Tesla is approaching a strategic turning point, where the classic electric-car business is losing momentum, brand value is declining for the third year in a row, and the company is increasingly associated with Elon Musk's political and media activities rather than its products. Last year, the Tesla brand lost $15 billion in value, roughly equal to the estimated capitalization of the Discord IPO, and since the beginning of 2024, its value has declined to $27.6 billion. The key reasons are both reputational costs amid Musk's political involvement and the lack of truly notable new models.

In this context, Tesla is increasingly shifting its focus toward what Musk himself calls the next phase of growth. Namely, unmanned taxis and humanoid robots. The company's head still promises to begin selling the latter by the end of 2027, but, according to him, robotaxis should become widely adopted in the United States by the end of this year. Musk made these statements at the World Economic Forum in Davos, where he again expressed confidence that the problem of autonomous driving has largely been solved.

However, the practice still looks noticeably more prosaic. Since June last year, a limited number of prototype robotaxis based on the production Tesla Model Y have been transporting carefully selected passengers in Austin, Texas. Until recently, every car had an insurance observer in the front passenger seat, who was not formally a driver, which allowed Musk to call the service completely unmanned. This week, he announced that observers had been removed from some cars and that passengers now ride alone in the vehicle.

However, even this step comes with significant caveats. As independent spectators have noted, robotaxis without an observer in the cabin are accompanied by other Tesla electric vehicles that follow and provide additional oversight. Previously, the company had already used a dual surveillance scheme, in which a car with passengers was monitored by specialists in a separate vehicle. As a result, the conditional driver disappears from the cabin, but he is effectively replaced by several employees outside the vehicle, which sits poorly with the rhetoric about the almost solved problem of autonomous driving.

Regulatory restrictions remain another major barrier. In California, Tesla still operates its robotaxis only with drivers behind the wheel, using this mode to collect data and train neural networks. Competitors such as Waymo and Zoox in the United States, as well as Apollo Go and WeRide in China, have long been transporting passengers in fully unmanned vehicles without a person in the cabin. Nevertheless, Musk said in Davos that the Chinese and EU authorities should approve the use of Tesla vehicles on public roads as early as next month. Many observers view this forecast with cautious skepticism.

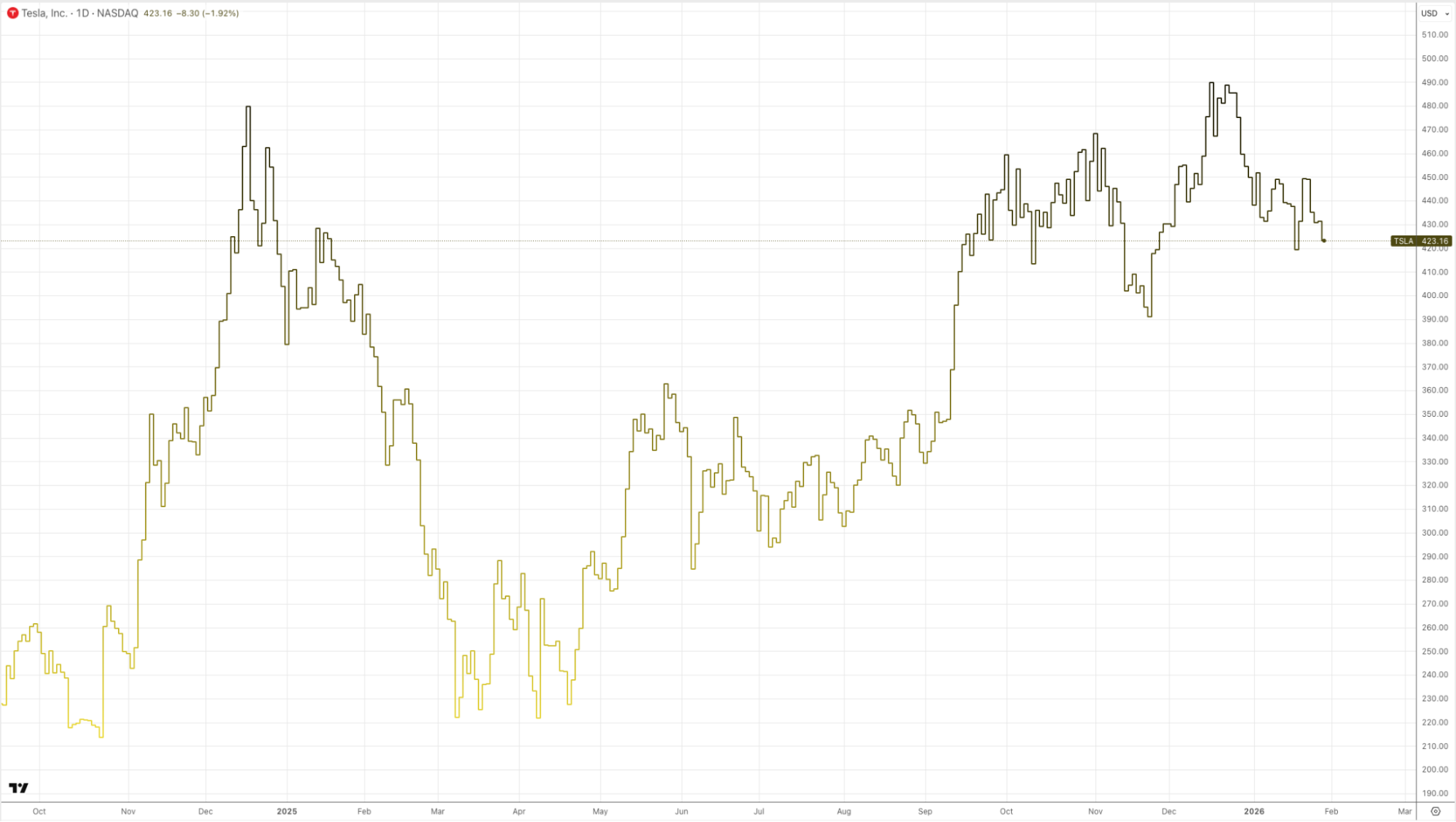

All of these dynamics overlap with Tesla's broader problems. Sales of electric vehicles are declining, the brand's recommendation rating in the United States has dropped to 4.0 out of 10, and the company is increasingly falling behind competitors not only in brand perception but also in the pace of new product launches. At the same time, the loyalty of existing owners remains high, providing Tesla with a temporary margin of safety but not solving structural problems that, if left unaddressed, could push the Tesla stock price lower.

As a result, Tesla is increasingly selling to the market not current results, but promises of the future — robotaxis, AI, and humanoid robots. The company's history shows that some of these promises do materialize over time, but increasingly often with significant delays and compromises. Against the backdrop of falling brand value and growing competition, the question is no longer whether Tesla will be able to create an autonomous taxi, but whether the market will have the patience to wait for the moment when loud statements begin to consistently align with reality.