Summary

· In the report I summarized an analysis of every pre revenue silver developer worldwide, the current state of the silver market and my overall take on the mining industry.

· I own share in Boab Metals (ASX: BML) (OTCMKTS: BMLQF). The stock is up 320% since I first posted about it in 2024. However, as I prove on this report, it is still the silver developer with the widest margin of safety.

· The most expensive silver stock is Vizsla Silver. Albeit it is also the silver developer with the most leverage to silver prices.

· This report is the results of over 2 months of research.

· I argue that silver miners should be taking over silver developers soon. If not, they should not have a ceiling on the hedges of their silver operations as silver price is not heading down in the medium to long term.

Current state of the silver market

Silver prices reached an all-time high in nominal terms of $53.765/oz just this quarter. However, nominal prices are meaningless in the commodity market.

The all-time high real (inflation adjusted) silver price was reached on January 18, 1980, during the Hunt Brothers’ attempt to corner the market. In nominal terms silver reached US$49.45/oz. Adjusted for inflation using the US Bureau of Labor Statistics’ Consumer Price Index (CPI-U, with October 2025 as the base period), this equates to approximately US$187.50 per troy ounce in current dollars. Therefore, the market price of silver is still very low in real terms.

This undervaluation stems from the gold to silver ratio hovering at 90-100:1 (far above the long-term average of ~60:1), making silver a compelling buy for those betting on industrial and monetary demand outpacing supply.

Is new silver production being incentivized?

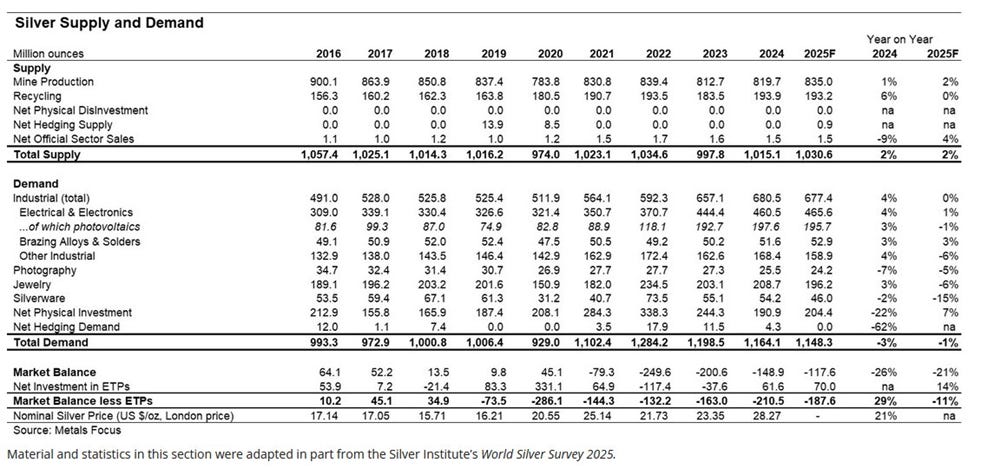

As for whether new silver production is being incentivized, the short answer is yes, but it is a slow-burn process due to the sector’s structural challenges. The silver market is in its fifth consecutive year of supply deficits: Projected at 117-149 million ounces for 2025, down slightly from 2024’s ~149 Moz but still historically large.

This is driven by stagnant mine output (down 7% since 2016 peaks) and surging demand from green tech like solar panels, EVs, and AI hardware. In fact, industrial use alone hit a record 681 Moz in 2024 and is forecast to grow another 3-5% in 2025.

Silver supply and demand. Silver Institute.

Key incentives for new silver supply:

1. Higher metal prices:

Most of the silver production does not come from silver mines, it comes from lead, zinc, copper, and gold mines. Therefore, these other metals drive the production for silver. Lead and zinc prices have gone nowhere since 2009, and copper production is not growing anytime soon as I explained on my very first report (link).

Gold prices have skyrocketed to over $4100/oz, but gold production is not increasing either. Silver prices are up 52% YoY and silver supply is up less than 2%.

Silver supply by type of mine. Own research.

Therefore, the biggest risk for producers is new primary silver mines flooding the market. These new mines will be generating significant FCF at current prices. However, existing silver mines are old and new primary silver development projects are scarce.

2. Mine complexity and capex:

Factors like mine depth, grade, metallurgy, overburden, altitude, and water are massive drivers that affect mining. These are often overlooked by generalist investors, but they determine the economics of a project.

