UK inflation eases for the first time in five months, setting the stage for a potential Bank of England rate cut ahead of the upcoming budget from Chancellor Rachel Reeves.

The Office for National Statistics (ONS) reported that annual inflation, as measured by the Consumer Price Index, fell to 3.6% from 3.8% in September. However, the rate is still well above the government’s 2% target.

The decline was largely driven by slower increases in gas and electricity prices, as well as easing hotel prices. However, food inflation is accelerating to 4.9%6 with higher prices for bread, meat, fish, vegetables, chocolate and confectionery. Yet fruit prices fell slightly.

What’s happening to the UK currency?

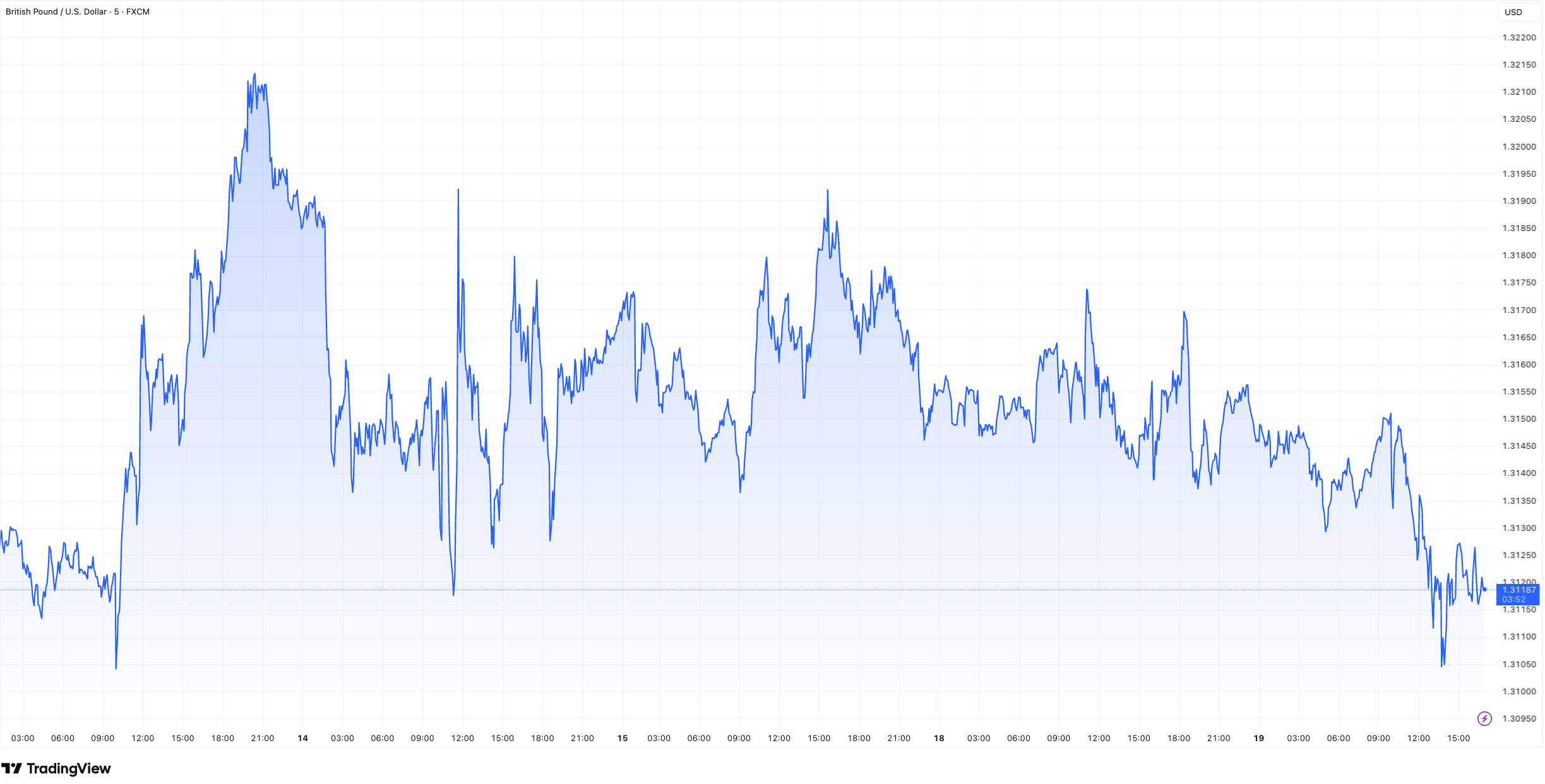

The GBP/USD barely moved on Wednesday, despite UK inflation slipping on a monthly basis. Typically, softer inflation would weigh more on a currency, but the pair held steady, trading around USD 1.3140.

The muted reaction reflected the fact that the CPI figure was widely anticipated and already priced into markets, which had been primed for the release as a key highlight on the economic calendar this week.

It may also be the case that the market had already priced in much of the Bank of England’s dovish shift, limiting further immediate downside for the pound. Traders swiftly raised the probability of a December quarter-point cut to 85%, up from 80% earlier in the week.

The Bank of England is currently holding its benchmark interest rate at 4% following a narrowly split vote. It has indicated that a cut in December is possible if price pressures continue to ease.

The inflation report comes just a week before the government's highly anticipated Budget. Britain's finance minister, Rachel Reeves, has made easing cost-of-living pressures one of the main goals of the Budget, which is expected to combine tax rises and spending cuts in a bid to stabilise government finances.

The autumn Budget will represent Labour government’s toughest fiscal test so far, after a downgrade in the productivity forecasts by the Office for Budget Responsibility. Reeves acknowledged the OBR had “consistently overestimated” UK productivity, and said the forthcoming revision of its assumptions would make her task even harder.

With no boom in economic growth, stubbornly high inflation, and rising public debt costs, the chancellor is being asked to bridge a shortfall estimated by some economists to be about £50 billion. This sum includes about £6 billion, reflecting the government’s reversal on winter fuel payments to pensioners and its decision to abandon planned welfare cuts.