Summary

· Manolete Partners Plc (LON: MANO) is a UK-based insolvency financing company. For those not familiar with the business, please read my first report on them on this link.

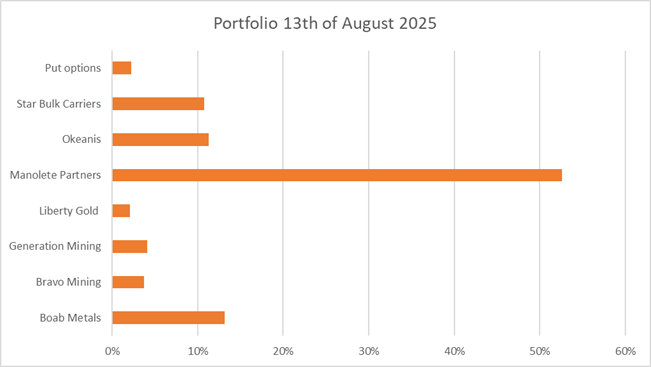

· Since I last shared my portfolio sizing, Manolete has gone from being 25% of my portfolio to over 50% now.

· The insolvency industry in the UK has been in a bear market since 2020. And Manolete has suffered a lot since they are a key player in the industry.

· The stock price of Manolete Partners has decreased 85% from its peak in 2020. However, most KPIs and revenue are now at record highs, which indicate that we are at an inflection point.

· Profitability has historically been high, with a 14% average net income margin. However, this profitability was driven by larger firms going bankrupt (administrations). These cases have been lagging in the past years but are making a comeback.

· The main tailwind for Manolete partners is that the UK is experiencing record high insolvencies, higher than in 2009.

· I have sold Mongolia Growth Group after management decided to return the capital to shareholders. This is what I expected as it was part of the thesis as I explained in my report about uranium, link here.

Alberto’s Substack is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Note to new subscribers

Since I last posted on the 9th of July, there are 500 new subscribers to the blog and almost 1000 new followers. There are now over 4000 subscribers and 4600 followers on the blog. So, I thought I would explain a bit about it.

This blog is 100% free, I live off my investments. I put out reports whenever I see something worth updating on, or when I find a new investment for my portfolio. This means that the time span between one post and another could be one day, two months or more, depending on the updates I see worth writing about, or the new investments I find.

Paid subscribers pay me to support the blog, but they get no benefits nor advantages. The only difference there is, is that “Founding members” can post new threads in the group chat. The only reason I did this was because there were a growing number of scammers posting in the chat, so I had to limit who can post on the chat. Prior to this anyone could post a new message there. This said, I want to thank paying subscribers for their generosity.

Let us get on with the report.

My portfolio

Since I last shared my portfolio, I have sold A-Mark Precious Metals Inc AMRK 0.21%↑ . I posted an email to all of you when I sold my stock in AMRK. Buying AMRK was clearly a mistake on retrospect. It displayed a high level of leverage to gold prices, but I did not consider the competitive nature of their business, and how sensitive retail demand is to gold prices.

And as I announced today, I have sold Mongolia Growth Group as the thesis is completed.

The put options I own can be found in the post I made about them, link here.

My other investments are explained in previous posts.

What is Manolete Partners

Manolete Partners Plc is a UK-based insolvency litigation financing company, founded in 2009. They specialize in funding or purchasing claims arising from insolvent estates, to pursue them through litigation or alternative dispute resolution (ADR).

Their business model focuses on partnering with Insolvency Practitioners (IPs) and lawyers to identify and resolve meritorious claims. They resolve those claims involving preference payments, transactions at undervalue, misfeasance, or breaches of duty, with the goal of maximizing returns for creditors while assuming all associated risks.

Key Elements of the Business Model:

Three-Way Partnership Structure: Manolete operates in collaboration with IPs (who manage insolvent estates) and their preferred external lawyers. IPs provide case summaries and evidence, and Manolete supports the pursuit of claims without requiring IPs to change their legal teams. This strategy fosters repeat business, as every IP who has worked with Manolete has returned with additional cases.

