A 34-Year Veteran’s Take On The Worst Precious Metals Selloff Since 1980

When everyone is on one side of the boat and someone yells “fire,” the exit gets very small, very fast.

Reposted from juniorminingpro.substack.com

If you’re watching your portfolio bleed red and wondering whether “the thesis” is broken, take a breath.

I’ve been through every major cycle in this sector since 1987.

The pattern is always the same: structural thesis builds, speculators pile on, leverage gets excessive, an exogenous trigger(s) hits, and the mechanical unwind overshoots the fundamentals.

Every single time.

I’ve been around long enough to remember every one of these events, and I am here to set the record straight - so that you can keep your cool (and your portfolio) through the best of times, and the worst of times.

1980 Silver Crash

Hunt Brothers corner unwinds, silver drops from $50 to $11 in two months. CME margin hikes triggered the collapse (sound familiar?)1980-82 Gold Bust

Gold falls from $850 to $300 as Volcker’s rate hikes crush inflation trades1987 Oil Collapse

OPEC price war drives crude from $31 to $101993-96 Voisey’s Bay / Diamond Rush

Massive speculation in Canadian exploration plays, most went to zero1995-97 Bre-X

$6B fraud, incinerated an entire generation of junior mining investors1999-2001 Gold Bottom

Gold hits $252, central banks selling, “gold is dead” consensus. The bottom of a 20-year bear.2003-2008 Commodity Supercycle

China industrialization drives “everything” - gold, copper, oil, uranium - to multi-decade highs2008 Financial Crisis

”Everything” liquidated. Gold dropped 30%, copper 65%, oil from $147 to $33. Juniors were obliterated.2009-2011 Recovery, Silver Mania & Silver Crash

Silver runs from $9 to $49, CME hikes margins five times in eight days, crashes it. Gold peaks at $1,920.2011-2015 Bear Market

Brutal grind down. Gold to $1,050, juniors wiped out, exploration budgets slashed 75%2016 Trump Rally

Brief gold spike, then rotation into equities2020 COVID Crash

March liquidity panic, gold drops $200 in days before rallying to $2,075 by August2020-2022 Lithium/Battery Metals Mania

Lithium prices up 10x, lithium explorers went into overdrive, then crashed 80%+ by 2024 - most juniors flipped into other metals, even other businesses entirely.2023-2024 Uranium Renaissance

Spot from $50 to $106, juniors ran 300-500%, then corrected sharply2025-2026 Precious Metals Supercycle & Crash

Gold $2,700 to $5,600, silver $30 to $120, then the Warsh Shock and CME margin cascade triggers investor panic, wiping out billions in gains in 48 hours

What’s happening right now is violent, ugly, and entirely mechanical - not fundamental.

Regular readers will have noticed that I’ve stayed completely away from commenting on the day-to-day action in gold, silver, copper, and other metals throughout this entire run-up and ensuing harsh volatility - I let it play out.

I watched from the sidelines as retail forecasters were regularly and dangerously calling for $10,000 gold and $200 silver. These are more dopamine hits than analysis, and can be harmful to novice portfolios.

My playbook has always been the same: identify individual junior mining stocks that will thrive in bull and bear markets alike.

Volatility will affect share prices as the tide rises and falls. That’s the nature of the sector. But the thesis in my core picks remains rock solid, and I believe they will deliver outsized market gains as management executes their plans.

That said, what’s unfolding right now deserves a deep dive, because the noise-to-signal ratio is absolutely brutal and a lot of investors, particularly newer ones, are making emotional decisions based on fear rather than mechanics.

The Numbers Don’t Lie. This Is Historic.

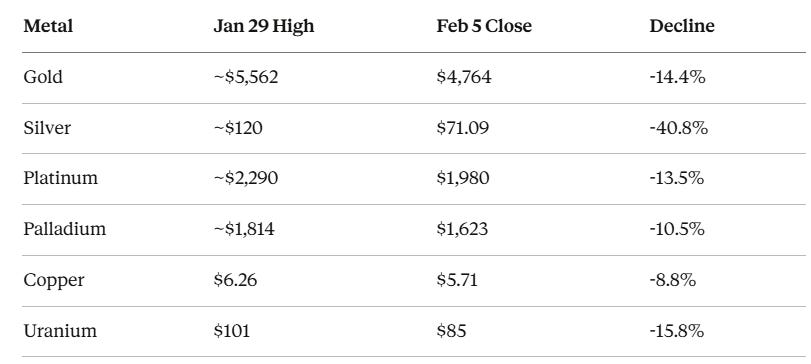

Since January 29th highs, the damage is staggering:

Silver’s single-day 30%+ drop was its worst since the Hunt Brothers collapse in 1980.