Regarding depth, my research suggests that the average depth of silver mines worldwide is 807m, let us call it 800m. Yes, mining at 807 m is economical at $50/oz silver with high-grade deposits (>200 g/t) and efficient operations, as seen in current producers. However, new ventures face higher upfront costs and risks, requiring sustained prices above $35/oz to justify development. The global deficit and industrial demand suggest prices may support this, but profitability hinges on site specific factors.

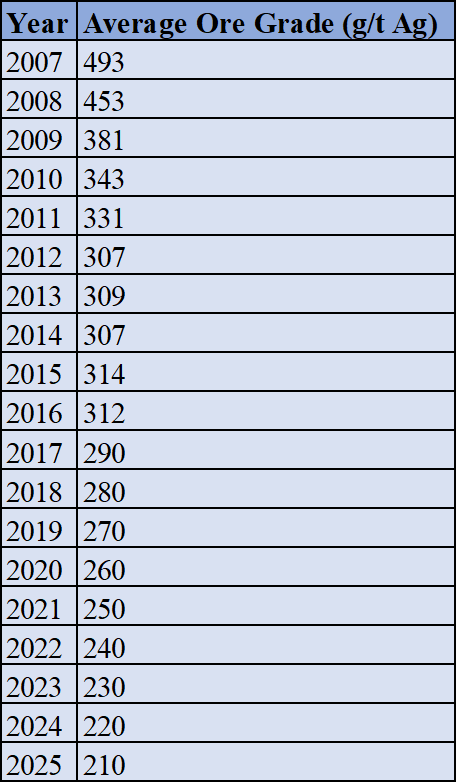

Regarding ore grade, this metric has decreased over 50% since 2007. It is just staggering.

Ore grade (silver grams/t) by year. Own research.

To obtain this table I have reviewed annual reports and technical filings from major silver producers worldwide including: Fresnillo, Hecla Mining, Pan American Silver, Hochschild Mining, Buenaventura, Gatos Silver, Silvercorp Metals, and others, representing over 80% of primary silver production.

I have also reviewed aggregate industry sources like the World Silver Survey (2020-2025 editions) and USGS Mineral Commodity Summaries, comprehensive year by year global average ore grades for primary silver mines are not directly reported beyond 2016. The data for 2007-2016 is from a detailed study on 12 leading primary silver mines (54% of global primary production), showing a clear decline.

For later years, I calculated estimates using individual mine head grades weighted by production from producer reports (e.g., Fresnillo’s Saucito mine at 243 g/t in 2024, Hecla’s Greens Creek at 350 g/t in 2024 but declining y/y, Pan American’s La Colorada at 280 g/t in 2023). The overall trend aligns with industry analyses (e.g., CPM Group and Sprott reporting ~55% decline since 2005, equivalent to ~4% annual average decline), leading to the estimated values shown. No single source aggregates this for all producers each year, so these are approximated averages based on available data from ~15-20 key mines per year.

Just this table has taken me over 100 hours of research, but it was a lot of fun.

The lower the grade, the higher the costs of production. There are exceptions to this rule, but it is true. The industry is structurally struggling with grades. Therefore, producers will need higher silver prices to justify new production.

3. Investment flows into mining:

Investor sentiment is “cautiously bullish”, with silver mining stocks outperforming (e.g., +25% YTD for the sector in 2025) amid M&A surges and institutional interest in juniors advancing to production.

Over 60% of companies are adopting AI, satellite monitoring, and carbon-tracking tech to cut costs and attract capital. This is key for 6-8% output growth in top producers like Fresnillo and Pan American. ETFs and physical bars/coins saw inflows topping 2024 levels by mid-2025, signalling renewed retail stacking.

However, mining has not changed much technologically at a fundamental level. 100 years ago, trucks were taking the ore from the mine to the processing plant and that is still the case today. Furthermore, 100 years ago mining operations were a lot simpler than they are today as engineers picked up the low hanging fruit: The shallow mining and high-grade operations are all gone. Now mines are very complex.

Therefore, mining operations need a much higher metal price than what was required 100 years ago.

I used the term “cautiously bullish” because although Sprott Silver Miners & Physical Silver ETF (NASDAQ: SLVR) is up 118% YoY, high quality silver producers like Pan American Silver are yet to see new all-time highs this cycle. Furthermore, a lot of these so called “silver producers” are gold producers with silver as a side hustle.