Case Evaluation and Decision Process: Upon receiving a case inquiry, Manolete conducts a thorough net-worth assessment of the defendants. Their Investment Committee reviews and approves funding or purchase offers, typically within about a week, ensuring a fast and efficient process.

Risk Assumption: Manolete bears 100% of the financial risk, including adverse costs if a case is lost, and provides full indemnity to protect IPs and estates from any liability or personal exposure. If a case fails, Manolete absorbs the entire loss (e.g., writing off £180,000 in one example, including £80,000 in adverse costs). This risk transfer is a core differentiator, as it eliminates downside for partners and creditors. This may seem like a massive risk for the firm, but Manolete completes over 90% of their cases.

Pursuit and Resolution: Cases are advanced through litigation or ADR, with many settling commercially before trial. Manolete's involvement adds credibility, often encouraging opponents to settle. They dominate the UK market with a 67% share of funded insolvency litigation cases.

Funding Mechanisms:

1. Funding Cases: Manolete provides immediate cash injections to cover unpaid work in progress (WIP) for IPs and lawyers, finances further investigations, and pays all ongoing legal and disbursement costs. They do not require After-The-Event (ATE) insurance, as they self-fund and overcome security-for-costs issues directly.

This method is very rarely used nowadays (1% of all cases last year were Funded Cases). When it is used, it is because the insolvent entity is a bankrupt individual, rather than an insolvent company.

2. Purchasing Claims (Buy-to-Own Model): In some instances, Manolete buys claims outright for a large upfront, non-refundable cash payment (e.g., £40,000 in some cases), taking assignment of the claim and removing all involvement and risk from the IP and estate.

Nowadays, 99% of case investments are done by way of Manolete taking a legal assignment of the case from the insolvent company (via the Liquidator or Administrator). Manolete refers to these as “Purchased Cases” because Manolete takes full ownership of the claim. Once it has purchased the claim, Manolete is in full control, because it solely owns the claim. Manolete has become the claimant. It is only within UK insolvency Law that a third-party, such as Manolete, is allowed to buy legal claims. No other area of UK law allows a third party to buy claims.

Owning the claims is highly attractive: Manolete skilled in-house team project manages all cases, it fixes all fees, and it leads all settlement negotiations. Manolete has no emotional attachment nor emotional history with the cases. It is simply looking to make a commercial return.

Purchased Claims, then fall into two sub-categories:

A) In most Purchased cases, Manolete pays a relatively small upfront cash payment as consideration to purchase the case. Manolete then pays the legal costs to advance the claim. Once a resolution is achieved (usually by way of mediation, very few cases ever go to trial), Manolete receives all its costs back, plus the initial consideration that it paid to purchase the case. The remaining net proceeds from the case are then split in a pre-agreed percentage between Manolete and the insolvent company. The split is usually 50/50.

B) In rare instances Manolete will make a single larger cash consideration payment to purchase the case at the outset. However, it will retain 100% of all proceeds resulting from that case.

How Manolete Partners Makes Money

Manolete generates revenue primarily from the net proceeds of successful case resolutions, after deducting costs. They do not charge fees upfront but instead share in the upside:

Revenue Sharing in Funded Cases: Creditors (via the estate) typically receive 50-90% of net recoveries, implying Manolete retains 10-50% as their return on investment. This structure ensures higher overall recoveries for estates compared to other models, as Manolete's full-risk assumption and non-contingent lawyer payments lead to more thorough pursuits.

Returns from Purchased Claims: When buying a claim, Manolete pays an upfront sum and keeps the full recovery minus costs. For example, in a case settling for £300,000 with £40,000 in legal costs, Manolete (after an initial £40,000 payment) received £99,000, while the estate got £161,000 total (including the upfront amount).

