Few metals & mining sub-sectors are as out favor as lithium (“Li“), the polar opposite of #silver & #gold juniors. The top quartile of gold juniors I’m tracking is up an average of roughly +545% from 52-week lows!

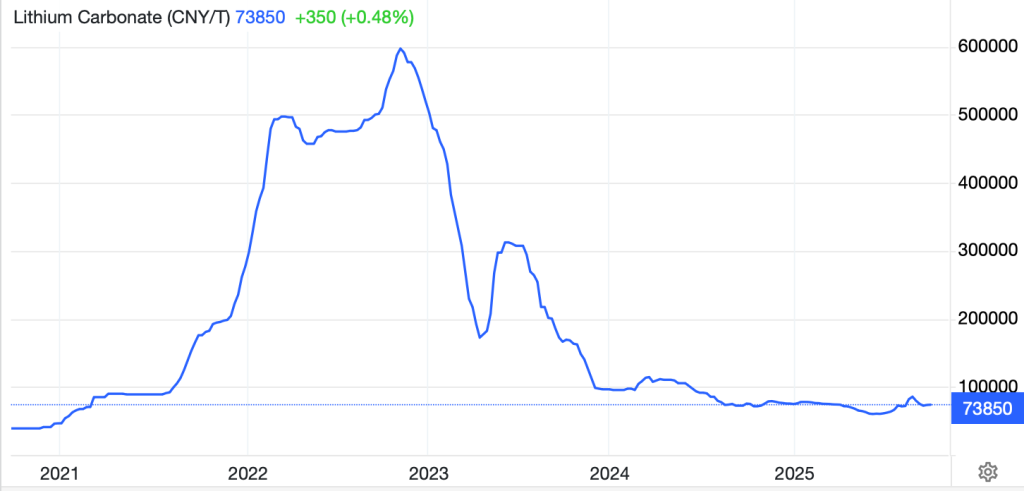

One might think the following chart says it all. Why would anyone invest in this tragic trajectory? Yet, this chart fails to show that demand for Li is expected to grow +10%-15%/yr (some think more) into the 2030s.

Pricing is depressed due to China enabling, and encouraging excess supply, a temporary state of affairs.

This year’s demand is coming in stronger than expected. EV sales are up solidly, Rho Motion reports +25% ytd through August. Meanwhile, stationary battery energy storage system (“BESS“) demand is up over 30%.

I feel strongly Li prices will rebound above 150,000 Chinese yuan/tonne (vs. the late-2022 high of ~600,000 yuan) within two years. Note, 150,000 yuan is US$21,090. Is a rebound to just 25% of the former high an aggressive call?

What gives me conviction? Several things. Dozens of Li projects on the drawing board are not viable under US$18-$20,000/t. Many probably need $22,000+/t due to mining cost inflation.

Until recently, BESS was going to be a broad mix of Li-ion batteries, sodium-ion, vanadium redox flow batteries, and other chemistries. Today, Li-ion has 90%+ market share of BESS due in large part to low Li prices.

This one factor alone is critically important because BESS could account for 20-25% of total Li demand by the early 2030s.

Another bullish datapoint is the demise of competing fuel cell technology in trucking due to limited refueling infrastructure, high costs, and operational challenges.

Given strong demand (3x-4x the CAGR than copper!), the world needs ALL logistically feasible projects, not just the low-cost ones. If ALL projects were to come online as planned, we might have a shot at meeting demand.

There’s zero chance of that happening, more likely the projects in the lowest three quartiles of the cost curve will make it across the finish line, but only if prices rebound to $20k+/t. The price has to double, or the Li units won’t be there.

Due to brine pumping constraints, and local community scrutiny, Chile’s substantial Li carbonate production in the Atacama salar by Albemarle & SQM will grow < 7%/yr through 2035, roughly half that of global demand.

What about China manipulating price and low-cost African supply? These are backward looking factors that have been crushing Li prices because the market is small. However, in 2031 or 2032, demand will be ~3x larger than it was last year.