For example, for 2025 (Q2) 75% of the revenue for Pan American Silver came from gold, while only 25% of their revenue came from silver. For First Majestic Silver that figure is 54% and for Fresnillo its 41% (H1 2025). As a result of this, I doubt the market is assigning a lot of value to the silver production side of these firms. I argue the market values these firms as gold producers. Therefore, as far as mining firms are concerned, the silver market has not reached euphoria, yet.

4. Government and Policy Support:

Renewables incentives (e.g., solar subsidies in the EU and US) indirectly boost silver via PV demand (expected to consume 20%+ of total supply in 2025, up from 10% in 2020). Critical minerals designations in the US, Canada, and Australia offer tax credits, streamlined permitting, and funding for domestic projects to reduce China dependency (which dominates refining).

However, the reality is that this is not enough. Supply in China has doubled in the past 2 decades, while it has lagged in other regions. Silver mining output in Australia, United States has fallen by 50% since the year 2000. Output in Canada has decreased by 75% since 2000. In fact, I argue that the production peak we saw in 2022 may not be seen again for a very long time.

Therefore, every decision taken by policy makers support a higher silver price.

Why I focus on developers, not miners

Lassonde Curve. Dakotavalue/Scott Reardon

The Lassonde Curve, named after mining industry veteran Pierre Lassonde, illustrates the typical lifecycle of a junior mining company’s value (often reflected in share price) from early exploration through to production.

Developers are companies in the post discovery development phases, such as resource definition, feasibility studies, permitting, and financing. They have already discovered a mineral deposit but are not yet in production.

This table highlights why investing in developers can offer superior risk adjusted returns compared to “mining firms”, or producers (established companies already operating mines).

After the initial discovery hype fades, projects enter a prolonged, “boring” phase of detailed studies (e.g., resource estimates, environmental assessments) and permitting. As the image notes in the sweet spot: “Our sweet spot: gold development projects with proven economics where investors have little interest.”

Investor attention shifts elsewhere, causing share prices to trough, often irrationally low relative to the project’s intrinsic value. This creates a buying opportunity for patient investors and mining firms.

By this stage, the biggest risk (finding a viable deposit) is already overcome. Only about 1 in 1,000 exploration projects succeed, as the image points out in #1 (”We don’t invest here”). Therefore, by investing in developers, you are investing in survivors. Evolution has done its work, and we get a chance to be higher in the food chain.

Developers with “proven economics” (e.g., positive feasibility studies showing profitable reserves) have a clearer path to production. As they progress through permitting and financing, value accretes steadily, often leading to multi-fold share price gains (e.g., 5x–10x or more) when construction begins and operation nears. The curve’s upward slope from the valley represents this value creation.

Developers benefit disproportionately from rising metal prices (e.g., gold) because their costs are fixed in studies, and the project’s net present value (NPV) scales with higher prices. This asymmetry amplifies returns without the operational overhead of producers. Strong developers often become takeover targets for larger miners seeking to replenish reserves, providing exit opportunities at premiums.

Mining firms have historically done a very poor job at delivering value. During bear markets they underinvest, and during bull markets they overleverage to buy uneconomical assets. So, on this matter, I agree with Scott Reardon, who manages Dakota Value Funds: Developers are the best way to play rising metal prices.

Timing is everything when it comes to any cyclical industry, and that includes mining. Investing at the top of the cycle can spell disaster. However, selling halfway there can leave a lot of returns on the table. Most of the returns are made when the market is approaching the top, and I argue that silver prices are nowhere near the top.

Why Mining Firms (Producers) Are Generally Weaker Investments

As the image states in #2: “Large miners with operating mines claim to have leverage to rising gold, which is false. We’re generally not interested here either.” Producers are at the curve’s second peak, where valuations are already high, reflecting steady cash flows from operations. However, this leaves less room for explosive growth as the “easy” value from discovery and development is already captured.

Running mines involves ongoing challenges like reserve depletion (mines have finite lives), rising costs (e.g., labour, energy, regulations), and exposure to downturns in commodity prices. If prices fall, profits erode quickly. Producers must continually invest in exploration or acquisitions to sustain output, which dilutes shareholder value and adds execution risk.

Many producers tout “leverage” to rising prices, but their costs often inflate alongside (e.g., higher royalties, supplier demands). This reduces upside compared to developers, whose valuations can surge on price improvements without proportional cost increases.