Overall Profitability: The model resembles a venture capital approach but in a niche industry with high barriers and favourable economics, allowing for compounding returns (historically around 17%). Revenue has grown significantly over time (e.g., from £4.8 million in 2016 to £30.5 million by 2025), driven by operating leverage and a track record of success. Losses on unsuccessful cases are offset by wins, with no revenue from failed investments.

Predictability

Manolete Partners has a business cycle that spans two years. In the first year they purchase and complete an insolvency claim. In the second year they wait until they collect all the money. So, in 24 months the cycle is complete. Since they have a completion rate of over 90% of cases, their revenue and net income should be predictable.

I have done some comprehensive analysis of Manolete Partners Plc's financial statements from 2013 to 2025, back testing of key accounting items (e.g., lagged investing cash flows and total assets as top predictors with R² up to 0.637 for revenue), and KPIs (e.g., case completions and new investments). The company's revenue and net income exhibit moderate long-term predictability aligned with its ~24-month business cycle and high completion rates (>90%).

However, they are not as reliably fixed as a bond due to economic sensitivities (e.g., insolvency volumes post-COVID causing 20-50% YoY fluctuations), case mix variability, and occasional one-offs, making it more akin to a stable equity with bond-like elements in upcycles. Recent FY2025 results (revenue £30.48m, net income £0.893m) and ongoing macro tailwinds (rising UK insolvencies) support continued growth.

Manolete Partners can be considered a recession proof stock as they profit from increasing bankruptcies. Therefore, some investors may want to own the stock due to its similarities to a hedge. However, I like to consider Manolete a sort of “recycler” of companies. Just like a recycling company, Manolete makes money all through the economic cycle, therefore making it a great company to compound capital. However, when there are a lot of insolvencies (a lot to recycle), there is an uptick in business activity. Therefore, it is quite a unique business and that is why historically it has traded at such a high PE ratio.

Headwinds and tailwinds

Manolete Partners is down 85% in the stock market from its peak in 2019. In 2020 the UK government passed the Corporate Insolvency and Governance Act 2020 (CIGA). While in theory CIGA did not outright prohibit insolvencies, in practice it pretty much did. These measures restricted certain insolvency-related actions to provide breathing space for distressed companies. It was a headwind that led to the situation the firm is in now.

The main catalyst and tailwind behind Manolete is that the UK is experiencing record high levels of business insolvencies, even higher than in 2009. Furthermore, individual bankruptcies for low-income households are at record high levels, a lot higher than in 2009. Therefore, the UK is going through a troubling period both for businesses and households, in fact they feed onto each other like a vicious cycle.

Average revenue per case for Manolete Partners. Own research.

However, Manolete Partners is still trading 85% off its all-time highs. The reason that is the case is that average revenue per case has decreased 50% since 2019.

Average revenue per case is mainly driven by larger companies going insolvent, these are called “administrations” in insolvency lingo. And administrations are way off their 2009 levels.

Furthermore, while CIGA ended in mid-2022, the long business cycle for Manolete meant that they started feeling the effects in 2023, as seen by their losses that year. Therefore, they are still recovering from the government effectively shutting down the insolvency industry.

This brings us back to administrations and the largest insolvency cases. Once CIGA ended, the first businesses to go bankrupt were the ones with little access to the capital and debt markets: Small and medium sized businesses. This is reflected in the table above, from 2019 to 2025, the number of cases completed by Manolete increased by almost eight times. However, the largest companies kept issuing debt and/or capital, and this has kept them in business until today.

In fact, when I look at insolvency data which is published monthly by the Insolvency Service, I see that administration levels have decreased since I first published my report on Manolete in early 2024. However, the Insolvency Service is not describing the full situation well. Regarding this, I dig deeper later into the report.

