BUENOS AIRES, AR / ACCESS Newswire / October 6, 2025 / NOA Lithium Brines Inc. (TSXV:NOAL)(Frankfurt:N7N) ("NOA" or the "Company") is pleased to announce the positive results of the Preliminary Economic Assessment (the "PEA" or "Study") for the Company's Rio Grande project (the "Rio Grande Project" or "Project") in the Salta Province of Argentina. This PEA provides an independent economic assessment of the economic potential of the Project, based on the latest resource estimate filed by the Company in July 2024 (see the Company's news release dated July 10, 2024 for further details).

The Company engaged global engineering firm Hatch Limited ("Hatch") to complete the PEA. Hatch is experienced in lithium projects, including the execution of brine projects in Argentina.

Rio Grande Project PEA Highlights (all figures are in US Dollars unless otherwise noted)1 :

The results of the Study are positive and demonstrate that the Rio Grande Project may have the potential to become a world class operation supported by exceptional brine concentrations and economics:

Strong Project Economics may result:

Project production of up to 40,000 tonnes per annum (tpa) of battery grade lithium carbonate (LCE), developed in two stages of 20,000 tpa each, using conventional evaporation ponds processing.

Pre-tax net present value (NPV) at an 8% discount of $2.065 billion for a single 20,000 tpa operation. Post-tax NPV at an 8% discount of $1.276 billion for a single 20,000 tpa operation.

Pre-tax internal rate of return (IRR) of 27.3% for a 20,000 tpa operation. Post-tax IRR of 22.6% for a 20,000 tpa operation.

Project payback period of 3.3 years pre-tax and 3.4 years after tax from initial production.

Average annual life-of-mine (LOM) earnings before interest, taxes depreciation and amortization (EBITDA) of $317 million for a 20,000 tpa operation.

Project production mine life of 30 years.

Nameplate capacity operating expenses (OPEX) at full 20,000 tpa production including product transportation but excluding royalties and taxes is estimated at $5,897 per tonne LCE.

Average LOM OPEX including product transportation but excluding royalties and taxes is estimated at $6,012 per tonne LCE.

Initial capital expenditures (CAPEX) estimated at $706.2 million for 20,000 tpa operation.

Project economics are based on a long-term battery grade lithium carbonate price assumption of $24,000 per tonne.

Expansion of 20,000 tpa to a total of 40,000 tpa may lead to robust Project economics:

The expansion of an additional 20,000 tpa increases the entire pre-tax project NPV at an 8% discount to $3.776 billion for an incremental capital cost investment of $639.7 million, and apost-tax NPV at an 8% discount at $2.341 billion.

Pre-tax internal rate of return (IRR) of 28.1% for 40,000 tpa production. Post-tax IRR of 23.3%.

Average annual EBITDA of $613 million for 40,000 tpa production.

Nameplate capacity OPEX at full 40,000 tpa capacity including product transportation but excluding royalties and taxes estimated at $5,552 per tonne LCE.

Average LOM OPEX including product transportation but excluding royalties and taxes estimated at $5,692 per tonne LCE for 40,000 tpa operation.

Lower Technical Risk Development is expected:

The Study evaluates a conventional evaporation pond process, which is currently used by several producers in the same region, thereby minimizing the development risk.

Brine chemistry and concentration of lithium above 520 milligrams per litre (mg/l) support the use of proven technology while preserving flexibility to evaluate alternative flowsheets in subsequent study phases.

Staged development: Phase 2 (second 20,000 tpa) construction is expected to commence after Phase 1 (first 20,000 tpa) achieves initial commercial production. This approach reduces execution and ramp-up risk, optimizes capital allocation by deferring part of CAPEX to cash-flow and preserves optionality to integrate process improvements between phases.

Project Production Optionality:

The Company also evaluated, at a high level, an alternative for the development of the Project for production of lithium chloride instead of lithium carbonate. This alternative could potentially reduce initial CAPEX and delivery of product (time-to-market), as well as reduce the development risk of the Project. This option may be examined in more detail in a subsequent pre-feasibility study (PFS) phase. A preliminary assessment of this alternative for a single 20,000 tpa LCE-equivalent case, indicates a CAPEX reduction of 30-35% below the base case and OPEX of 35-40% below the base case.

