Nvidia is betting $100 billion on OpenAI’s future. Two AI juggernauts are teaming up to expand the sprawling AI ecosystem. The result: record highs across the board.

Nvidia will invest up to $100 billion in OpenAI and supply it with data center chips, marking a landmark partnership between two of the highest-profile players in the global artificial intelligence race.

The deal will involve two separate but intertwined transactions. OpenAI gains the cash and chip access it needs to maintain dominance in an increasingly competitive landscape, while Nvidia srcures a financial stake in the world's most prominent AI company.

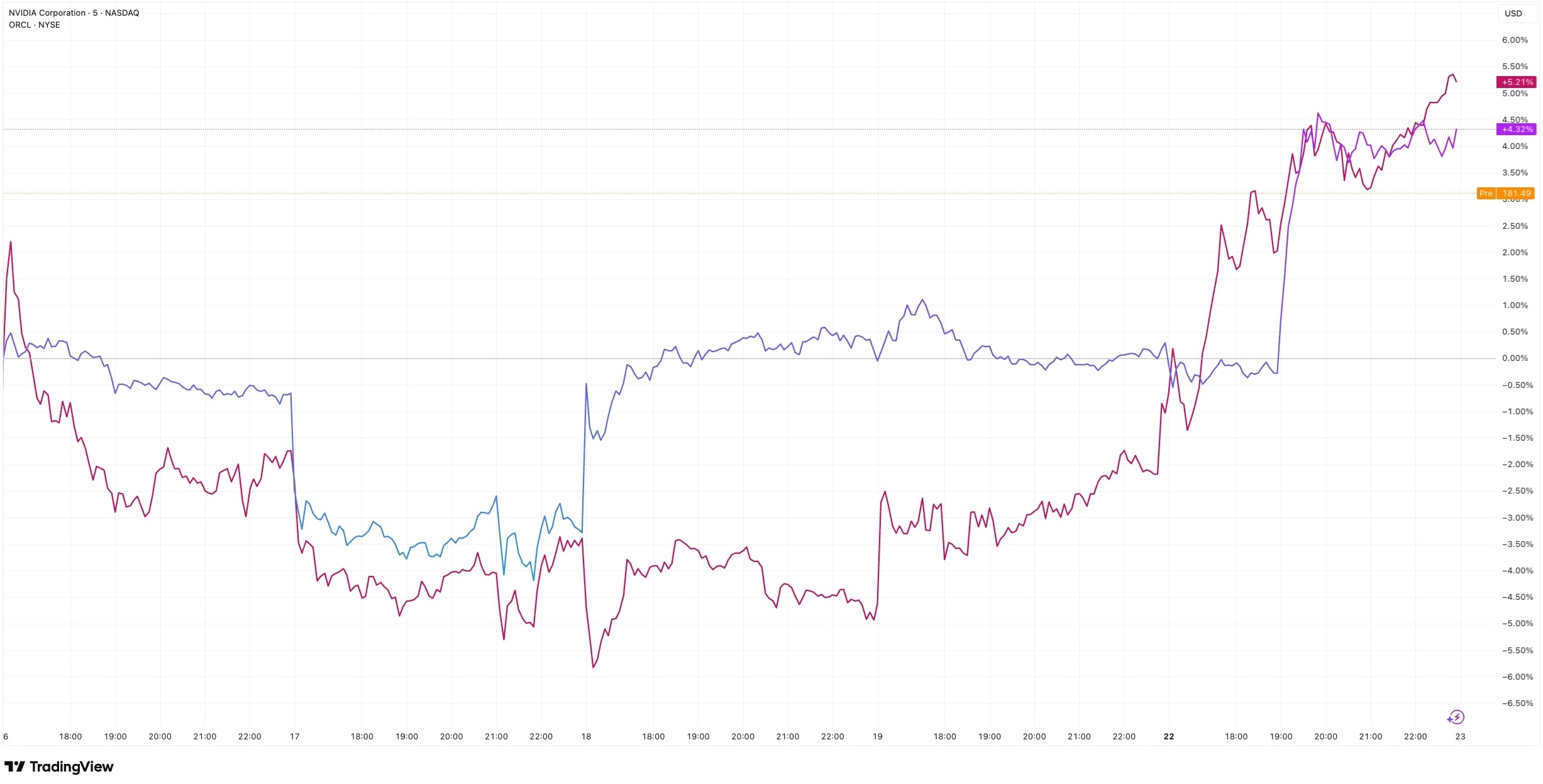

The announcement sent stocks to fresh highs. Nvidia stock rose as much as 4.4% while data center builder Oracle gained about 6%.

Oracle is also working with OpenAI, SoftBank, and Microsoft on Stargate, a $500 billion project, to build massive AI data centers around the world.

Nvidia’s rally pushed its market cap to nearly $4.5 trillion, extending its lead as the world’s most valuable company. Just to put that in perspective – it’s bigger than Apple and Microsoft combined a few years ago.

Meanwhile, Oracle recently surged on news of a $300 billion OpenAI cloud deal, pushing its valuation above $1 trillion for the first time.

The Nasdaq Composite hit a fresh all-time high. The Dow Jones Industrial Average added 0.1% to notch a new closing record, while the S&P 500 rose 0.4% to its own record close.

How high is too high? Analysts have warned for months that AI-driven valuations are stretched to the point where a pullback seems inevitable. Yet, deals keep fueling investor optimism, suggesting there may still be room for growth.

Despite signs of economic stress, AI bets continue to fuel investors' appetite for stocks. The Federal Reserve cut interest rates for the first time in 2025 amid a weakening jobs picture. Now, traders are hungry for more.