This came as no surprise to me. The UK government ended COVID relief in 2023, but since then has disguised support in other forms, the kind of support that did not exist prior to COVID. For example, UK relief measures in 2023–2025: Business rates relief, Recovery Loan Scheme, Employment Allowance, and legal tax avoidance schemes. These measures reduced larger insolvencies by enhancing business liquidity, negatively impacting Manolete’s case pipeline.

Another tailwind or catalyst is that Manolete has been involved in notable cartel cases, with a significant focus on the Truck Cartel claims. A recent £3.2 million settlement was announced on July 21, 2025, yielding 6.6 times return on costs (560% cash return) and due by August 1, 2025. This settlement highlights the profitability potential. This reduces the net asset value of remaining claims from £15.4 million to approximately £10.3 million. However, there is still upside as £10.3 million are yet to be potentially settled for.

With the next trial delayed to September 2026, ongoing settlement discussions and the company’s confidence in the remaining cases suggest there could still be substantial additional earnings, especially given its high success rate (>90%). Although Manolete has indicated it may not pursue similar cases in the future, the current portfolio’s value, and the possibility of further settlements or trial outcomes before 2026 could unlock more revenue. Although this depends on case progress and market conditions.

Specific details about the counterparties on those cartel claims are not explicitly disclosed in the available information. However, The Truck Cartel case generally refers to a well-known antitrust matter involving major European truck manufacturers (e.g., MAN, Daimler, Volvo/Renault, Iveco, and DAF). These firms were fined by the European Commission in 2016 for price-fixing and other anti-competitive practices between 1997 and 2011.

Given the size of the potential counterparties, I argue that a settlement is the most certain outcome. A £10.3 million is a rounding error in the financials of those companies, therefore the probability of them taking it to trial is extremely low. Furthermore, the full settlement of that claim would wipe out the financial debt of Manolete, and it would enable management to return capital to shareholders via dividends.

Debt maturity in 2025

One of the tailwinds I explained on my report last year, was that in 2025 UK businesses were facing record levels of maturities on their loans. In fact, a whopping 20–30% of market-based debt (especially high-yield and leveraged loans) is due by year-end.

The maturing debt, especially in high-yield and leveraged loan sectors, could trigger insolvencies in H2 2025, boosting Manolete’s case pipeline. With 896 referrals in FY2025 (+23%) and Q1 FY2026 new cases up 27%, this trend is already emerging, likely driven by maturing debt pressures.

Larger insolvencies could raise average realizations (£108k in FY2025) and net income (£0.893m), countering the relief-driven suppression of FY2022–2023 (revenue £20.4m, -27% YoY). Lagged investing cash flow (£6.9m) and total assets (£62.7m) remain key predictors, but a surge in defaults could enhance predictability if case sizes grow.

Furthermore, The Bank of England, in its Financial Stability Reports (e.g., updates through mid-2025) highlights a big problem.

In the 2025 reports, the Bank of England highlights that only 5% of business assets can be classified as liquid (easy to use to pay bills or debts). On the other hand, 60% of what they owe is debt, which is a huge amount compared to their available cash. The Bank of England pointed this out to warn that these companies, especially those with bonds or loans maturing in 2025, might struggle to pay back what they owe if they cannot borrow more money, or make enough profit.

Interest rates in the UK have remained elevated in 2024–2025 (Bank of England base rate around 5% as of mid-2025, per recent trends), increasing borrowing costs. This could pressure corporations, especially those with high-yield or leveraged loans, to refinance earlier or face defaults.

Reports up to mid-2025 indicate a surge in bond issuances and loan renegotiations in H1 2025, as companies pre-empt the 2025 maturity wall. Investment-grade firms have likely secured favourable terms, while high-yield and leveraged loan sectors may see distress, with default rates rising (estimated 3–5% for high-yield debt, per industry forecasts).

UK GDP growth has been modest (1–1.5% in 2025), and inflation (around 2–3%) adds strain. Corporations with maturing debt in 2025 may lean on cash reserves or equity raises, reducing insolvency risks in the near term and potentially delaying larger failures.

