Part II of the Smarter Markets podcast featuring billionaire mining entrepreneur Robert Friedland and Carlyle energy and commodities analyst Jeff Currie. The second half of the conversation arguably tops the first, as Currie expands on his critical-minerals hoarding hypothesis and Friedland uncorks a striking prediction: tech giants Apple and Nvidia may ultimately begin funding hard-rock mining development.

Given recent market movements and media coverage, there is little doubt that far more people are becoming acutely aware of metals and critical minerals—and the integral role they play in modern life.

Jeff Currie on the prospect of $35,000/tonne ($15.90/lb) copper:

“Where do I throw out the $35,000/tonne copper? That would be if copper went up the exact same amount that oil did in the 2000s super cycle. It was a seven bagger. At the beginning of this cycle, I would say that copper was a $5,000 commodity. You do a seven bagger, that gets you the $35,000. So these kind of numbers are not unreasonable when you start thinking about the mountain of capital that has to be redirected.”

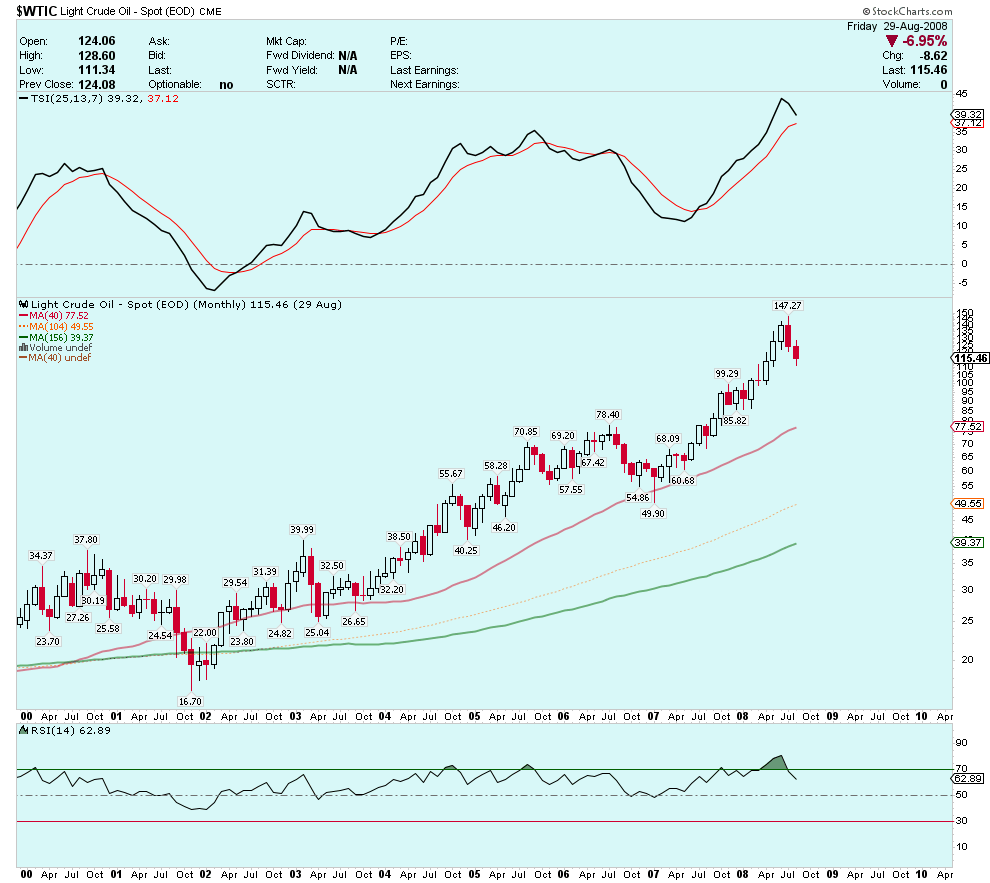

WTI Crude Oil (2000-2008)