Gold’s two-session decline was the steepest since 1983.

Warsh, Margins, and Crowded Exits

The Warsh Shock

Trump’s nomination of Kevin Warsh to replace Jerome Powell as Fed Chair caught everyone flat-footed.

Warsh is a known hawk. He favours aggressive balance sheet reduction and higher real yields.

Non-yielding assets like gold and silver are the natural casualties of a “hard money” Fed.

The dollar ripped higher, making greenback-priced metals more expensive for foreign buyers overnight.

Does this kill the bull thesis? No.

Analysts still expect two more rate cuts in 2026. Central bank gold buying hasn’t stopped. De-dollarization trends are structural, not cyclical. But the perception of a tighter Fed was enough to blow the doors off an overcrowded trade.

CME Margin Hikes

Exchange margin policy can dramatically amplify a move that’s already underway.

In this selloff, CME’s hikes didn’t cause the crash alone, but they significantly accelerated the downside.

After a historic plunge, CME raised gold futures margins from 6% to 8% and silver from 11% to 15%, with platinum and palladium also increased.

Those jumps forced highly leveraged traders to either post more collateral or liquidate into a falling market.

It’s a liquidity‑driven “death spiral” layered on top of underlying fundamentals, not a sudden change in long‑term supply and demand.

We’ve seen similar dynamics before, including in silver’s 2011 reversal, where margin hikes coincided with a violent break after a parabolic run.

Announcing the latest increases at the end of last week, effective after Monday’s open, ensured they hit when liquidity was thin and markets were already stressed, deepening the rout.

The Crowded Trade Unwind

By mid-January, positioning in gold was at an 8-year high.

Retail investors had been pouring into SLV and physical bullion at record rates. Silver had more than doubled from $50 to $120 in three months. Gold went from $4,000 to $5,500 in the same window.

As Finimize put it: “so many investors had piled into precious metals in recent months that the exit was very crowded… a lot of sellers and very few buyers.”

A Note On Project Vault and FORGE

The U.S. government just launched the most aggressive critical minerals policy in American history.

Then the market puked. What’s going on?

Project Vault — The $12 Billion Stockpile

On February 2nd, Trump signed an executive order creating a first-of-its-kind strategic critical minerals reserve for the private sector.

Project Vault combines $1.67 billion in private capital with a record $10 billion loan from the U.S. Export-Import Bank, their largest deal ever by more than double.

More than a dozen major manufacturers have signed on as participants, including General Motors, Stellantis, Boeing, Corning, GE Vernova, Western Digital, Clarios, and Alphabet’s Google.

Ex-Im CEO John Jovanovic said the program was oversubscribed because investors are attracted by the credit quality of participating manufacturers and their long-term purchase commitments.

Participating companies commit to purchasing minerals at a specified inventory price, which effectively creates a price floor.

They can draw down their allotted materials as needed, but must replenish them, with full access permitted during major supply disruptions. This buy-at-fixed-price, repurchase-at-same-price structure is specifically designed to dampen the kind of volatility that kills mining projects before they ever reach production.

FORGE— 55 Countries, Price Floors, and a Preferential Trade Zone

Two days after Project Vault, on February 4th, the administration hosted 55 countries, representing 2/3’s of the global GDP, at the inaugural Critical Minerals Ministerial at the State Department. Vice President JD Vance unveiled the FORGE (Forum on Resource Geostrategic Engagement ) framework.

FORGE proposes a preferential trade zone for critical minerals with enforceable price floors maintained through adjustable tariffs.

This was designed to prevent any single country from flooding markets with artificially cheap supply to kill Western competition.

The EU, Japan, and Mexico each signed agreements with the U.S. to develop price floor mechanisms, with MOUs and action plans due within 30-60 days. The administration has also provided up to $100 billion in lending authority for critical minerals projects.

Knocking the Biden era “let’s diagnose this” to actual execution, Vance said “We’re not spending our time writing 200-page book reports about how important critical minerals are. We have a plan, and we’re focused on project execution.”

So Why Didn’t The Market React?

Because none of this matters in a margin call.

Investors are asking “if the initial fear was no price floor, and now we have guaranteed price floors, why are we tanking?”

The answer is brutally simple: institutional deleveraging doesn’t read policy briefs.