Producers are more sensitive to broad market sentiment and economic cycles. During booms, they perform well but often underperform in the long term due to capital misallocation (e.g., overbuilding during highs leads to busts).

Developers are not risk-free: Delays in permitting or financing can extend the “valley” where share price is flat or downwards for a long time. But with proven economics, good jurisdiction, and good management the reward to risk ratio is often superior. Historical data shows junior developers can deliver outsized returns in bull markets for commodities like gold.

What has been optimal price to pay for developers

For junior mining developers (pre-production stage with economic studies), historical data suggests that buying at a market cap (MC) to net present value (NPV) ratio of 0.3x or lower (i.e., a 70%+ discount to NPV) has been optimal for maximizing returns, particularly during market downturns or early in commodity cycles. This threshold provides a margin of safety against risks like exploration failures or price volatility, often leading to 5-10x+ gains as projects de-risk toward production in bull markets.

For example, in the 1990s gold transactions analysed by Ludeman (2000), development-stage measured/indicated resources traded at an 83% discount to NAV (0.17x NPV). This represented attractive entry points that yielded strong performance as reserves were proven up.

During the 2000s bull market, junior miners expanded to 2-3x NPV (50%+ premium) at peaks, but optimal buys occurred at 0.2-0.5x during the preceding 2008-2010 downturn, with subsequent returns amplified by commodity leverage (e.g., 20% metal price rise doubling NPV).

In uranium bull runs (e.g., 2006-2007), juniors reached 5-20x NAV at highs, but entries at <0.5x during lows (post-2008 crash) captured the bulk of upside.

Recent silver/gold juniors (2020-2025) have shown similar patterns: undervalued at 0.1-0.3x NPV during corrections, rerating to 0.5-1.5x as silver prices rose 50%+ in 2024-2025, delivering 3-5x returns for early buyers.

I am particularly knowledgeable about uranium. During the current bull market for uranium, the best returns were from stocks I bought for about 80% discount to NPV like Global Atomic or Vimy Resources. There were exceptions like Boss Energy, which delivered me a 10x return even though the company itself was never cheap. But in most cases larger discounts resulted in extraordinary results.

In my experience, the larger the discount, the better the moment in the cycle to buy developers. Larger discounts often imply that the pessimism is at its peak, therefore the market is often nearing the bottom. On these spots, producers should be taking over developers, but ironically these are the times that mining firms are in retreat.

Cheapest and most expensive developers

How I did the analysis

About 2 months ago I was researching various silver projects. The price of silver was beginning to increase, and I wanted to know what silver projects would be worth at extremely high silver prices. So, for the past 2 months I have been plotting into a spreadsheet the data on dozens of silver projects, so I could figure out what the NPV would be at $50/oz or $100/oz.

For the sake of this investigation, I have had to filter the silver projects, so they can be compared on equal conditions. These were my set of assumptions:

· All the silver projects and companies I modelled have zero revenue.

· Silver had to be at least 42% of gross revenue at $50/oz for the project.

· All NPV values must be discounted at 10% and after tax.

· Price assumptions: (I used the metal prices of the day I did the calculations)

o Silver (Ag): US$50/oz

o Gold (Au): US$4000/oz

o Lead (Pb): US$2,000/t

o Zinc (Zn): US$2,945/t

o Copper (Cu): US$9,500/t

Explanation of assumptions:

The 42% may seem arbitrary, I just used the figure that Boab Metals has. In other words, 42% of the revenue from Boab’s project will be from silver.

As only 27.8% of silver comes from primary silver mines, a comprehensive supply and demand silver model would include hundreds of mines. This is because there are many zinc, lead, copper, and gold projects that produce some silver.

I may do such a model in the future, but for now, this report should suffice. I wanted this report to have fair comparisons across silver projects. I do not believe that a project that yields 20% of its revenue from silver would be a fair comparison with Vizsla Silver or Boab Metals.

Vizsla and Boab have a lot of leverage to silver prices, while a project that has 20% of its revenue coming from silver does not have that leverage.

All developers must have zero revenue because I wanted a fair comparison for Boab Metals, my second largest investment. I am very interested in Vizsla, and I wanted a fair comparison for them too.

The 10% after tax NPV is obvious for me. No financier is going to lend money to these firms for less than 10% cost. Most developers use 0% or 5% rates to discount NPV values on their economic studies, and that is insulting in my opinion.

The metal price assumptions I used were the ones that metals were trading at the day I was finishing my analysis. They are all rounded down except zinc.

