Gold has gone blue — for the first time in three months. What happened to the bullion? The answer is simple: Trump, like the rest of the market. More specifically, his latest post on Truth Social.

Gold prices tumbled when gold bugs received direct presidential assurance. On Monday President Donald Trump declared that gold would not face tariffs, overturning a U.S. customs ruling that bars of the precious metal imported from Switzerland be subject to duties. His post — “Gold will not be Tariffed!” — ended months of speculation.

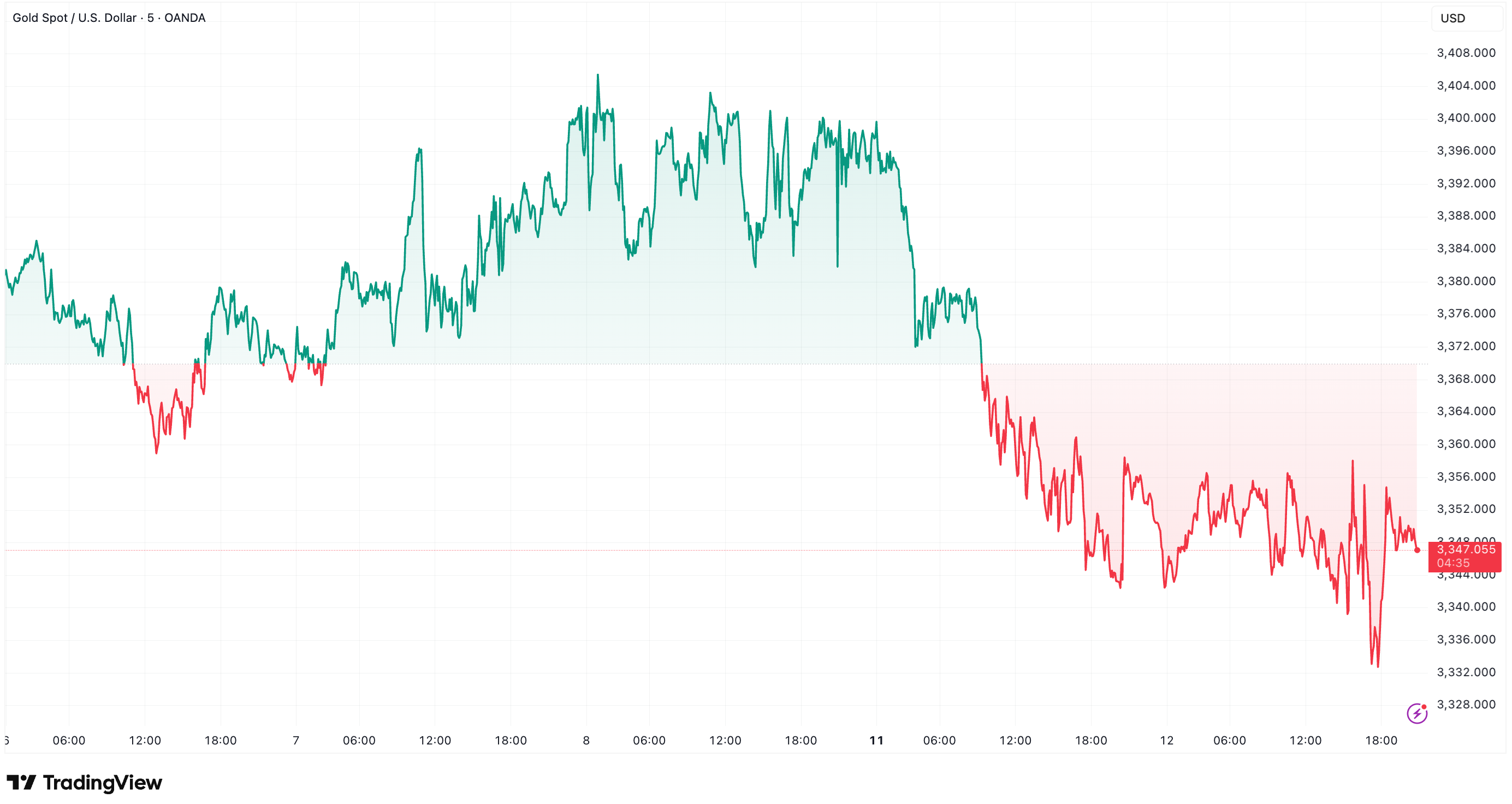

You might expect tariff immunity to give gold a boost, much like how stocks rally when tariff threats recede. Instead, bullion dropped 1.6% on the day, hovering near $3,350 — its sharpest single-session decline since May 14.

The move puzzled some observers. With gold already up 27% year-to-date — matching BTCUSD gain and far outpacing S&P 500’s sub-9% rise — traders saw little urgency to buy at such elevated prices.

The precious metal had hit a record high on Friday, after U.S. Customs and Border Protection ruled that 1 kilogram and 100 ounce gold cast bars from Switzerland would be subject to Trump’s 39% import tariffs.

Switzerland was hit with a 39% tariff on all imports, from gold to luxury watches, chocolate and cheese. That decision was seen as a major blow to the country, which dominates the bullion market, with $36 billion in gold exports accounted for more than two-thirds of the country’s trade surplus with the U.S. in the first quarter.

Gold bars of this type are used to back contracts on The Commodity Exchange (COMEX), the main futures market for gold, silver and other metals.

The ruling would have applied not just to Switzerland but also to any country exporting these types of gold bars to the U.S. In other words, gold bars would have been subject to the prevailing U.S. tariff rate against the country of origin.

Trump’s statement on Monday eased concerns about bullion exports. Gold remains a classic safe-haven asset for investors ranging from individuals to sovereign wealth funds.

The lack of follow-through buying suggests that markets are no longer worried about tariffs denting gold prices — in other words, the safe haven still looks safe… for now. The metal remains in a strong uptrend for the year, but Monday’s drop is a reminder that even gold’s shine can fade from time to time.