Potential for Upside Opportunities:

While the Project may be eligible for Argentina's Large Investment Incentive Regime (RIGI), the timing and applicability remain uncertain. The PEA base case excludes RIGI benefits, and any potential upside is presented for illustrative purposes only. The RIGI is a regime created by national law in Argentina that grants tax stability and incentives in taxes, among others things, that may have material impacts if granted, on the Projects economics. Assuming acceptance of RIGI's on the Project, this may have the following impacts:

Pre-Tax NPV (20,000 tpa): $2.220 billion

Pre-Tax IRR (20,000 tpa): 28.1%

After-Tax NPV (20,000 tpa): $1.621 billion

After-Tax IRR (20,000 tpa): 24.8%

For the expansion to 40,000 tpa the results would be:Pre-Tax NPV (40,000 tpa): $4.078 billion

Pre-Tax IRR (40,000 tpa): 29.1%

After-Tax NPV (40,000 tpa): $2.987 billion

After-Tax IRR (40,000 tpa): 25.8%

Direct lithium extraction (DLE) methods will be evaluated and tested during the PFS phase and may further improve recoveries and production, which may positively impact the Project's economics.

The PEA evaluates execution of the full flowsheet at site. During the PFS phase, the Company will assess producing lithium chloride at site with a downstream carbonate plant in Güemes, Salta, which may potentially lower construction and operating costs for the Project.

There is broad industry consensus that lithium demand is expected to remain strong, with demand anticipated to outpace supply, potentially leading to higher prices and a potential supply deficit in the coming years.

The Rio Grande Project remains one of the few undeveloped projects with average lithium concentrations above 520 mg/l with approximately 2.66 million tonnes of LCE in the Measured + Indicated resource categories and approximately 2.04 million tonnes in the Inferred category from the Company's resources estimate filed in July 2024.

NOA's Chief Executive Officer Gabriel Rubacha states: "The results of this PEA validate our confidence in the potential of the Rio Grande Project. They confirm that the Project can become a high margin, world class operation supporting global lithium demand in the coming years. We have covered a lot of ground in a very short period of time to take the Project to this stage. Our next milestone is to take Rio Grande to feasibility and then production in the shortest possible time period".

Economic Analysis of the Project

Initial Capital Expenditures (CAPEX) - 2025 Q3 basis

Total estimated initial capital costs for the Project are $706.2 million for Phase 1 (20,000 tpa) of LCE product. Contingency costs for the Project are estimated at 30% of direct and indirect costs. CAPEX for the Project includes the initial investment for a lithium carbonate chemicals plant using evaporation ponds processing with an estimated annual production of 20,000 tpa.

An additional $639.7 million for Phase 2 (additional 20,000 tpa) of the Project for total initial capital cost of $1.346 billion for a total of 40,000 tpa of LCE product was estimated for this option, considering the same contingency and assumptions as Phase 1. See the tables below which show a summary of the initial CAPEX costs for the Projects Phase 1 and Phase 2.

Summary of Initial CAPEX - 20,000 tpa (Phase 1)

US$ million | 20,000 tpa LCE |

Direct Cost | $ 414.4 |

Wellfield / Ponds | |

Brine Extraction Wells | $ 22.1 |

Evaporation Ponds + Lime Plant | $ 197.2 |

Lithium Plant | |

Purification & Concentration | $ 26.0 |

Boron Solvent Extraction | $ 34.8 |

Carbonation | $ 24.4 |

Lithium Carbonate Production | $ 15.0 |

Utilities & Services | $ 49.5 |

Site Development & On-Site Infrastructure | $ 45.5 |

Indirect Cost | $ 116.4 |

Owner's Costs | $ 12.4 |

Contingency | $ 163.0 |

Total CAPEX | $ 706.2 |

Summary of Initial CAPEX - 40,000 tpa Expansion including initial CAPEX for 20,000 tpa above (Phase 2)

US$ million | 40,000 tpa LCE |

Direct Cost | $ 810.1 |

Wellfield / Ponds | |

Brine Extraction Wells | $ 45.2 |

Evaporation Ponds + Lime Plant | $ 394.5 |

Lithium Plant | |

Purification & Concentration | $ 51.9 |

Boron Solvent Extraction | $ 69.6 |

Carbonation | $ 48.7 |

Lithium Carbonate Production | $ 30.0 |

Utilities & Services | $ 98.9 |

Site Development & On-Site Infrastructure | $ 71.3 |

Indirect Cost | $ 206.6 |

Owner's Costs | $ 24.3 |

Contingency | $ 305.0 |

Total CAPEX | $ 1,345.9 |

Operating Cost (OPEX) of Project

Total estimated annual operating costs for Phase 1 of the Project are $117.9 million. The main operating costs for the Project are reagents accounting for 51% of the total operating costs, labour accounting for 16% of the total operating costs, and energy accounting for 12% of the total operating costs.

