(TheNewswire)

| |||||||||

|  | ||||||||

■

Combined After-Tax NPV8% of US$1,321 Million and

IRR of 43% over 25 years

■

Initial Capital Costs of US$185 Million for Lola Graphite Project and

US$73 Million for Morocco Anode Plant

■

Preliminary Economic Assessment for Integrated Development Plan Replaces November 12, 2024 Press Release

Abu Dhabi, United Arab Emirates – TheNewswire - December 23, 2024 – Falcon Energy Materials plc (TSX-V: FLCN) (“Falcon” or the “Company”) today announces the positive results of the Preliminary Economic Assessment (“PEA”) for the integrated development plan (“IDP”), consisting of the Lola Graphite Project (the “Mine”) in the Republic of Guinea (“Guinea”) and a natural graphite spheroidization, purification and coating plant (the “Anode Plant”, view the video HERE) in the Kingdom of Morocco (“Morocco”). The PEA, prepared by Dorfner Anzaplan UK Limited (“Anzaplan”), showcases the financial and operational potential of Falcon’s vision to become a vertically integrated producer of coated, spheroidized and purified graphite (“CSPG”) anode material at industry leading operating costs.

Falcon issued a press release on November 12, 2024 (the “November 12 Release”) which announced positive results from a preliminary economic assessment for the Anode Plant. Following a review by the Autorité des marchés financiers, the Company clarifies that the terms “preliminary economic assessment” and “feasibility study” referred to in the November 12 Release are not the same as those associated with mineral projects as defined under National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) because the Anode Plant, considered on

a stand-alone basis, is not a mineral project but rather an industrial project and thus not governed by NI 43-101. As a result, the Company retracts the November 12 Release, which related exclusively to the assessment of the Anode Plant, and replaces it with this press release which discloses the PEA for an integrated mineral project consisting of the Mine (Phase I) and the Anode Plant (Phase II).

Highlights and Key Assumptions of the Integrated Development Plan Preliminary Economic Assessment include:

-

After-tax net present value (NPV”) at a real 8% discount rate of US$1,321 million;

-

After-tax internal rate of return (IRR”) of 43%;

-

Phase I Mine pre-production initial capital costs, including contingency, estimated at US$185 million;

-

Phase II Anode Plant pre-production initial capital costs, including contingency, estimated at US$73 million1

-

Anode Plant average operating costs of US$3,193 per tonne of CSPG;

-

Mine average direct operating costs of US$616 per tonne of concentrate; and

-

Average saleable production of 26,000 tonnes CSPG per annum (tpa”) and 18,000tpa fines from the Anode Plant alongside 42,000tpa of coarse flakes from the Mine.

Matthieu Bos, Chief Executive Officer of Falcon, commented “The robust PEA results affirm Falcon’s strategic vision and dedication to closing critical gaps in the battery materials supply chain. We’re poised to advance as a key, vertically integrated, CSPG supplier to Western markets, ensuring a reliable source of high-quality, sustainable battery materials.’’

Leveraging Advanced Technology and Procurement with Hensen Partnership

The Anode Plant in Morocco will feature Falcon’s integrated mine-to-market strategy, backed by a strategic partnership with Hensen Graphite & Carbon Corporation (“Hensen”). Hensen, a leading CSPG producer, brings years of operational expertise from its successful synthetic and natural graphite anode plants in China. Hensen is currently building a large-scale anode plant in Weihai, China (the “Weihai Plant”), commissioned in Q4 2024. Hensen and Falcon have leveraged the proven design, procurement and existing supply chain practices from Hensen’s recently completed Weihai Plant to establish a highly competitive, cutting-edge facility in Morocco. The partnership allows Falcon to implement advanced technology and process efficiency to deliver high quality anode materials at scale and with competitive costs to the rapidly growing European and North American markets.

“With the Hensen partnership and redomiciliation to Abu Dhabi, we have created a unique platform, headquartered in the UAE with a listing on the TSX Venture Exchange, while maintaining an open mind to additional partnerships with industry leaders in China,” Mr. Bos continued. “Falcon’s strategy and structure are truly unique and cannot be replicated by anyone in the short to medium term. The very complicated nature of the CSPG supply chain, which is almost entirely dominated by China, makes partnerships with long-standing anode material producers a critical pathway to success.”

