value of the Second Credit Facility, nor the consideration received from related parties, will exceed $2,500,000. The Second Credit Facility was unanimously approved by the board of directors of the Company, excluding the director who is related to the company providing the Second Credit Facility, who abstained from voting. Tailwind Capital Neo Fund Ltd., the related company, currently holds 50,000 common shares of San Lorenzo and holds no options. Conversion of the Initial Credit Facility and the Second Credit Facility, if fully drawn to the maximum permitted amount, would result in the issuance of 7,857,143 common shares which would represent 9.00 percent of the then issued common shares of San Lorenzo.

Qualified Person

Terence Walker, a qualified person for purposes of National Instrument 43-101, has reviewed and approved of the contents of this news release.

About San Lorenzo

San Lorenzo is focused on advancing its flagship Salvadora property located in Chile’s mega-porphyry belt. Results obtained from prior drilling programs conducted on 4 different targets have convinced management that several significant gold and copper enriched epithermal and porphyry style systems are contained within the Salvadora property.

For further information, please contact:

Terence (Terry) Walker, VP Exploration Al Kroontje

Email: twalker@goldenrock.cl Email: al@slgold.ca

Ph: + 56 9 5179 5902 Ph: +1 403 607 4009

Or:

Roger Blair or Jeff Wilson, Acuity Advisory Corp.

Email: info@acuityadvisorycorp.com

Ph: +1 604 351 0025 or +1 604 837 5440

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Cautionary Note Regarding Forward-Looking Information

This news release may contain forward-looking information that involves substantial known and unknown risks and uncertainties, most of which are beyond the control of San Lorenzo including statements related to IP data, its interpretation, geological programs based on IP results or based on geological interpretations generally; the timing and plans for the exploration including drilling; and the obtaining of regulatory approval of the Second Credit Facility. All statements included herein other than statements of historical fact are forward-looking information. Such forward-looking information involves various risks and uncertainties. There can be no assurance that such information will prove to be accurate, and actual results and future events could differ materially from those anticipated in such information. Any forward-looking statements are made as of the date of this news release and, other than as required by applicable securities laws, San Lorenzo does not assume any obligation to update or revise them to reflect new events or circumstances.

Copyright (c) 2025 TheNewswire - All rights reserved.