Are larger companies going bankrupt

Since larger company insolvencies are such an important diver in profitability, this factor is worth examining in detail.

Yes, there are indications that the trend of insufficient large company insolvencies in the UK is changing, particularly toward an increase in overall volumes and potentially larger cases in 2025. Official statistics show a rise in company insolvencies in early 2025: 2,238 in May (15% higher than May 2024) and 2,043 in June (after seasonal adjustment).

The retail and hospitality sectors are the hardest hit, with ongoing distress from high costs and consumer spending slowdowns. For instance, as of mid-2025, companies like Pizza Hut's main UK franchisee are attempting to offload 140 sites due to tax hikes, risking insolvency. Thames Water remains in severe distress with £16bn debt, potentially facing collapse if refinancing fails.

I have gone through every insolvency in the last three years for companies with the following features: >£50m turnover, hundreds of employees, or national presence. The results are that fourteen large businesses have gone bankrupt or entered significant insolvency processes (e.g., administration or liquidation) in the last two years. Around 10,000 employees have been laid off, layoffs for indirect employees are countless. When it comes to debt, £7.8bn–£8bn has been wiped out or restructured.

In 2025 there are four large firms at risk of insolvency: Thames Water, TalkTalk, the Pizza Hut UK franchise, and potentially Stonegate. They are indeed large, with significant economic impact and debt burdens.

Thames Water serves 15 million customers with £16bn in debt and thousands of employees (estimated 4,000–5,000), while TalkTalk has 2.2 million customers, £1bn debt, and ~2,000 employees. The Pizza Hut franchise operates 140 sites with ~3,000 employees and £50m–£100m debt, and Stonegate manages 4,500 pubs with £3bn debt and 20,000+ employees.

A collapse could wipe out £20bn–£25bn in debt (depending on restructuring), disrupt water supply, telecom services, and hospitality, and lead to 25,000–30,000 job losses. This will severely impact the UK economy through reduced consumer spending and tax revenue, though partial rescues might mitigate some effects.

As a result of this, I conclude that administrations are coming back. This is a massive tailwind that was not there when I first published my report last year.

Recent changes in management and shareholders

On April 7th, 2025, Mark Taverner left the role of CFO of Manolete. This was a positive as Taverner had done a poor job for several reasons. Firstly, Taverner had chosen an accounting style for the business that reflected poorly how the firm worked, and was difficult to understand. But most importantly, he owned almost no shares, and Taverner did not know how to portray the business in a way that the retail investor could understand.

Michale Faulkner, former CIO at River and Mercantile is one of the founding shareholders at Manolete Partners. On June 2025 I started noticing in the regulatory news that Faulkner has selling some shares. By mid-summer it was evident that he wanted out. This was concerning for me as Faulkner owned 13% of the business before he started selling.

If a shareholder of this size tried to exit any business, it would mean disaster for the share price. More so considering that Manolete is an unknown business with low liquidity on its shares. However, the management team navigated this crisis beautifully finding a buyer for all of Faulkner’s shares. On the 5th of August news came out that Brightlight Capital (a US hedge fund) bought all his shares.

I do not consider this a negative as insiders might want to sell shares for a multitude of reasons, none of which must be related to the actual business. Seth Klarman explains insider selling in his book Margin of Safety very well, I highly recommend it.

However, just a few days later, on the 11th of August, Steven Cooklin, the CEO of Manolete stepped down from the role. This came as a surprise to me as Steven was very involved in the business he had founded. Furthermore, Steven had turned the firm from a startup into a firm that has 67% market share.