These are the companies I discarded:

Companies I discarded based on the assumptions. Own research.

The results of the research

Benjamin Graham, in “The Intelligent Investor” (Chapter 15), advocated buying stocks trading at one-third to their net current asset value (NCAV). Focusing on silver projects below 30% NPV captures similar undervaluation in juniors.

This said, I prioritize those with strong metallurgy, shallow deposits, and lower geopolitical risk to mitigate the risk that I could be very wrong on my analysis.

Therefore, I will focus my efforts in digging deeper into Silver Bull, Minco Silver, Southern Silver, Boab Metals, Bunker Hill, Blackrock Silver, Investigator Resources and New Pacific Metals. They are trade below 30% their NPV at $50/oz silver prices.

The most expensive developers are Silver Mountain, Silver Tiger, and Vizsla Silver. Therefore, those are the ones that I will avoid. Vizsla will be a target for producers looking to increase their silver leverage. It is a good takeover candidate as it has a high silver revenue relative to other metals. However, its high price relative to NPV and the geopolitical risk in Mexico makes it risky.

NPV analysis on silver projects. Own research.

The cheapest silver developers out there are Silver Bull, Minco Silver, and Southern Silver. However, I argue that any company trading below 30% of NPV is interesting. Now that I have verified that they are cheap, let us look one by one at these companies and see their flaws.

Silver Bull Resources is engaged in an ongoing international arbitration against Mexico over the Sierra Mojada project. They are claiming expropriation and damages exceeding US$100 million, with hearings starting October 6, 2025, following commencement in 2023. Financial challenges include low cash reserves of approximately $375,363 as of April 30, 2025, down from prior periods, amid legal battles.

It is a pass for me as I am not interested in a company facing a legal battle.

Minco Silver is operating in China. This exposes the company to increasing regulatory restrictions, including new export controls on rare earth technologies (effective October 9, 2025) that could indirectly impact silver mining operations. Broader issues in China’s mining sector include unpredictable weather, heightened safety scrutiny, and export crackdowns.

The company has not updated their investor presentation since 2018, and they have had 9 insider transactions in the last 5 years.

This said, I have had good experiences with extremely cheap mining developers in China. I used to own shares of Gobimin. Their stock price skyrocketed in 2022 after they sold their gold project in China. I had initially invested in 2016, so it took some time for the investment to work out, but it eventually increased over 600% in stock price.

The CEO owns around 5% of Minco and the company has some very interesting assets besides the silver project. I am trying to contact Minco Silver to get to know them better. I will dig deeper into the company, and I will write a separate report if necessary. Their capex is incredibly attractive too as it sits at around $70M. The main problem with the company is that its economic study is from 2009, so it is obviously outdated.

Southern Silver owns the Cerro Las Minitas project. They own a large resource, but only about 50% of it is silver in terms of future revenue. Insiders own 2% of the stock. They have updated their corporate presentation once in the past 3 years, which suggests that just like Minco, they do not care very much about investor relations.

The president is also director for 3 other mining firms: Bravada Gold, Equity Metals and Paradigm Gold. I am not a fan of the president of the firm being involved in other mining ventures. But in this case, I do not mind it as he owns $1M of stock in Southern Silver and has been involved with the company for over 20 years.

The technical studies look great. The only problem I see with Southern silver is the high level of capex required to build the mine, and the fact that it is in a dangerous part Mexico. However, I might consider it as an investment as the discount to NPV is too tempting.

Bunker Hill Mining owns the Bunker Hill Project in the US (Idaho). The project restart has been delayed to Q2 2025 due to cost overruns, with total costs rising from $67 million to $103 million, plus an additional $50 million in expenditures. The site is part of the Coeur d’Alene Basin Superfund site with ongoing EPA cleanup for historical contamination, including a five-year review in 2025. Therefore, it is a pass for me.

Blackrock Silver owns the Tonopah West in the US (Nevada). I see nothing wrong with metallurgy, technical reports, or management. Insiders own around 4% of the company.

Tonopah West features low-sulfidation epithermal silver-gold veins in volcanic rocks, with historic grades of 1,384 g/t silver and 16 g/t gold (100:1 ratio). Mineralization is in multiple veins (e.g., DPB, Merten), with recent drilling confirming high-grade continuity (e.g., 1,661 g/t AgEq over 0.55m).

Geology is complex with faulting and variable vein widths; some areas show thinner or discontinuous mineralization. Exploration risk: While 150,000m drilled, eastern extensions are scout-level, with potential for misses.