Integrated Development Plan Flow Sheet

The PEA contemplates the development of a large high-purity graphite mine and concentrator in Guinea and a value-added CSPG conversion facility in Morocco. Falcon’s Anode Plant envisages the construction of three distinct production lines, using established and proven Hensen technology and design, focusing on the key steps to produce CSPG. The IDP flow sheet includes:

-

Phase I: Guinea Mine and Concentrator: Low strip ratio, open pit mine followed by conventional crusher, concentrator, floatation, dewatering and screening circuit to produce a graphite concentrate (the Concentrate”);

-

Phase II: Morocco Spheroidization Plant: Employing the latest, innovative processes to shape the graphite flakes into spheres, increasing the surface area density and energy density, to produce spherical graphite (SG”);

-

Phase II: Morocco Purification Plant: Employing hydrofluoric acid alongside hydrochloric and nitric acid to remove impurities, producing 99.95% spherical purified graphite (SPG”); and

-

Phase II: Morocco Coating Plant: Applying an amorphous carbon (pitch tar) coating on the SPG surface to enhance energy density and increase battery safety and longevity, producing coated SPG (CSPG”).

Location and Infrastructure

The 100%-owned Lola Graphite Project is located in Guinea, close to the border with Liberia. The Concentrate is expected to be exported by road through the port of Monrovia in Liberia. It is anticipated that all Concentrate that is suitable for conversion in the Anode Plant will be shipped directly by sea from Libera to Morocco, while the remaining Concentrate will be sold worldwide. The Anode Plant, which requires approximately 8 hectares of land, is strategically located in Morocco on the African continent, benefiting from access to critical port and energy infrastructure and free trade agreements with both the United States and the European Union.

Lola Graphite Project Resource Statement

The resource estimate was established using data from boreholes drilled and sampled up to December 1, 2018. The total resource estimate of the Lola Graphite Project, as disclosed in the “Updated Feasibility Study” for the Lola Graphite Project with an effective date of February 27, 2023 and a report date of April 7, 2023 and available on SEDAR+ at www.sedarplus.ca (the "Lola FS”), includes Measured and Indicated Resources of 54.0 Mt grading 3.98% Cg, and Inferred Resources of 12.3 Mt grading 3.6% Cg. The resource estimate has been prepared using a cut-off grade of 1.0% Cg for oxides and 1.4% Cg for fresh rock. The PEA for the IDP does not incorporate or include Mineral Reserves disclosed in the Lola FS. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

Table 1: Lola Graphite Project Resource Statement

|

Category |

Tonnage (Mt) |

Grade (% Cg) |

Contained Cg (kt) |

|

Measured Resources |

8.26 |

4.04 |

333.6 |

|

Indicated Resources |

45.70 |

3.97 |

1,812.0 |

|

Total M&I Resources |

53.96 |

3.98 |

2,145.6 |

|

Inferred Resources |

12.30 |

3.60 |

442.5 |

-

Mineral Resources has been estimated by the Resources QP.

-

The Mineral Resources are reported in accordance with the CIM Standards on Mineral Resources and Reserves, Definitions and Guidelines prepared by the CIM Standing Committee on Reserve Definitions and adopted by the CIM Council.

-

Resources are constrained by a Pseudoflow optimised pit shell using HxGn MinePlan software.

-

Pit shell was developed using a 34-degree pit slope in oxide and 42-degree pit slope in fresh rock, concentrate sales price of US$1,389/t concentrate, mining costs of US$2.75/t oxide, US$3.25/t fresh rock, processing costs of US$10.25/t oxide and US$15.18/t fresh rock processed, GA cost of US$1.52/t processed and transportation costs of US$50/t concentrate, 84.2% process recovery and 95.4% concentrate grade and an assumed 100,000 tpa concentrate production.