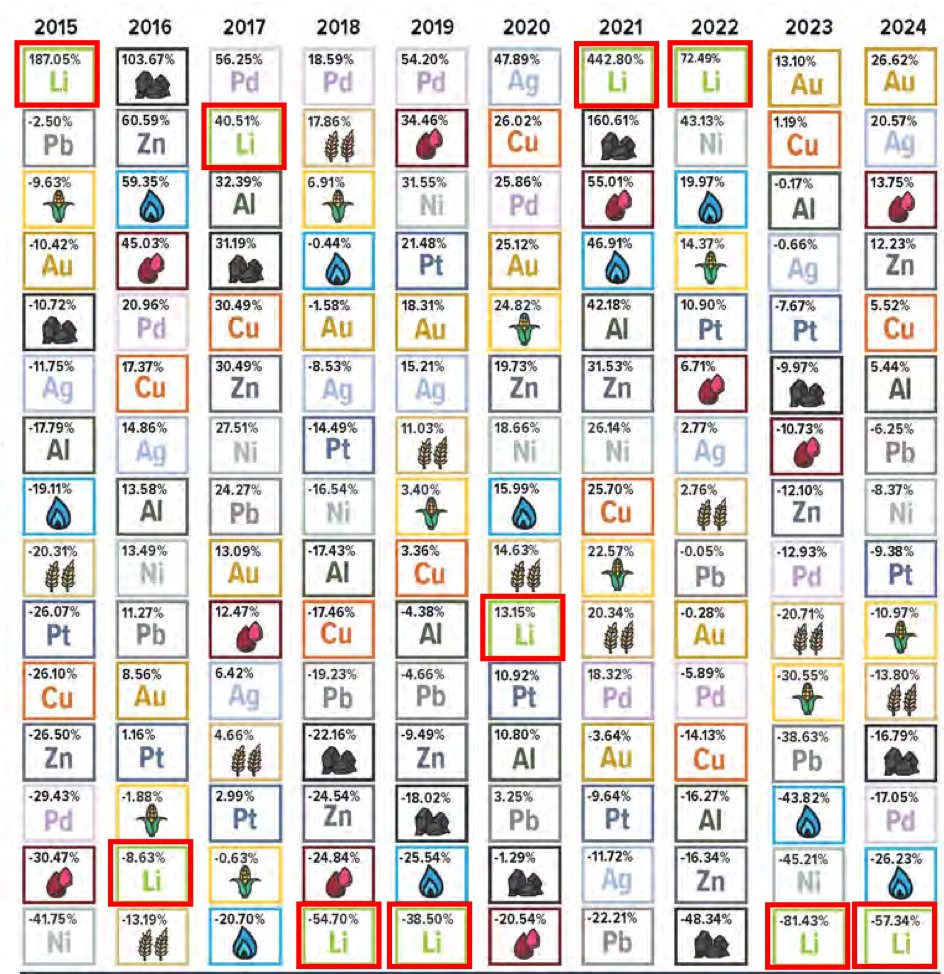

I’ve been writing about Li stocks for a decade, there have been several boom/bust pricing episodes. In the following chart, notice that Li has been the top or second best performer four times, and the worst or second worst performer five times in the past 11 years!

This extreme volatility and two big down years in 2023-24 is weighing heavily on project funding & development timelines.

Most projects are moving very slowly or are stalled. Argentina was expected to be producing over 250,000 tonnes/yr of lithium carbonate by now. It will deliver less than half that this year.

Demand’s tracking higher, and supply is coming online slower. Five years ago, the average expectation by Joe Lowry, RK Equity, Benchmark Mineral Intelligence, Albemarle & Fastmarkets for 2030 was ~2.2M tonnes LCE. Today, estimates call for ~3.2M tonnes.

A final major challenge for supply is project size. It’s not growing commensurate with demand. The typical new project size has been, and continues to be 20-25,000 tonnes LCE/yr. Due to permitting & capital constraints, projects in the pipeline can’t easily or quickly increase scale.

Therefore, companies reaching production this decade are in the drivers’ seat, especially ones in good jurisdictions, (Canada, Australia, Brazil) high-grade (> 1.20% Li20 for hard rock) with tried & true operating methods — not unproven science projects (most DLE efforts).

Lithium Ionic (TSX-v: LTH) / (OTBQX: LTHCF, with a high-grade hard rock project in Brazil, remains one of my favorite Li plays. Its company-wide Li2O grade is 1.25%, and its flagship project is 1.34%. NOTE: The Company is in the middle of a C$10M equity raise.

