Markets’ rule #1: Bullion tends to shine when rates fall and during periods of economic or geopolitical uncertainty. Right now, stars are aligned — gold is ripping higher.

Concerns over a potential U.S. government shutdown are rattling global markets, boosting safe-haven demand and sending gold to record highs, while the U.S. dollar faces mounting pressure. Ongoing bets that the Federal Reserve will cut rates further this year have also buoyed the yellow metal.

Gold prices spiked to a record $3,820 per ounce Monday before easing to $3,810, marking a staggering 47% year-to-date gain. Forget Bitcoin’s 17% or the S&P 500’s 13% — gold just stole the performance crown.

The rally’s been relentless, with gold posting gains in 10 of the past 14 sessions. It’s become the ultimate “don’t panic” asset, outpacing every other large-cap player in 2025. Broader metals are rallying too, with silver and platinum both surging.

Investors treat gold as insurance against bad times. That dynamic is on full display as markets brace for a possible U.S. government shutdown this week, amid faltering bipartisan negotiations on a funding bill.

A prolonged shutdown could delay the release of key nonfarm payrolls data due later this week and disrupt economic activity. The last partial government shutdown — spanning 35 days from late 2018 into early 2019 — shaved an estimated $11 billion off GDP, according to the Congressional Budget Office.

Another powerful tailwind for bullion: growing conviction Jerome Powell and the Fed will resume the rate-cutting cycle. After September’s move, another cut could come as early as October.

Lower rates shrink the opportunity cost of holding gold. (After all, it pays no yield, dividends, or interest.) If Treasuries aren’t offering much, parking cash in the yellow metal suddenly looks smarter.

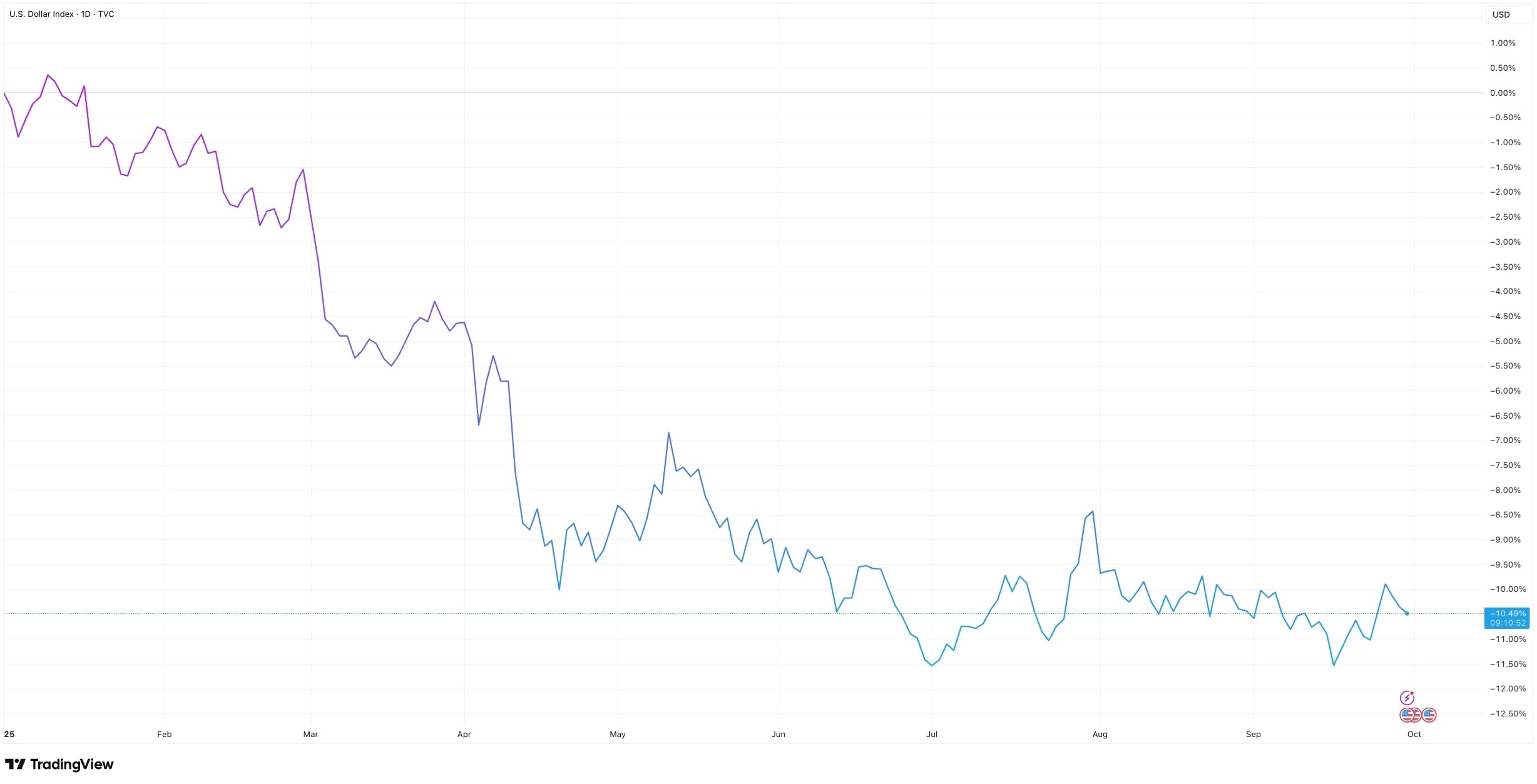

In short: gold thrives when confidence in the dollar, the economy, or politics wavers. The U.S. dollar index is down about 10% year-to-date; the labor market outlook is muddied by major job-count revisions; and in politics, Washington is slapping tariffs on nearly everyone.

Sparkly future, right? But what if gold’s run is overdone? Shorting gold here is essentially a bet that:

• The Fed’s cuts are already priced in.

• Inflation could flare up again, forcing rates higher and weighing on gold.

• Risk assets rebound, reducing the appeal of safe havens.

Here’s the tricky part: both the bull and bear cases carry weight. Fundamentals favor continued strength, but technicals are flashing exhaustion.