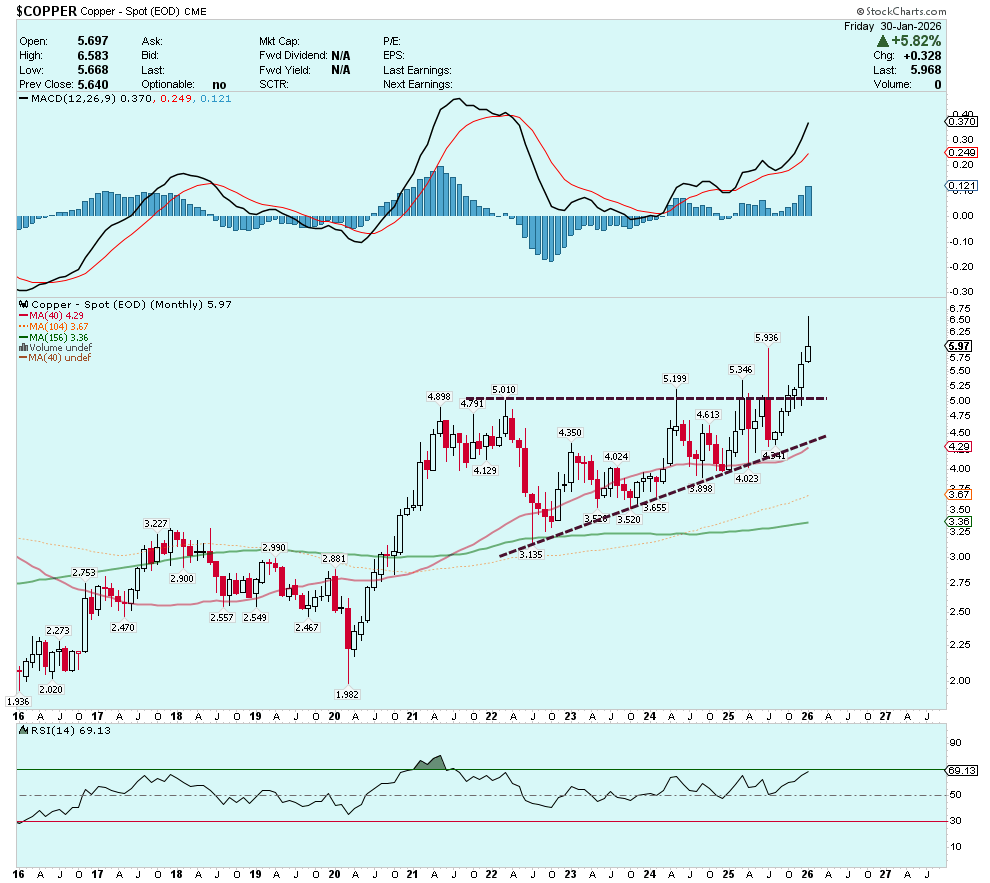

If copper is to follow a similar pattern to crude oil during the 2001-2008 China-fueled global commodities boom, we should expect to see ~$15/lb copper reached at some point in 2027 or 2028.

Copper (Monthly)

Currie asks Robert Friedland about the potential for graphene to displace some areas of copper consumption:

“There is no comparison between copper and graphene. Graphene is brittle. It can’t be formed into wires and it doesn’t transmit heat like copper does. Copper is ductile. It bends. It conducts electrical energy better better than anything other than silver which is too expensive for the purpose, and gold.

You can substitute some aluminum for copper in certain applications. And thank God we can because there’s always going to be some recycling and some substitution. If you want something to last, if you want something to be reliable like in the data center, and you’re putting in those big bus bars, there’s no way to get around copper demand.”

Friedland explains that copper mine supply is relatively inelastic:

“I was speaking with my friend Mike Henry of BHP and we just don’t understand where this copper is going to come from. What is the equilibrium price?

Even if copper went to $50,000/tonne tomorrow you won’t see an incremental speeding up of material copper supply. It just takes too long to permit, engineer, design, and construct.”

On copper mining in Arizona:

“I want you to know that in mining timeframes, three, four, five years is nothing. Literally nothing.