Summary of OPEX - 20,000 tpa (Phase 1)

Cost Component | Annual Cost | Cost per Tonne | Opex Distribution % |

(US$ million) | (US$/t tonne LCE) | ||

Direct Cost | |||

Chemical Reagents | $ 60.2 | $ 3,011 | 51% |

Salt removal and transport | $ 7.2 | $ 358 | 6% |

Energy | $ 14.6 | $ 731 | 12% |

Consumables | $ 1.7 | $ 87 | 1% |

Water Treatment | $ 1.1 | $ 56 | 1% |

Labour | $ 19.2 | $ 960 | 16% |

Catering & Camp Services | $ 5.5 | $ 275 | 5% |

Maintenance | $ 3.3 | $ 165 | 3% |

Product Transportation to Port | $ 2.0 | $ 100 | 2% |

Indirect Cost | |||

General & Administrative | $ 3.1 | $ 156 | 3% |

Production Li2CO3 Total Cost | $ 117.9 | $ 5,897 | |

Summary of OPEX -40,000 tpa Expansion (Phase 2)

Cost Component | Annual Cost | Cost per Tonne | Opex Distribution % |

(US$ million) | (US$/t tonne LCE) | ||

Direct Cost | |||

Chemical Reagents | $ 120.4 | $ 3,011 | 51% |

Salt removal and transport | $ 14.3 | $ 358 | 6% |

Energy | $ 27.0 | $ 676 | 11% |

Consumables | $ 3.5 | $ 87 | 1% |

Water Treatment | $ 2.2 | $ 56 | 1% |

Labour | $ 32.6 | $ 816 | 14% |

Catering & Camp Services | $ 8.3 | $ 206 | 3% |

Maintenance | $ 6.6 | $ 165 | 3% |

Product Transportation to Port | $ 4.0 | $ 100 | 2% |

Indirect Cost | |||

General & Administrative | $ 3.1 | $ 78 | 1% |

Production Li2CO3 Total Cost | $ 222.1 | $ 5,552 | |

Economic Analysis and Summary of the Project

The economic evaluation of the Project in the PEA was performed assuming an 8% discount rate. Cash flows were modelled with a final investment decision estimated to be in 2027 and construction initiating in 2028. The resulting economics of the Project are as follows:

Base Case - 20,000 tpa Project (Phase 1)

Lithium Carbonate Production | tpa | 20,000 |

Project Lifetime | years | 30 |

Initial CAPEX | US$ million | $ 706.2 |

OPEX | US$/tonne | $ 5,897 |

Avg. Selling Lithium Carbonate | US$/tonne | $ 24,000 |

Average Annual EBITDA | US$ million | $ 317 |

Pre-Tax NPV (8%) | US$ billion | $ 2.065 |

Pre-Tax IRR | % | 27.3% |

After-Tax NPV (8%) | US$ billion | $ 1.276 |

After-Tax IRR | % | 22.6% |

Payback Period (Pre-Tax) | years | 3.3 |

Payback Period (After-Tax) | years | 3.4 |

Expansion Case - 40,000 tpa (Phase 2)

Lithium Carbonate Production | tpa | 40,000 |

Project Lifetime | years | 30 |

Initial CAPEX | US$ million | $ 1,345.9 |

OPEX | US$/tonne | $ 5,552 |

Avg. Selling Lithium Carbonate | US$/tonne | $ 24,000 |

Average Annual EBITDA | US$ million | $ 613 |

Pre-Tax NPV (8%) | US$ billion | $ 3.776 |

Pre-Tax IRR | % | 28.1% |

After-Tax NPV (8%) | US$ billion | $ 2.341 |

After-Tax IRR | % | 23.3% |

Payback Period (Pre-Tax) | years | 4.6 |

Payback Period (After-Tax) | years | 5.0 |

The discounted cash flow model for the Project, generated independently by Hatch, with consultants providing tax estimates, demonstrates the potential for an attractive economic result from the production of lithium carbonate chemicals from the Rio Grande Project.

