Donald Trump announced on social media that he has fired a senior Federal Reserve official — a move that sent shockwaves through global markets on Monday night. The big question now: Is the Fed losing its independence under Trump’s pressure?

Firstly, let’s clarify: the figure Trump moved to fire is not Jerome Powell, whom the U.S. President has repeatedly critisized for not cutting interest rates fast and deep enough. Instead, Trump targeted Federal Reserve governor Lisa Cook, escalating his campaign to exert more control over the central bank.

In a Truth Social post, Trump published what he called Cook’s termination letter, citing “sufficient reason” related to alleged false statements about mortgage agreements.

However, under U.S. law, a president can only remove a Fed governor for cause — and even then, it’s subject to judicial review. Firing Cook would allow Trump to nominate a more compliant voice likely to favor aggressive rate cuts.

But Cook is not backing down. She immediately rejected the allegations, declaring that Trump “has no authority to fire me.”

As it stands, the FOMC has 12 voting members. Two are Trump appointees already advocating for faster cuts. One seat is vacant after Adriana Kugler’s resignation. If Cook is ousted, Trump-aligned voices could make up nearly one-third of the votes.

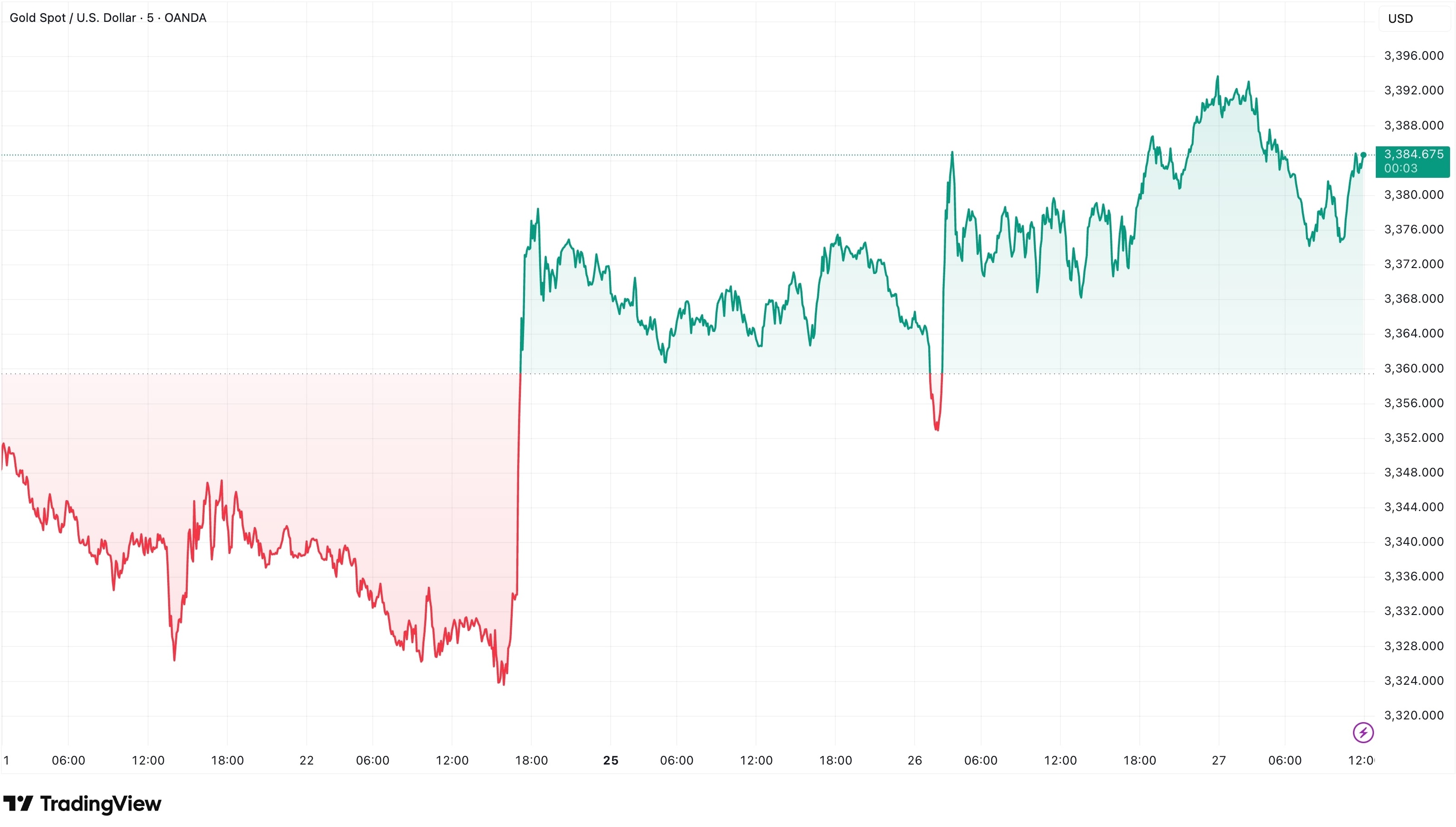

The turmoil briefly fueled a rally in gold. XAUUSD surged to a two-week high right under $3,390 per ounce before giving up most of the session gains.

Safe-haven bids picked up as traders braced for potential institutional instability. While the bullion rallied, the U.S. dollar index and Treasury yields both declined.

Importantly, the Fed had not been in a hurry to cut interest rates. Officials remained cautious, citing concerns over the inflationary impact of Trump tariffs. However, last Friday, Fed Chair Jerome Powell hinted at the possibility of a September rate cut, pointing to rising risks in the labor market.

The U.S. unemployment rate has climbed nearly a full percentage point over the past year, while job growth is decelerating — averaging just 35,000 new positions per month over the last quarter. Even more concerning, recent revisions stripped 258,000 jobs from the May and June employment reports.

For many traders, this was the lightbulb moment: a weakening labor market gives Powell cover to pivot toward easing.

That hint was all markets needed. Risk appetite surged into Friday’s close. The S&P 500 climbed 1.5% pop, the Dow Jones surged 1.9% to a new all-time high, and the Nasdaq rebounded with a 2% increase, erasing much of its weekly losses.

Powell hasn’t cut rates yet. But he’s given markets a reason to believe that rate cuts are now on the table.