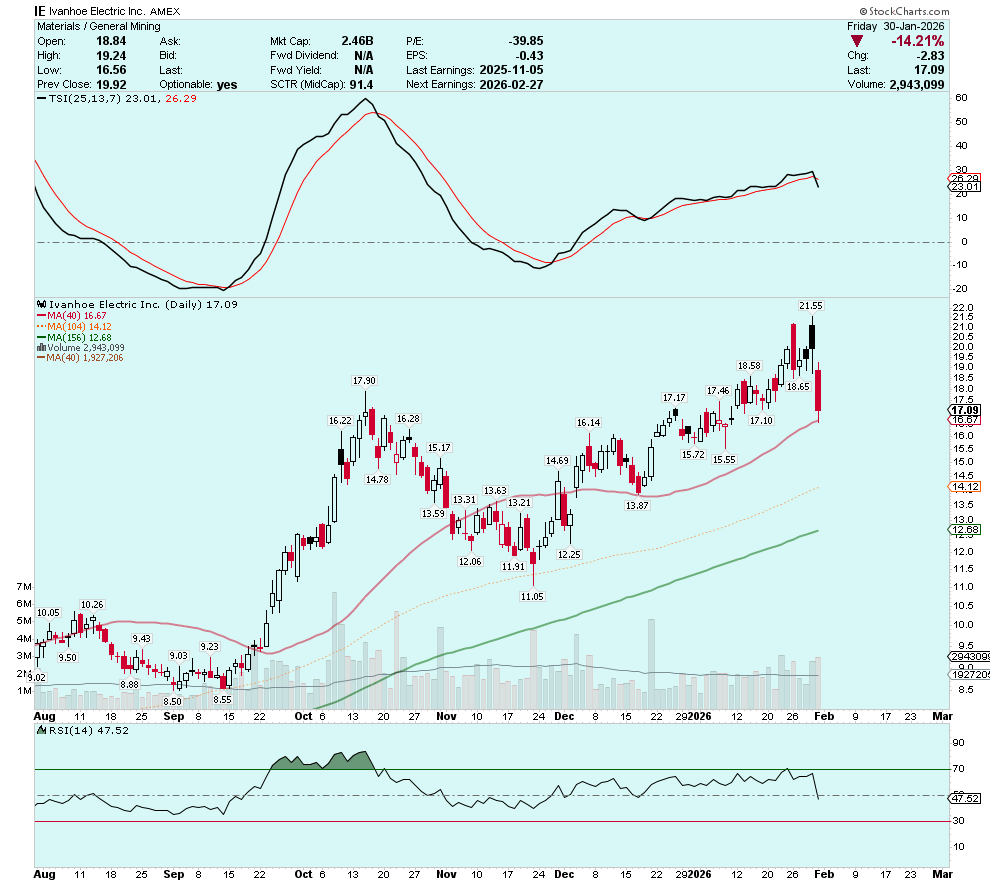

We’re building a copper mine in Arizona (Ivanhoe Electric’s Santa Cruz Copper Porphyry Project), none of that copper will ever leave the state. That’s Ivanhoe Electric (NYSE:IE). There’s 1,400 defense contractors in Arizona alone. And we’re going to produce cathode copper in Arizona.

Our shares are trading today at an all-time high. But they desperately need that 99.99% high purity copper in the state of Arizona for our defense contractors. And I think this is going to age very well….. I’ve been saying for ten years, take some of your dollars and buy copper bricks and build your house out of copper bricks. You don't have to buy my mining company. Just buy the copper….”

Ivanhoe Electric (Daily)

On Trump 2.0’s understanding of the vital strategic importance of critical minerals and AI/energy independence:

“This is the first administration that is beginning to realize that the demand for these critical raw materials has to be solved at the scale of the American economy…

There is no limit in military demand. If I'm faster than you are, I've got more AI. Nobody cares. It's life or death.”

Trump 2.0 gets it, but the timelines are still far too optimistic:

“When you really start boiling down the scale of our supply chain issues, it’s extremely daunting. This administration understands it. I think there’s a determination to do something about it.

And maybe with Yankee Ingenuity, where we get everybody together kind of in the spirit of the Manhattan Project, where we really get everybody listening to this podcast. And we throw the full weight of our Yankee ingenuity, then maybe, just maybe, just maybe, over a period of maybe 10 or 20 years, we could pull this together.

But it won’t be over a two or three year horizon. That’s impossible.”