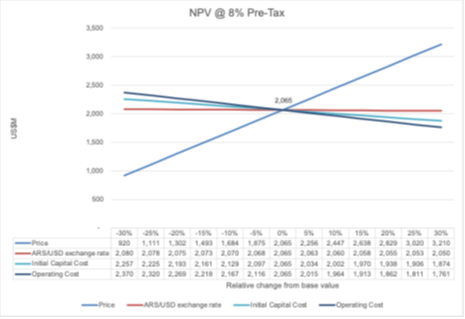

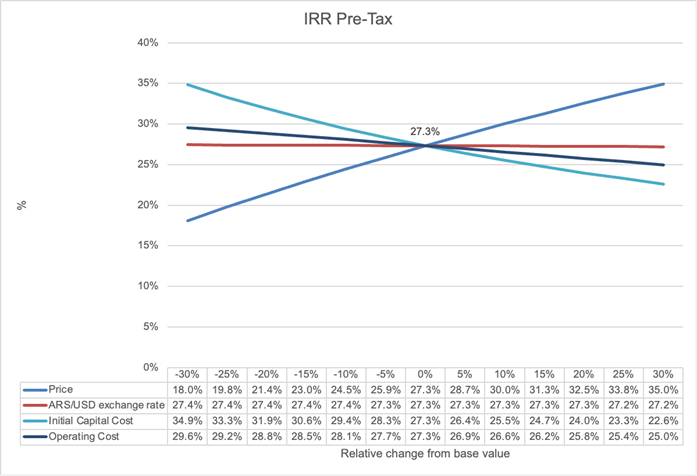

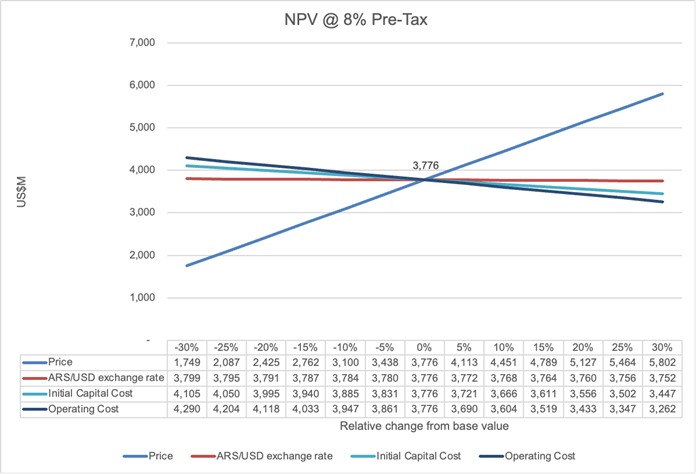

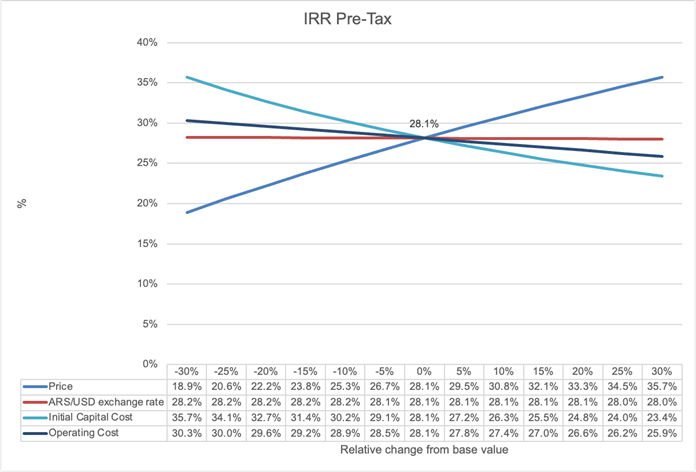

Sensitivity Analysis

Economics sensitivities for the Project are set out in the charts below, on a pre-tax basis at an 8% discount, with a key sensitivity being the lithium carbonate prices, with not as much sensitivity seen in the change in CAPEX, OPEX and FX for the Project.

Base Case - 20,000 tpa (Phase 1)

Expansion Case - 40,000 tpa (Phase 2)

Next Steps For the Company

The next stage for the Rio Grande Project is a PFS. To support this work, the Company will continue its exploration campaign with additional drilling including pumping wells and additional freshwater wells, a basin-wide water balance, hydrogeological modelling, additional laboratory tests as well as process piloting studies, among others.

The current PEA is based upon brine grades across the company's Measured, Indicated and Inferred Mineral Resources only. Mineral resources that are not mineral reserves do not have demonstrated economic viability. There is no certainty or assurance that the Rio Grande Project envisioned by the PEA will be realized. The PEA is preliminary in nature and includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves.

The PEA was prepared by Hatch Limited in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects (NI 43-101) standards and it integrates the work of Hatch and Montgomery & Associates each having the qualifications necessary to author their respective sections of the PEA.

Hatch has reviewed the technical content of this news release for accuracy, however, Hatch is not responsible for and does not endorse any non-technical content appearing herein, including, as to financing, governance or otherwise.