Since I do not know the actual reason behind his departure, I am approaching it on two separate scenarios. These are that this was either a planned transition, or not. So, let us explore both cases:

1. It was a planned transition: I think this would be positive for the company. Mena Halton was appointed CEO of Manolete Partners succeeding Steven Cooklin. Halton served as the Managing Director of Manolete Partners and was a member of the company's Board of Directors. She has been with the company for 11 years, joining in 2014, and became Head of Group Legal in February 2018. She qualified as a solicitor in 1984 (some sources mention 1985) and has extensive experience in insolvency litigation. She has worked in private practice and in-house for insolvency practitioners before joining Manolete.

Halton is a highly respected figure in the insolvency litigation funding sector. She has been ranked as a Band 1 lawyer for Litigation Funding: Insolvency by Chambers and Partners, in their Litigation Support Guides for 2022, 2023, 2024, and 2025, making her a leading figure in this field for four consecutive years. This is the most respected guide in the litigation industry.

As Managing Director, she led Manolete’s in-house legal team of twelve lawyers across the UK and was responsible for all commercial operations of the company, positioning her as an ideal candidate to transition into the CEO role.

Halton has been described as a cornerstone of Manolete’s success over the past decade, with her legal insight and leadership setting industry benchmarks. She has worked closely with Steven Cooklin, contributing significantly to the company’s growth and reputation.

However, I would have thought that an investor with experience in insolvency founding might have been a better candidate. This could enhance communication with investors by framing Manolete’s business in terms of financial metrics, growth potential, and market positioning, which are critical for investor confidence. An investor-CEO would have also had shareholder priorities in mind, and it would have enhanced the market credibility.

That said, Mena Halton is a highly suitable CEO for Manolete Partners, given her extensive operational experience, industry expertise, and alignment with shareholder interests through her 1.28% stake. While an investor-CEO could enhance financial communication and market credibility, their potential lack of insolvency litigation expertise and company-specific knowledge, makes them less ideal for leading Manolete’s specialized business.

Halton’s track record ensures she can effectively communicate the company’s strategy to investors, as evidenced by her role in recent successes like debt refinancing and the Cartel claim. For investors seeking deeper understanding, her legal and operational insight is more valuable than a purely financial perspective: However, she may need to leverage the financial expertise in investor presentations of a new CFO.

2. It was not a planned transition: This scenario raises some issues as well as some opportunities. The main issue it raises is whether Steven wants to remain a shareholder of the company or not. He owns a 15% stake in the firm, so if he wants to sell, a buyer would need to be found. I doubt he would like to sell his shares in the market without a deal as this would make the stock price plummet. Furthermore, since management was able to find a suitable buyer for Faulkner’s shares, I argue that there are more buyers in line if Steven decided to sell.

Another issue this scenario raises is that there may have been disagreements between management and shareholders, namely Jon Moulton a UK private equity legend who owns 26.5% of the company. This is just pure speculation, but it could have well been that Moulton wants an exit while Steven wanted to keep the company going. Therefore, Moulton would want to sell the company.

This however would mean an opportunity as a takeover would be on the table.

All this said, I would say scenario 2 is very unlikely as Steven owns 15% of the company, he has been the CEO for 16 years (from the beginning), and he is a very respected industry leader. I argue that scenario 1 is the most plausible and therefore the most likely. Either way, my thesis has not changed due to a change in management.

Why I have doubled my investment in Manolete

Firstly, I overestimated how much it would cost me to move to Andorra. So, by the time all my expenses were paid, I had a lot more money left than I expected. Therefore, I had plenty of cash to take advantage of opportunities in the market, like buying more shares in MANO.

I argue that Manolete has already reached an inflection point. This is proven by record high revenues and KPIs (excluding average revenue per case). Also, the macro and micro economic situation in the UK points that the insolvency industry is returning to normality.

By normality I mean a constant flow of bankruptcies from different sizes of companies. Manolete does not need an extremely high level of insolvencies like the UK is experiencing now, in fact its peak in profitability was in 2019, when the macro situation was great.