“There's guys like Peter Thiel or Alex Karp in the private sector, or Elon who have spoken to the military. Silicon Valley has come into the White House and there is an understanding that capital is going to have to be redirected towards funding mining. I wouldn’t be surprised if Apple (Nasdaq:AAPL) and Nvidia (Nasdaq:NVDA) have to start funding mining development competitively.

And so at least there is a change in mentality that people realize that a ham sandwich does not come from a refrigerator.”

On money and metals role in the monetary system:

“We have to really start thinking about what is money here, and like what is real? What is tangible? Like what makes you sleep well at night?”

Friedland reminisces about the 1990s metals bull market and why the current metals bull market is not even close to the mid-90s:

“We find it to be extremely difficult to raise capital to find a mine and build a mine. Extremely difficult. Now what has happened is a lot of the sovereign wealth funds in the Middle East have gotten nervous that the copper price and the gold price have risen so much against crude oil. We’re being shown a lot of capital from the sovereign wealth funds in the Middle East and the Norwegians and others.

We’re also in the very very early stages of a raw materials bull market. Now, a lot of people alive have never lived through a bull market in metals. But when we found Voisey’s Bay, which was the largest nickel discovery in the world in 1995/1996, our shares went from $1/share to $181/share adjusted for splits in 13 months.

And that kind of performance was before we had internet shares. I had taxi cab drivers recommending Diamond Fields Resources to me because our shares went up $1/day, and there were stretched limousines, and there were women drinking champagne out of their shoes, and wild parties. It was a real bull market in metals shares.

But that was 30 years ago.

So the younger generation of kids who are allocating capital have never lived through a real bull market in metals. You talk to Frank Giustra, an old-timer who used to run Yorkton Securities, a lot of us of that age we lived through what is a true bull market in metals. Recently things have been a little bit effervescent, but this is not a real bull market. At some point in our life real things will come fully back into fashion, they’ll probably trade on Abaxx exchanges, and they’ll trade at astronomic relative valuations.”

On positioning for the real bull market in metals:

“I don't think a move from $3/lb or $4/lb copper to $6/lb copper is at all what I'm talking about. It just isn't.

When we really get that move, it'll be psychedelic. It'll be shocking. And you have to be a few years early. You can't be a few days late. I want to repeat that a thousand times. You have to be a few years early, not one hour late.”

Friedland on the more obscure strategic metals that are absolutely vital for defense & aerospace industries:

“….we really need to talk about metals like scandium, rhenium, niobium, or tantalum, you absolutely have to have for national security requirements. These are metals that are more thinly traded, less transparent, and these metals can go up 10x, 20x, 50x in price. And this is really going to open at a theater near you because we’re in touch with the demands of the United States military, and we know that these metals are very hard to find and they absolutely have to be had. So, it’s some of these more interesting metals that we should talk about at some point in the near future…”

Tantalum is used in jet engines, scandium is added to aluminum for high-strength, lightweight components in aerospace. Meanwhile, niobium and rhenium are superalloys that are used in jet engines and rocket components due to heat resistance.

Jeff Currie on his near-term bullishness on copper, commodities and hard assets:

“They’re not going to tell you they hoarded…..I think we’re going to see that more and more where people don’t really understand the dynamic of hoarding, and they’re going to just see things taken off the market. Then the other one is just the size of the fiscal stimulus coming down the pipeline this year; Big beautiful bill., the Germans, the Japanese, the Chinese are going to have to keep people happy given all that anxiety and political unrest going on around the world. The best way to get rid of it, or at least appease it, is throw money at the people. So you know I look at the size of the fiscal stimulus coming down.

Does that create a thing where the economy could wobble? Probably not. So you have growth on top of hoarding on top of the financial world trying to put steel in the ground. That’s a concoction for much higher physical commodity prices.”

_____________________________________________________________________________

DISCLAIMER: The work included in this article is based on current events, technical charts, company news releases, corporate presentations and the author’s opinions. It may contain errors, and you shouldn’t make any investment decision based solely on what you read here. This publication contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. This article is provided for informational and entertainment purposes only and is not a recommendation to buy or sell any security. Always thoroughly do your own due diligence and talk to a licensed investment adviser prior to making any investment decisions. Junior resource companies can easily lose 100% of their value so read company profiles on www.SedarPlus.ca for important risk disclosures. It’s your money and your responsibility.