About NOA Lithium Brines Inc.

NOA is a lithium exploration and development company formed to acquire assets with significant resource potential. All NOA's projects are located in the heart of the prolific Lithium Triangle, in the mining-friendly province of Salta, Argentina, near a multitude of projects and operations owned by some of the largest players in the lithium industry. NOA has rapidly consolidated one of the largest lithium brine claim portfolios in this region that is not owned by a producing company, with key positions on three prospective salars, being Rio Grande, Arizaro, and Salinas Grandes, and totalling over 140,000 hectares.

About Hatch Ltd.

Hatch is a global multidisciplinary project management, engineering and professional services consultancy. Hatch has experience in critical minerals, including the processing and engineering of lithium-rich brines, including projects located on salars in Argentina.

About Montgomery & Associates

Montgomery & Associates ("M&A") is an international water resource consulting firm that specializes in management and mining hydrogeology services which includes characterization of aquifer conditions. It has been operating since 1984, with South American offices now located in Santiago Chile and Salta Argentina. M&A's Head office is in Tucson Arizona. M&A's client list includes most of the domestic and international mining entities operating in the Americas.

On Behalf of the Board of Directors,

Gabriel Rubacha

Chief Executive Officer and Director

For Further Information

Website: www.noalithium.com

Email: info@noalithium.com

Telephone: +54-9-11-5060-4709

Alternative Telephone: +1-403-571-8013

Qualified Person

Mr. Michael Rosko, M.Sc., C.P.G. of E. L. Montgomery and Associates ("M&A") is a Registered Geologist (C.P.G.) in Arizona, California, and Texas, a Registered Member of the Society for Mining, Metallurgy and Exploration, and is a Qualified Person (QP) as defined by NI 43-101. Mr. Rosko and hydrogeologists from M&A have been on site multiple times during the various phases of drilling and sampling operations; Mr. Rosko has extensive experience in salar environments and has been a QP on many lithium brine projects. Mr. Rosko and M&A are completely independent of NOA, as defined in, and required by, NI 43-101. Mr. Rosko has reviewed and approved the content of this news release.

A complete PEA technical report prepared in accordance with NI 43-101 in support of the disclosed PEA results herein will be filed on SEDAR+ (www.sedarplus.com) and on the Company's website (www.noalithium.com) within 45 days from the date hereof. The PEA technical report is intended to be read as a whole, and sections should not be read or relied upon out of context.

Cautionary Note Regarding Forward-Looking Statements

This news release contains forward-looking statements and other statements that are not historical facts. Forward-looking statements are often identified by terms such as "will", "may", "should", "anticipate", "expects" and similar expressions. All statements other than statements of historical fact, included in this news release are forward-looking statements that involve risks and uncertainties. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from the Company's expectations include the assumptions and information disclosed in the PEA, anticipated production and/or results of water wells, further brine process testing and exploration, the accuracy of mineral or resource exploration activity, reserves or resources, the accuracy of cash flow forecasts, projected capital and operating costs, lithium processing recoveries, mine life, production rates, regulatory or government requirements or approvals including approvals of title and mining rights or licenses and environmental, local community or indigenous community approvals, the reliability of third party information, continued access to mineral properties or infrastructure or water, changes in laws, rules and regulations in Argentina or any other jurisdiction which may impact upon the Company or its properties or the commercial exploitation of those properties, currency risks including the exchange rate of USD$ and ARS$, fluctuations in the market for lithium related products, changes in exploration costs and government royalties, export policies or taxes in Argentina, and other risks detailed from time to time in the filings made by the Company with securities regulators. The reader is cautioned that assumptions used in the preparation of any forward-looking information may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted, as a result of numerous known and unknown risks, uncertainties, and other factors, many of which are beyond the control of the Company. The reader is cautioned not to place undue reliance on any forward-looking information. Such information, although considered reasonable by management at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated. Forward-looking statements contained in this news release are expressly qualified by this cautionary statement. The forward-looking statements contained in this news release are made as of the date of this news release and the Company will update or revise publicly any of the included forward-looking statements as expressly required by applicable law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. No securities regulatory authority has reviewed nor accepts responsibility for the adequacy or accuracy of the content of this news release.

1 Readers are cautioned that reliance on information in this news release without reference to the complete PEA technical report may not be appropriate. The forthcoming complete and filed PEA technical report should be read in its entirety, and sections should not be read or relied upon out of context.

SOURCE: NOA Lithium Brines Inc.

View the original press release on ACCESS Newswire