Average revenue per case is the most important metric for the business. And although this metric is down 50% from its highs, it has recovered from 2024. Furthermore, Manolete has proven that they are profitable even when this metric has been decimated. Management at the firm has been able to turn a profit from a high volume of cases, this shows the versatility of their business model.

What could Manolete's management do better

· Finding a new CFO to strengthen market credibility: Hiring a strong CFO should be a priority right now for the company. The previous CFO did not know how to communicate the virtues of the firm and chose accounting principles that made financials difficult to understand, even for professional investors. Furthermore, the new CFO should be willing to put significant capital into the stock, unlike the previous CFO. This would align his interests with those of the shareholders.

I argue the new CFO should not be a lawyer or an insolvency expert, but rather an investor who understands the business and can explain what Manolete is about. I believe I have done a better job at explaining what the company does with my reports than what investor presentations achieve at Manolete, and that is not right. Investor presentations should significantly improve, focusing on the important KPIs like average revenue per case and actual ROE. Other KPIs like IRR should be deleted altogether, as they do not describe accurately the business financials.

· Leveraging opportunities to improve economies of scale: Other firms like Omni Bridgeway or Burford have done an excellent job at getting capital from third party investors to invest in litigation. I believe Manolete could do exactly that. Management should raise money to be managed at a fund by Manolete. This would achieve two main objectives: 1. Earning management and success fees. 2. Investing in insolvency cases for which Manolete has not enough capital, therefore increasing market share.

Manolete’s partnerships with R3, IPA, and ICAEW have driven record referrals (437 in H1 FY25, +27%), but deeper collaboration could unlock profitability. Co-developing training programs or certification courses for IPs could position Manolete as the go-to financier, increasing referral exclusivity and insolvency case flow by 10–15% (e.g., 480–500 referrals annually). Additionally, marketing its FT Europe Long-Term Growth Champion 2025 status could attract institutional investors, enabling a £5m–£10m capital infusion for aggressive case acquisition, potentially lifting revenue by £10m–£15m over two years if ARRCC holds.

· Ignore volume, focus on quality: The current investor presentation of Manolete focuses on the volume of inquiries the firm is getting. I argue this is the wrong approach as the firm makes more money on larger cases, not on a lot of smaller cases. Therefore, management should focus on targeting larger, higher value cases to boost realizations.

· Optimize Case Duration and Cost Efficiency: The average case duration of 15.7 months in H1 FY25 (up from 11.5 months in H1 FY24) reflects a focus on older, complex cases, increasing legal costs (65% of recoveries) and reducing cash flow velocity.

Manolete could streamline operations by adopting technology-driven case management (e.g., AI for document review, predictive settlement modelling) to reduce duration to 12–13 months, mirroring its lifetime average of 13.3 months. This could cut legal expenses by 5–10% (£1.5m–£3m annually based on £30.5m revenue), directly improving gross profit (£10.4m in FY2025) and net income.

Additionally, negotiating bulk legal fee agreements with its 200+ IP firm partners could lock in cost savings, enhancing margins without compromising the 95%+ completion rate.

· Diversify: Funding claims against firms misusing COVID relief funds (e.g., Bounce Back Loans) or tax avoidance schemes (HMRC Spotlight cases) could tap into a growing market, potentially adding £5m–£10m in annual revenue if 50–100 cases are pursued at £100k average value. This diversification requires new expertise but could mitigate risks from fluctuating insolvency rates, supporting long-term profitability.

· Better cash flow management: Accelerating cash collection (currently ~12 months post-completion) through stricter payment terms with defendants could increase operating cash flow (£9.4m in FY2025) by 10–15%, providing capital for reinvestment without diluting equity.

· Better portfolio valuation: The £1.2m unrealized gain in FY2025 and a £1.9m planned write-down for Truck Cartel claims by September 2025 suggest valuation volatility.

