Earlier today, President Donald Trump signed an executive order invoking the Defense Production Act (DPA) to bolster domestic production of critical minerals, aiming to reduce U.S. reliance on foreign sources, particularly China. The reliance on foreign adversaries for these critical minerals has now been officially deemed a national security threat. Thereby, harnessing the vast resources of the US government to ensure that a robust and secure US critical minerals supply chain is developed.

The executive order authorizes the U.S. International Development Finance Corporation, in collaboration with the Department of Defense, to provide financing, loans, and other investment support for projects focused on mining, processing, refining, and smelting critical minerals.

This initiative addresses national security concerns by ensuring a stable supply of minerals essential for electronics, electric-vehicle batteries, and other technologies.

Today’s actions follow President Trump’s message to Congress last week in which he stated that his administration would "take historic action to dramatically expand production of critical minerals and rare earths here in the USA."

The Defense Production Act grants the president authority to prioritize and expand the production of materials deemed critical for national defense, including minerals vital for technological and energy applications.

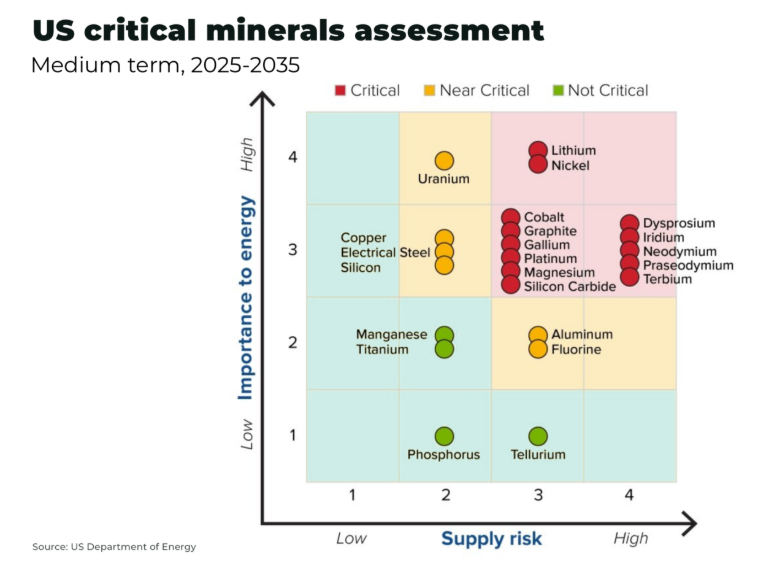

Which metals are vital for defense, technology, and energy?

It’s a long list, but we can begin with rare earth elements (neodymium, terbium, etc.), copper, nickel, tungsten, aluminum, and silver. The full list is much longer.

President Trump is not the first US President to appreciate the national security threat that a non-domestic critical minerals supply chain poses to the United States. However, Trump 2.0 is the first US administration that appears to be taking decisive, and urgent, action to bolster domestic production and processing of critical minerals.

Key aspects of the executive order on critical minerals:

- The administration is considering constructing metals refining facilities on land managed by the Department of Defense to enhance domestic processing capabilities. This opens up more than 25 million acres of land for locating suitable areas to build smelting and refining infrastructure - building this integral metals processing infrastructure on DoD land aligns with the national security theme.

- The order would also seek to reclassify mine waste on federal land, potentially tapping into piles of old waste rock previously thought to be worthless. This action is meant to produce copper, and other minerals such as antimony faster and cheaper than building new mines.

- It is not yet clear whether the Trump Administration will formally declare copper to be a critical mineral, unlocking tax credits for US copper producers. Copper is vital to the economy through its uses in power generation, electronics and construction.

- The executive order also includes uranium, potash, and gold on federal lands.

- Trump directed federal agencies to compile lists of pending mineral projects and expedite their review in coordination with the National Energy Dominance Council led by Interior Secretary Doug Burgum. This could mean that many advanced-stage mining projects located on BLM (Bureau of Land Management) or US Forest Service (USFS) lands could get fast-tracked.

Perhaps most notable is that today’s executive order encourages engagement with private sector entities to prioritize contracts and resources for mineral production, ensuring alignment with national defense needs.

For the mining industry, the level of urgency contained within today’s executive order is something that it has never seen before from the federal government. It is not just refreshing, it is actually shocking:

“Sec. 3. Priority Projects. (a) Within 10 days of the date of this order, the head of each executive department and agency (agency) involved in the permitting of mineral production in the United States shall provide to the Chair of the NEDC a list of all mineral production projects for which a plan of operations, a permit application, or other application for approval has been submitted to such agency. Within 10 days of the submission of such lists, the head of each such agency shall, in coordination with the Chair of the NEDC, identify priority projects that can be immediately approved or for which permits can be immediately issued, and take all necessary or appropriate actions within the agency’s authority to expedite and issue the relevant permits or approvals.”

10 days! Not even 10 business days!

While I am sure I will have more thoughts on the implications of Trump 2.0’s commitment to securing a robust US critical minerals supply chain. The three companies that come to mind as potentially immediately benefiting from today’s actions are (RIO/BHP's Resolution Copper Project is at the Supreme Court so I didn’t include it in this list):

- Hudbay Minerals (TSX:HBM): Rosemont Copper Project located on US Forest Service land in Pima County, Arizona.

- Trilogy Metals (NYSE:TMQ): Upper Kobuk Mineral Projects in Alaska's Ambler Mining District.

- Northern Dynasty Minerals (NYSE:NAK): Pebble Project in the Bristol Bay Region of Alaska.

It’s game on for the US mining industry!

DISCLAIMER: The work included in this article is based on current events, technical charts, company news releases, corporate presentations and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. This article is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SEDARplus.ca for important risk disclosures. It’s your money and your responsibility.