-

Mineral Resources, which are not Mineral Reserves, do not have demonstrated economic viability. The Mineral Resources estimate may be materially affected by environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues. There is no certainty that Mineral Resources will be converted to Mineral Reserves.

-

The Inferred Mineral Resource in this estimate has a lower level of confidence than that applied to an Indicated Mineral Resource and cannot be converted to a Mineral Reserve. It is reasonably expected that the majority of the Inferred Mineral Resource could be upgraded to an Indicated Mineral Resource with continued exploration.

-

Contained graphite without mining loss, dilution, and processing recovery (In-situ).

-

The effective date of the estimate is February 27, 2023.

-

The open pit Mineral Resources are estimated using a cut-off grade of 1.0 % Cg oxide and 1.4% Cg fresh rock.

Totals may not add due to rounding.

Phase I: Guinea Mine and Concentrator

The Company anticipates using a contract-mining operation to mine approximately 2.5Mtpa of material and 2.3Mtpa of waste in a conventional drill-and-blast mining operation over a 25-year period. The resulting average feed-grade to the processing facility is 3.91% Cg.

The mineral processing plant consists of a crushing area and a concentrator where material beneficiation and concentrate dewatering, screening, and packaging takes place. The process flowsheet includes crushing, grinding, rougher flotation, polishing, and cleaner flotation. The back end of the concentrator includes tailings thickening, concentrate filtration and drying, dry screening and bagging of graphite products, and material handling. All the tailings from the concentrator will be thickened and pumped to the lined tailings ponds. The graphite concentrate, which has a target concentrate grade of >94% Cg, will be recovered by a conventional flotation process at an overall recovery over the life of mine of 83.6%. Over the life of the mine, the processing plant is expected to produce graphite concentrate divided into four standard-size fractions: +48 mesh, -48+80 mesh, -80+100 mesh and -100 mesh. The -100 mesh portion of the production will be used as feedstock for the Anode Plant.

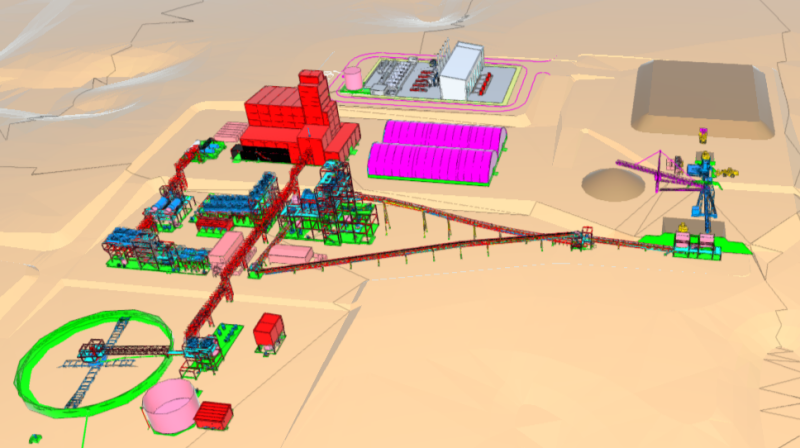

Figure 1: Illustration of Falcon’s Concentrator

Phase II: Morocco Spheroidization Plant

The 45,000tpa spheroidization plant consists of three separate process steps: micronization, spheroidization of the micronized graphite to produce coarse primary SG, and secondary spheroidization to produce a fine secondary SG product. The overall yield of the spheroidization plant is 60% resulting in 27,000tpa of SG. The micronization and spheroidization process is designed to produce spherical particles of a size of 20 microns (categorized as “SG20”) and 10 microns (categorized as “SG10”). SG20, representing 86.7% of the feed, is collected into a main collector and sent to the purification plant by pneumatic transportation. SG10 is collected and sent to secondary spheroidization circuit, which contains additional spheroidizers. SG10, representing 13.3% of the feed, is collected into a main collector and sent to a separate circuit in the purification plant by pneumatic transportation, while the remaining fines by-product particles are sent directly to the bagging station and sold separately.