Manolete could improve profitability by refining its risk assessment model, using historical data (1,064 completed cases) to better predict case outcomes and avoid overvaluation. I estimate that implementing quarterly stress tests on the £41.5m live case portfolio, could reduce write-downs by 20–30% (£0.5m–£0.7m), preserving net income.

This also enhances investor confidence, potentially supporting a higher valuation (current 93p vs. Canaccord’s 172p target), indirectly boosting capital access.

· Change the name of the company: This suggestion pains me as Manolete resembles a great bullfighter from Spain, my home country. For MANO the bull fighter symbolizes the stopping of the bull, or the madness that often embodies bull markets. However, the name of the company sometimes confuses investors as they think that its operations are related to Spain. Manolete is 100% UK focused, both in its operations and in its management. The only significant Spanish shareholder is probably me.

Therefore, I argue that a name that hints more directly to the nature of their business would be more appropriate.

Conclusion

The situation in the industry is as follows: Corporate insolvency levels in the UK remain at record highs, corporations are facing a debt time bomb, household insolvencies are at record high levels and larger companies are going bankrupt.

Manolete currently has record high revenues and a massive pipeline of projects. They just settled part of the Cartel Cases, and I expect a full settlement on the rest of the claim. Management changes do not affect the company; in fact, I argue it may lower costs and bring some new ideas into the company.

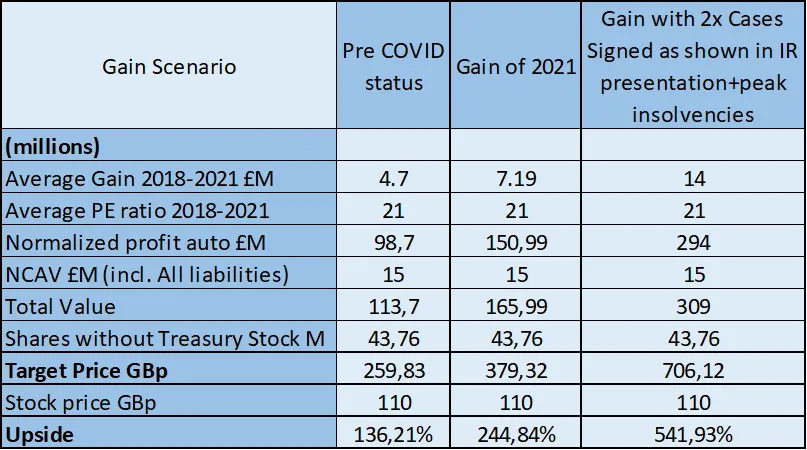

The thesis remains intact, and I reinstate the target price I set on my first report. My valuation shows that Manolete has a protected downside thanks to its fundamentals and the price its trading at, while the upside is immense due to the tailwinds it has. The thesis is simple: A good business with a great tailwind.

Manolete annual reports. Valuation of Manolete. Details on my first report.

To quote Stanley Druckenmiller: “Soros has taught me that when you have tremendous conviction on a trade, you have to go for the jugular.” I could only dream of one day becoming half a good of an investor as Druckenmiller or Soros, but this message resonates with me. Right now, Manolete is over 50% of my portfolio but due to the massive conviction I have on the stock, this percentage will go a lot higher.

Any feedback is more than welcome in the comments, or you can send me a message on Substack, or through my Twitter (X) account @AAGresearch.

As always, I want to thank my wife Yeimy, who has helped me a lot while I was writing this by myself. This report and this blog would not be possible without her. Thank you.

I hope this finds you well,

Alberto Álvarez González.

Disclaimer: I assume no liability for any and all of your actions, whether derived out of or in connection with this information or elsewhere, and you hereby warrant and represent that any and all actions that you take or that you may take at a later date in connection with this information shall remain your sole responsibility and, in case, I shall not be held liable for any such actions.

Link to report: https://open.substack.com/pub/albertoag/p/doubling-my-investment-in-manolete?r=3hhq06&utm_campaign=post&utm_medium=web&showWelcomeOnShare=false