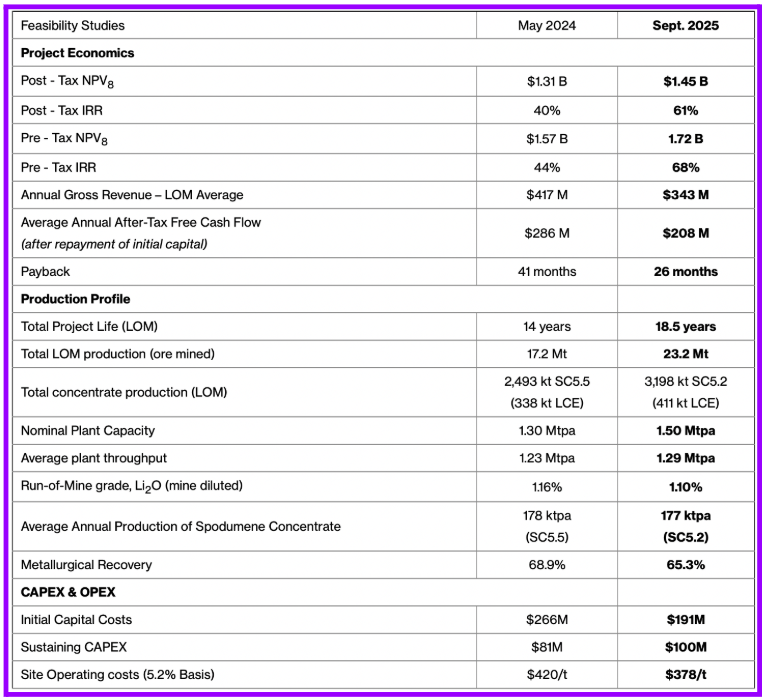

The project boasts a low site-operating cost of US$378/t and has an 18 year mine life. A new BFS/DFS was released last week showing the most favorable post-tax (NPV, 8%)/upfront cap-ex ratio I’ve ever seen at 7.6:1.

Cap-ex of US$191M is not a big hurdle, especially with low-cost loans, free-money grants, and partially pre-paid off-take agreements possibly on the table.

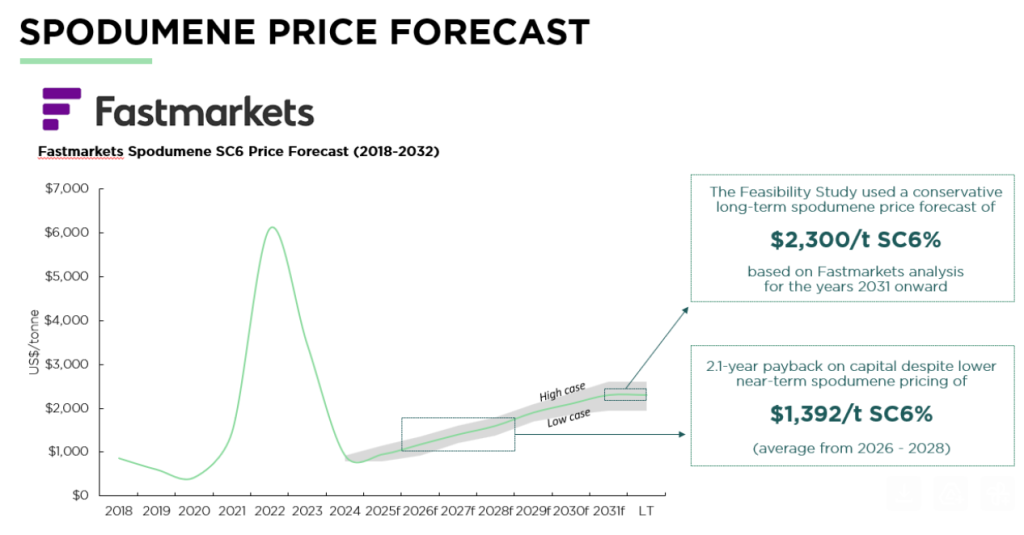

As is the case with other Li project studies, the long-term Li spodumene concentrate (“spod con”) price assumption of $2,200/t is well above the current spot price.

Fastmarkets’ 2025 long-term spodumene concentrate (“SC6”) price forecast assumes US$1,392/t SC6, CIF China, in H2 2027. Readers should note, if one doesn’t believe we will revert to US$2,000+/t spod con by the late 2020s, one shouldn’t invest in Li juniors!

