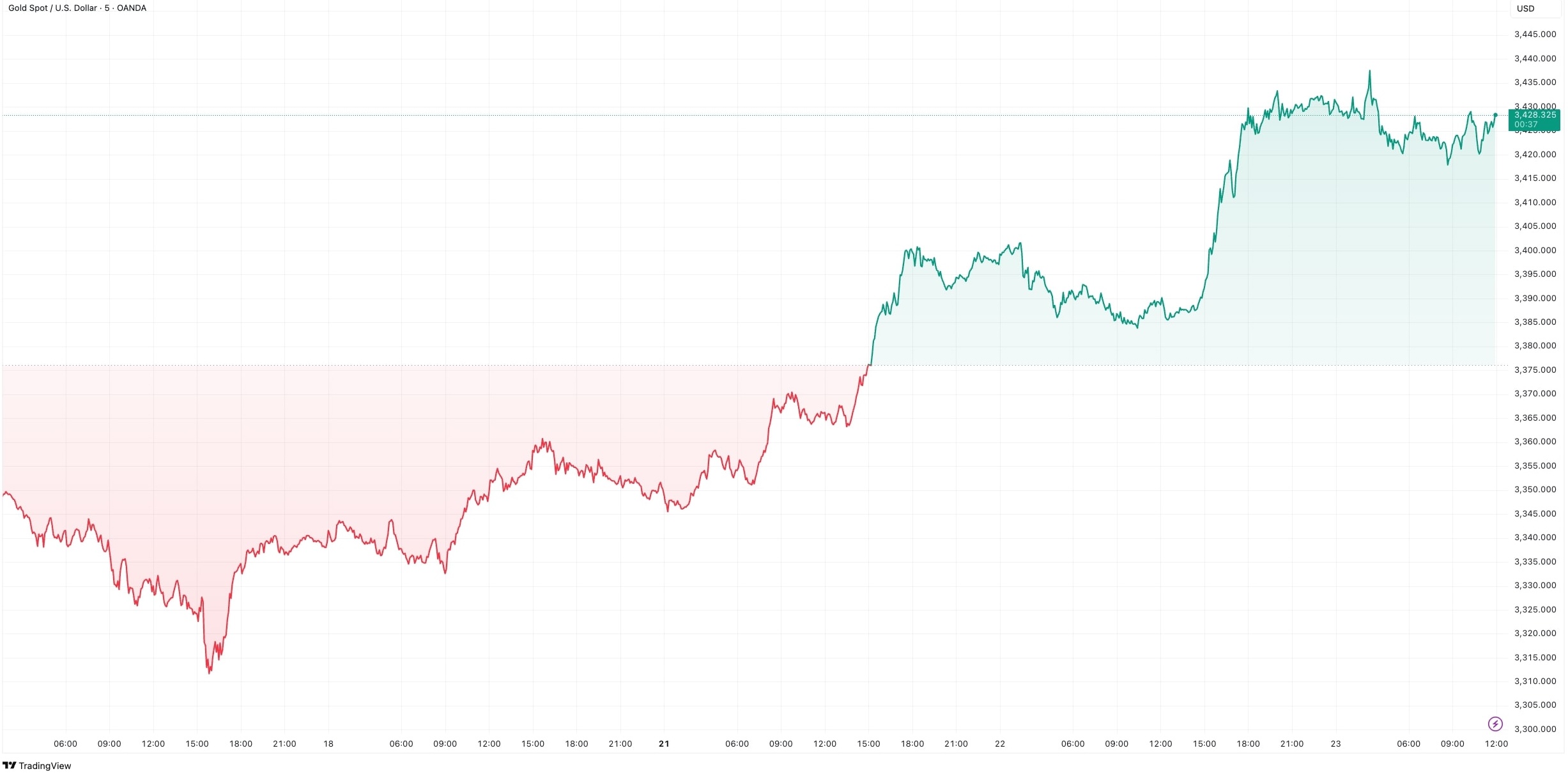

Gold prices spiked to above $3,400 per ounce — its highest level in over a month. What fueled the move, and what macro catalysts could swing bullion next?

A weaker dollar — reflected in a declining DXY — lower yields, and rising global tensions feed a bullish bid for gold.

Top near‑term catalyst: the Fed’s July meeting. On July 30, the Federal Open Market will set short-term interest rates. This year, it has held the fed funds target range at 4.25% to 4.5%.

Without a cut, higher-for-longer keeps U.S. yields relatively attractive, potentially drawing foreign capital and lending support to the dollar. Because gold is dollar-denominated with no yield, a stronger USD and elevated rates raise its opportunity cost. However, geopolitical concerns — trade wars, ongoing central-bank gold buying, Fed independence worries — could still underpin safe‑haven demand.

Fed Chair Jay Powell delivered opening remarks on Tuesday at a Washington conference. In his brief statement, he avoided any mention of monetary policy — there was no commentary on interest rates, inflation, or future Fed moves. While the speech itself had little to no impact on the markets, Trump’s recent hints about firing Powell fueled speculation about a possible resignation, keeping traders on edge.

Rate cut expectations remain slim. Both markets and analysts believe a dovish move from the central bank is months away as the Fed remains cautious about any potential inflationary pressures stemming from tariffs.

Traders are eyeing the August 1 tariff deadline. President Donald Trump is poised to impose up to 50% tariffs on dozens of countries, including EU members, next week. Such a move would mark a sharp escalation in U.S. trade policy and could raise prices on everyday goods from coffee to footwear.

The EU is preparing retaliatory measures should U.S. tariffs take effect. Last-minute negotiations are underway, with Brussels hoping to secure a lower tariff rate.

The bloc had aimed for a deal similar to the U.K.’s, the first country to strike a trade agreement with Washington. That deal sets a 10% baseline tariff with cars, steel and aerospace exemptions. However, economists and analysts increasingly doubt that the EU can reach a comparable framework.

Besides the United Kingdom, the White House announced trade agreements with Vietnam and Indonesia and a preliminary accord with China.

Why tariffs matter for gold? Tariffs influence bullion indirectly through macro channels — namely inflation expectations and risk sentiment.

Higher import costs can pass through to consumer prices, lifting headline inflation and, more importantly, inflation expectations. Escalating tariff threats, countdown headlines, and retaliation risk inject uncertainty and market volatility. When risk aversion spikes, safe‑haven flows often find gold.

Presently, though, momentum favors bullion, but two-way risk is high. A hawkish Powell, progress on tariff deals, or a rebound in the dollar could knock gold back into consolidation mode. Conversely, dovish Fed signals or tariff escalation headlines could reignite the rally. The next catalyst may be just one headline away.