This said, I would say it is a fine project. The only problem I have with them is how early they are in the cycle. They still have many years of permitting ahead, but this would be a fine takeover target for a mining firm with a long-term view. However, given how early they are in the permitting process and the lack of reserves I am not interested in them. In the future it will be interesting to see how much of that resource they can turn into reserves.

Next up we have investigator resources, who own the Paris project in South Australia. This company does not make a lot of sense to me. They have no reserves; their resource size is small relative to Boab, and their permitting still has a lot of work ahead. All this for the same market cap as Boab.

Project comparison. Boab Metals investor presentation.

New Pacific Metals is “uninvestible” in my opinion. They own the Silver Sand project in Bolivia. High capital needs for Silver Sand (estimated US$740 million) pose funding risks. Social issues include negotiations with illegal artisanal miners, shifting focus post-2024 PEA. Past controversies from a 2020 report allege corruption in acquiring concessions, potentially violating Bolivian law, and risks from political instability (e.g., coups).

Finally, Boab Metals remains my top pick for the silver sector worldwide: They have all the important permits in order. Management is qualified and incredibly motivated: Simon has turned Boab into his life’s work. He even got his truck driving license to drive the first truck of ore with his son.

Unlike most silver juniors, Boab has reserves, while most other juniors have resources. For those unfamiliar with this: Reserves have a higher probability of being mineable than resources.

At an 85% discount to NPV, I think it is a matter of time before a mid-tier miner takes Boab over.

The only problem I see with Boab is the high CAPEX relative to NPV. But they were able to do an accretive deal to reduce CAPEX: They bought out a processing plant from Sandfire Resources for $10 million AUD. This move should reduce CAPEX by A$10 to A$50M.

Leverage to silver prices

Vizsla Silver, with its Panuco project, has the most leverage to silver prices among the stocks in our list. At 76% silver revenue in the current price environment, it offers high sensitivity to silver upside. Its adjusted post-tax NPV10% rises by approximately US$400 million per $10/oz increase in silver (from the sensitivity table, e.g., from US$1,413M at $40/oz to US$1,813M at $50/oz), driven by the project’s high-grade veins and low breakeven of $18/oz.

Leverage to silver prices. NPV (10%). Own research.

This makes it more responsive than lower silver-exposure peers like Sorby Hills (44%, ~US$144M delta per $10/oz) or polymetallic projects, while its developer status amplifies potential stock volatility in a rising silver market. Other pure silver plays like Investigator Resources’ Paris (100% silver revenue) or New Pacific Metals’ Silver Sand (100%) are close contenders with even higher proportional leverage.

Vizsla also has a very good management team, and it could have some upside if silver prices continue to deliver. However, it is the most expensive silver developer.

If you are wondering why Toponah West has a positive NPV at $20/oz silver and Bowden does not have a negative NPV: In both cases, the apparent oddity stems from the distinction between operational breakeven (AISC, focusing on cash costs) and full economic breakeven (for NPV>0, incorporating capex and time value of money). Positive cash flow from by-products like gold can sustain operations but not always yield immediate positive NPV at marginal prices.

Boab Metals has an average leverage to silver prices relative to its peers. Boab’s advantage lies in its negative AISC (cost) for silver (due to lead credits), providing downside protection but capping upside compared to silver dominant peers.

Margin of safety

If I were to consider purely quantitative data, Southern Silver offers the most margin of safety among the silver developers in our list, trading at a 91.7% discount to NPV at $50/oz silver. This deep undervaluation provides a substantial buffer against uncertainties, aligning with Graham’s emphasis on buying well below intrinsic value.

Southern Silver’s Cerro Las Minitas benefits from strong metallurgy (93%+ silver/lead/zinc recoveries), shallow mineralization enabling low-capex startup, and a clear path to an updated PEA/FS amid ongoing drilling (as of October 2025).

It stands out compared to peers like Silver Bull: 0.012 MC/NPV but paralyzed by arbitration against Mexico, with hearings completed October 2025 and risks of prolonged delays. Southern is also better off than Minco Silver: 0.016 MC/NPV but exposed to China’s tightening export controls and safety regulations on mining.

Southern’s combination of low costs (AISC ~US$10/oz AgEq), polymetallic diversification (52% silver revenue), and lower relative risks provides a great positioning.