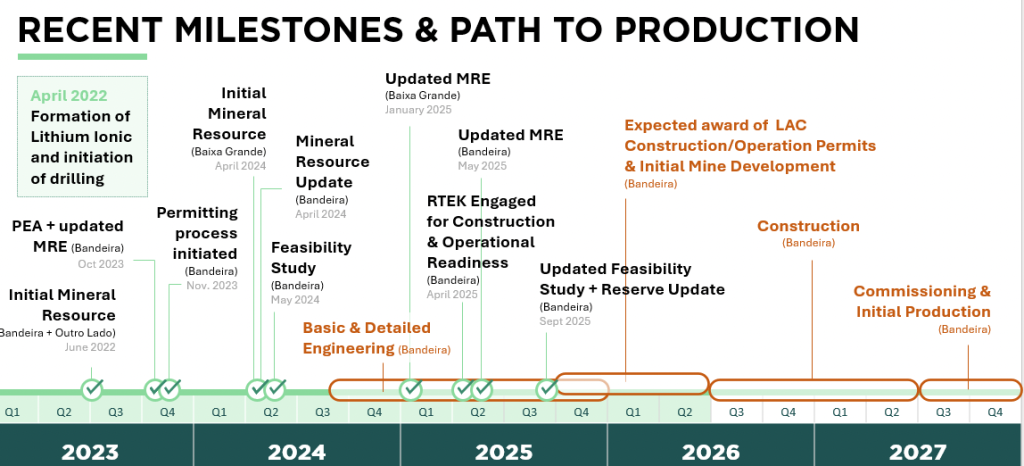

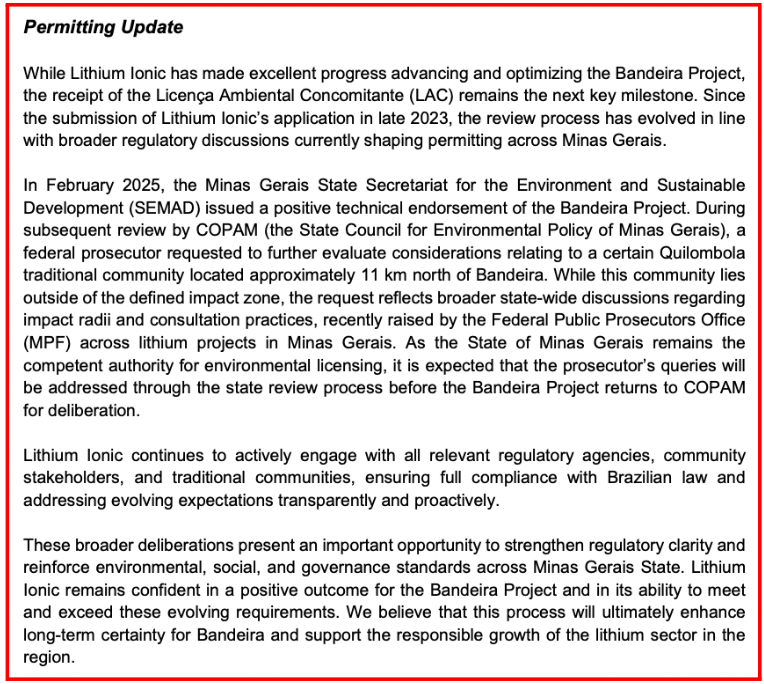

Li prices and permitting delays are the two biggest risks to this story. Management provided the following update on permitting last week and has incorporated anticipated delays into a new timeline of first commercial production in 2H 2027.

Lithium Ionic is valued at just 5% of its post-tax NPV(8%) of C$2.0B (IRR = 61%). That’s absurd for a BFS-stage asset. With such a tiny cap-ex burden, many companies (both lithium & diversified miners) could comfortably afford to acquire Lithium Ionic & develop it.

The obvious prospective acquires are Pilbara Minerals, Rio Tinto, SQM, Albemarle, Mineral Resources (MinRes) and Sigma Lithium. Chinese players are all over Brazil’s natural resources.

Miners like Zijin, Gangfeng, Tianqi might not acquire Lithium Ionic, but could buy other assets in Brazil’s Lithium Valley, boosting valuations of the remaining companies.

Notably, management adopted a lower recovery rate assumption in the latest study. Importantly, the Project has long-term access to clean-green, low-cost hydroelectric power.