When the CME hikes margins and the dollar rips on the Warsh nomination, risk models don’t pause to evaluate whether Project Vault changes the five-year outlook for rare earth equities.

They sell what’s volatile, raise cash, and sort out fundamentals later.

But here’s what matters for anyone with a time horizon beyond next Tuesday: Project Vault and FORGE represent the U.S. government positioning itself as a repeat buyer, market stabilizer, and strategic counterparty in critical minerals for the first time in modern history.

As one legal analyst at Baker Botts noted, “projects able to demonstrate reliable production, domestic or allied processing, and credible clean supply chains will have an easier path to financing and offtake.”

That’s the setup. The selloff is creating the entry point. The policy infrastructure being built right now is creating the floor beneath it.

What The Social Media Folks Are Saying

I’ve been sweeping the social media universe this week to get a pulse on what investors on the ground are actually saying about this volatility.

The sentiment ranges from blind panic to stubborn denial.

I took notes and here’s what stood out:

The smart money in the room gets it:

The macro is overriding sector-specific catalysts. Price floors, international pacts, critical minerals designations. None of it matters when institutional money is in full liquidation mode.

Geopolitical tailwinds are real but they don’t stop short-term deleveraging.

Somebody said “Just survive your positions. Big money is stepping in. Time will do the rest” – this is actually the correct long-term read, even if it’s cold comfort right now.

Dollar volume matters more than share count when assessing true liquidity.

One of the sharpest takes I came across all week: “Liquidity sweep, speculative commodity market with high retail % will make precipitous drops last for awhile. Gonna be a slow grind back up.”

That’s exactly right, and it’s the part most people don’t want to hear.

When retail makes up a disproportionate share of the float (which it absolutely does in junior mining and critical minerals names) selloffs are deeper and recoveries are slower.

Institutional algos and market makers don’t step in to provide a bid on a TSX Venture stock the way they do on the S&P 500. The liquidity simply isn’t there, so the drops overshoot on the way down and the recovery grinds rather than snaps.

If you’re positioned in this space, that’s the reality you signed up for.

The asymmetric upside comes with asymmetric drawdowns.

Accepting that is the difference between the investors who compound wealth in this sector and the tourists who buy the top and sell the bottom.

Where the crowd is getting it wrong:

Assuming good news should immediately translate to higher prices. Markets don’t work that way, especially when leverage is unwinding.

Confusing “the market should go up because fundamentals are good” with “the market will go up.” The market can stay irrational longer than you can stay solvent, especially in microcaps.

Underestimating how violently high-beta names get sold when institutional risk models flash red across the board.

The Veteran’s Playbook

Here’s how I see things playing out in the near term:

Week 1-2 (we’re here): Panic selling, margin liquidation, retail capitulation. The weak hands who bought the FOMO top in January are now puking. Every bounce gets sold. Social media is full of people swearing off the sector forever.

Week 3-4: Stabilization. Forced selling exhausts itself. The margin calls are met or the positions are liquidated. Volume drops. Price action gets boring. This is where most people stop paying attention.

Month 2-3: Quiet accumulation. Institutional money that sold for risk management purposes begins re-entering. Smart money uses the lower prices. The stocks that held up best during the selloff are usually the ones that lead the recovery.

Month 4+: The structural thesis reasserts itself and markets continue their ascent.

The Bottom Line

Nothing has changed in the structural thesis for precious metals or critical minerals.

Central bank buying continues. De-dollarization is accelerating. The critical minerals supply chain reshoring is a multi-decade theme backed by billions in government capital.

Uranium supply-demand fundamentals remain tight despite the Kazatomprom noise.

What has changed is positioning and leverage.

The trade got crowded, the CME raised margins, a hawkish Fed chair nominee spooked the market, and the mechanical deleveraging did the rest. This is what corrections look like in a bull market. They’re brutal, they shake out weak hands, and they create the conditions for the next leg higher.

Gold has pulled back 14% from its high. It’s still up roughly 8% year-to-date and massively higher than a year ago. Silver is getting destroyed, but it also more than doubled in three months. Some giveback was inevitable.

The question isn’t whether the bull market is over.

The question is whether you have the conviction and the positioning to survive the volatility.

Corrections don’t announce themselves politely, and they don’t care about your feelings.

They care about leverage, liquidity, and mathematics.

What am I doing? What I’ve always done during times like this: Stay positioned. Stay patient. And for the love of everything, stay away from the margin button.