However, taking all quantitative and qualitative factors into account: I argue that Boab Metals does indeed offer a stronger overall margin of safety compared to Southern Silver Exploration and most peers in our list, when balancing economic robustness, jurisdictional stability, and valuation discounts.

It trades at a solid 85% discount to NPV at $50/oz silver, but the real edge comes from its exceptional downside protection: A negative AISC for silver (-US$14/oz at spot) and a lead breakeven of US$1,400/t (well below current ~US$2,050/t).

This ensures a positive NPV even at very low silver prices (e.g., profitable at $0/oz equivalent due to lead credits covering costs).

Western Australia is a top tier jurisdiction with low geopolitical risk, strong infrastructure, and supportive mining policies. I argue that Western Australia is in fact the best mining region by far. It offers a straightforward permitting process coupled with both physical and legal safety. Workers there do not face the dangers of working in a place like Mali or Mexico and your mine will not get nationalized. Infrastructure is great and energy is available for operations.

Southern Silver’s project is located in Durango (Mexico). The project faces threats from cartels, regulatory overhauls, or social conflicts. Sinaloa Cartel activity has led to increased security costs (up to 10% of opex in affected areas) and theft incidents (e.g., a 33-ton concentrate hijacking in July 2025). This does not happen in Western Australia, where Boab operates.

Boab’s near term catalysts (FID targeted Q4 2025, production mid-2026) further de-risk it, with shallow open-pit mining, simple metallurgy (90%+ recoveries for lead/silver), and low capex (relative to other mining projects) reducing execution hurdles.

While Southern’s deeper discount (0.11 MC/NPV) is appealing, its higher breakeven (US$12/oz silver, US$1,600/t lead) and exposure to Mexico’s uncertainties tip the scale toward Boab.

Compared to others like Blackrock (early-stage with no reserves, MC/NPV 0.17 but higher uncertainty) or New Pacific (0.23 MC/NPV but Bolivia’s political risks), Boab’s combination of low breakeven, safe location, and reasonable valuation provides the broadest protection against downside scenarios in a volatile silver market.

How Mexico is turning away from mining

During the past 20 years Mexico has truly dominated the silver market. In the year 2000, Mexico and Peru produced more or less the same amount silver, give or take 10% difference. Today Mexico produces twice as much silver as Peru as Mexican production has more than doubled since 2000.

However, I argue that this is slowly changing as politicians are using mining firms as a scapegoat. They blame mining firms for “extracting” the wealth off the local communities in order to enrich shareholders. What is even more worrisome is that these attacks are directed towards US and Canadian companies, who own most of the mines in Mexico.

Claudia Sheinbaum, as President of Mexico, has made several statements critical of mining practices, particularly regarding environmental impacts, foreign (especially Canadian) companies’ compliance, and restrictions on new activities.

In this regard, I argue that I have an edge over some investors as I speak Spanish, I know Mexican politics and history, and I know about mining.

Below are key examples of Claudia Sheinbaum’s negative comments on mining, reformatted for clarity and accessibility to English speaking audiences. I have translated the Spanish quotes and paraphrases into English while staying faithful to the originals (noting where they are direct quotes or close summaries). These are drawn from news reports, videos, and official statements, organized chronologically with context for each.

June 23, 2025: Sheinbaum emphasized ongoing environmental issues with mining tailings and reiterated that no new concessions would be granted: “The Secretary of Semarnat, Alicia Bárcena, is working very importantly to resolve the problem that still exists with contamination from tailings of various mining companies, so there will be no new concessions.” She also denied any hidden deals: “In our government, there are no arrangements in the dark.”

August 6, 2025: During a meeting with ministers, Sheinbaum highlighted damages caused by Canadian mining companies: She “exposed the impacts that Canadian mining companies have made in Mexico,” pointing to environmental harms as a key issue in bilateral discussions.

September 19, 2025: Sheinbaum indicated that Canada’s envoy would urge Canadian miners to comply with environmental laws, implying current non-compliance: “Mark Carney will ask mining companies operating in Mexico to comply with environmental laws.” This followed her pressing Canada on the “serious environmental damage from large Canadian mining companies in Mexico.”

October 1, 2025: In a press conference, Sheinbaum announced sending an updated list of Canadian mining companies to Canada for review due to alleged violations: She discussed “mining companies from that country that do not comply with environmental regulations in Mexico,” and considered revealing names and specific violations, highlighting implications for the environment.