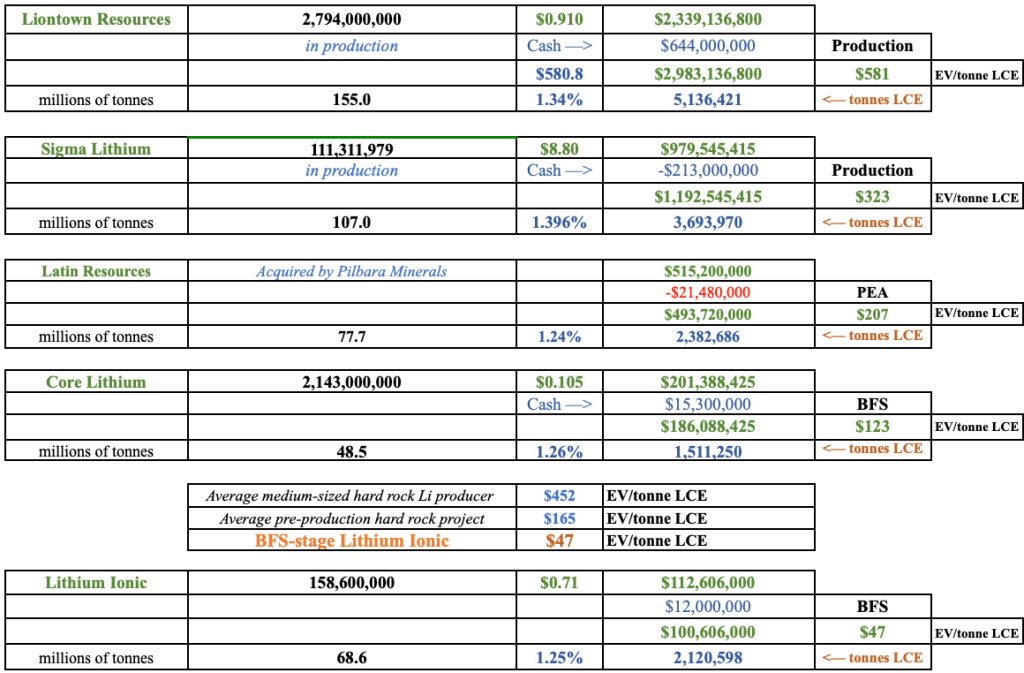

Lithium Ionic gets compared to nearby producer Sigma, which has 74% more resource tonnes, but is valued 6.8x higher on an EV/tonne basis. See chart below.

In my view, Sigma is 3-4 years ahead, it deserves a healthy premium, but 6.8x might be excessive. To be clear, Sigma is NOT overvalued, Lithium Ionic is undervalued.

Last year, significant Australian player Pilbara Minerals acquired Brazil’s earlier-stage Latin Resources for ~C$207/tonne. Compare that to Lithium Ionic’s C$47/t.

Looking at valuation another way — the average EV/2027e EBITDA multiple of seven non-Chinese Li producers is ~9x.

Although Lithium Ionic will not be fully-ramped up to the full 177K tonnes/yr of spodumene concentrate/yr for 2027, and there will be equity dilution between now and then, by my estimates the Company’s valued at < 1.0x EV/2029e EBITDA.

R-TEK played Major role in optimizing new flow sheet!

Lithium Ionic remains wide open for strategic partnerships, funding commitments and off-take agreements. It would not take a big move in the Li price to rekindle interest in Li names.

Last week Lithium Ionic’s share price touched $0.85 on the new BFS news, but has since fallen to C$0.71 as a modest uptick in Li pricing proved to be a head fake.

For investors willing to take on meaningful risk on a contrarian bet, this one offers a compelling opportunity.

Disclosures:

Lithium Ionic has not been a paying advertiser on Epstein Research for over six months, but had been prior to that, and might be again in the future. Mr. Epstein owns shares of Lithium Ionic bought in the open market. He iw biased in favor of the Company.

Lithium Ionic is a high-risk small-cap company. Investors can lose a very substantial portion of their investment in high-risk small-cap stocks like this one. Therefore, readers are strongly advised to consult with a trusted & qualified financial advisor before buying small cap stocks. Lithium stocks are currently out of favor. This article suggests they will not be out of favor forever — but they could remain out of favor for years.

Lithium Ionic will need to raise equity capital, which will be dilutive to shareholders. On September 20th management announced a C$10M equity raise which is currently open. The Company recently pushed back the anticipated start date of operations until 2H 2027. Obtaining permits to operate in Brazil is expected, but timing is uncertain.