October 28, 2025: Sheinbaum instructed Conagua to halt reforms allowing mining waste dumping: She rejected modifications that would “allow mining companies to dump toxic waste in rivers,” emphasizing that her government “will not allow modifications that favour the contamination of waterways.”

Broader critiques (e.g., November 29, 2024, context): Sheinbaum has been associated with views that Canadian miners “extract wealth from Mexico for almost nothing,” paying minimal taxes (less than 1% of total tax revenues annually) under T-MEC protections, though this is more a systemic criticism than a direct quote. Similarly, in June 2025 contexts, she noted that Canadian mining “is not an example to follow” due to environmental and community issues.

Will no mines be opened?

Silver Tiger Metals received all required approvals from Mexico’s Federal Environmental Department (SEMARNAT) on November 7, 2025, for constructing the El Tigre Stockwork Zone silver-gold project in Sonora, Mexico.

The key distinction is between “concessions” (long-term rights to explore and mine new areas, which Sheinbaum has halted to prioritize environmental protection and strategic resources) and “approvals/permits” for construction or operations on existing concessions.

Silver Tiger’s El Tigre project operates under pre-existing concessions in the historic El Tigre Mining District (covering 28,414 hectares, acquired before Sheinbaum’s administration), so it qualifies for permitting if it meets SEMARNAT’s environmental and regulatory standards, which the company confirmed in their announcement.

Sheinbaum’s administration has clarified that while no new concessions will be issued, existing projects can proceed if they demonstrate compliance with environmental laws, as evidenced by other approvals in 2025 (e.g., for companies like Sonoro Gold, unaffected by the policy).

This selective approach allows ongoing development while addressing her concerns about pollution and accountability, particularly for foreign miners.

However, this is not the type of environment I want to be investing in. And I doubt very much larger mining firms are interested in operating with such a hostile administration.

Noteworthy company

As you saw on one of the first tables, I had to discard a lot of companies because I wanted a fair comparison across pre revenue silver developers.

However, there is one company that really stands out. That company is Gogold resources. I am not a buyer, but if the company was in Australia, Canada, or the US, it would be trading even more expensive than what Vizsla Silver is trading at.

Gogold owns three assets. They own two silver projects: Los Ricos north and south. Plus, they own a tailings facility which loses money when precious metals are weak and makes some money when prices increase. Los Ricos North has an NPV of $1.9 billion and Ricos South $1 billion. All data post tax and under the same assumptions ($50/oz silver, etc).

Conclusion

In conclusion, I argue that Boab Metals is the best positioned for the current market. They may not have the most leverage to silver prices, but considering geology, metallurgy, capex, financing, geopolitics, and project economics, Boab has the best margin of safety. I argue that it already is a great target for any mid-tier mining firm for a takeover.

Boab’s management made done three great decisions: 1. Buying their Chinese JV partners. 2. Buying a processing plant to reduce CAPEX. 3. Great timing with its financing.

They announced the buyout of their partner on the 23rd of September 2024 when silver was still trading at $31/oz. And they announced the deal to buy the processing plant on the 30th of April 2025 when silver was trading at $33/oz. So, the timing on these deals was ideal.

They did a A$50M dilution when silver was trading at $51/oz on late April. Considering this should be the last dilution, I think this was the risk averse and correct decision. Waiting till last minute to issue shares is never a good idea as the market may turn.

Mining firms and investors that think that silver price is going parabolic ought to remember the following: Almost no one cares about silver prices and even less people care about obscure silver miners or developers. The average investor or household only pays attention to the S&P500.

I say this because people often go into “tunnel vision,” they think that everyone knows what is going on with the inner workings of their interests: That is false. Almost no one knows that precious metals have risen in price. When the average household starts to notice, that should be a good sign that the bull market reaching a top.

Any feedback is more than welcome in the comments, or you can send me a message on Substack, or through my Twitter (X) account @AAGresearch.

As always, I want to thank my wife Yeimy, who has helped me a lot while I was writing this by myself. This report and this blog would not be possible without her. Thank you.

I hope this finds you well,

Alberto Álvarez González.

Disclaimer: I assume no liability for any and all of your actions, whether derived out of or in connection with this information or elsewhere, and you hereby warrant and represent that any and all actions that you take or that you may take at a later date in connection with this information shall remain your sole responsibility and, in case, I shall not be held liable for any such actions.

Link to report: https://open.substack.com/pub/albertoag/p/the-ultimate-guide-to-undervalued?r=3hhq06&utm_campaign=post&utm_medium=web