Figure 2: Illustration of Falcon’s Morocco Anode Plant

Phase II: Morocco Purification Plant

The 27,000tpa purification plant consists of a chemical treatment to increase the purity of the SG from 94.6% to 99.95% and SPG. The purification plant consists of four separate process steps: a thermally induced chemical reaction, pressure filtration, washing, and drying. The SG is washed with a mixture of hydrofluoric acid, hydrochloric acid, nitric acid (the “Key Acids”) and steam to remove the main impurities (e.g., SiO2, Al2O3, MgO, Fe2O3, and CaO). Following the purification step the Key Acids are recovered in a filter press and reused. Finally, the SPG is washed to remove water-soluble impurities generated during the reaction and dried to reduce the moisture content below 1%.

Phase II: Morocco Coating Plant

The coating process is the final step of the CSPG production process. The objective of this step is to coat particles with a thin film of carbon precursor (3-25 nanometres thick), which is then crystallized. This involves milling pitch tar (10% wt.), mixing the milled pitch tar with SPG, and thermally treating the mixture in a coating furnace. The coating furnace lines are dedicated to coat primary SP20 and SP10, separately. The cooled CSPG is deagglomerated, demagnetized, sieved and bagged to ensure the final product meets stringent end-user specifications. The coating line is initially built with a 5ktpa capacity and expanded to 26ktpa following end-user qualification of the CSPG.

Figure 3: Illustration of Falcon’s Coating Plant

Phase II: Morocco Gas and Water Treatment

The Anode Plant contains gas and water treatment systems. The gas scrubber cleans the off-gasses from the purification and coating plant. A hydrated lime solution is fed into the scrubber to capture residual gas, and the purge is sent to the lime scrubber buffer tank. The clean gas is sent to a stack and released in the atmosphere. The water purification plant, which predominantly treats the effluents of the purification plant, has a capacity for 1,200 m3 / day. All waste water will be tested before discharge to the local sewage system and will meet Moroccan discharge limits.

The Anode Plant footprint and buildings are designed such that production can be doubled by adding additional spheroidization, purification and coating lines without erecting new buildings. Additionally, the plant includes advanced gas and water treatment systems, ensuring compliance with local environmental standards. Tanger Med Engineering SA (“TME”) is currently completing a preliminary environment impact analysis of the Anode Plant.

Phase I and Phase II Capital and Operating Costs

The projected capital and operating costs for the project are presented below in Table 2 and 3. The capital and operational costs are estimated based on the actual costs of the Hensen Weihai Plant, adjusted for transport to and construction in Morocco. Estimations were performed in accordance with the Association for the Advancement of Cost Engineering (‘‘AACE’’) Class 5, Recommended Practice 47R-11, with typical variation in low and high accuracy ranges of -20% to -50% and +30% to +100%, respectively.

|

Capital Costs |

|

|

Phase I: Mine and Concentrator |

|

|

Mining |

$8M |

|

Process Plant |

$62M |

|

Tailings & Water Management |

$4M |

|

Site Infrastructure |

$11M |

|

Power Plant & Distribution |

$36M |

|

Preliminary & General |

$16M |

|

Mine Total Direct Costs |

$136M |

|

Indirect |

$25M |

|

Owners |

$6M |

|

Contingency |

$17M |

|

$185M |

|

Table 2: Capital Costs

|

Phase II: Anode Plant |

|

|

Spheroidization Plant |

$19M |

|

Purification Plant |

$13M |

|

Coating Plant |

$18M |

|

Land Acquisition |

$5M |

|

Contingency |

$18M |

|

Anode Total Pre-Development Capital Costs |

$73M |

|

Combined Total Pre-Development Capital Costs |

$258M (1) |

|

Coating Plant Expansion |

$24M |

|

Contingency |

$9M |

|

Total Expansion Capital Costs |

$33M |

-

Combined Total Pre-development Capital Costs of $258M includes Mine Total Costs (US$185M), Anode Total Pre-Development Capital Costs (US$73M). Expansion Coating Capital Costs is delayed capital expenditure which is deferred until after full product qualification.

Table 3: Phase I: Mine Operating Costs (US$ per tonne Concentrate)

|

Operating Costs in US$ per tonne Concentrate |

|

|

Contract Mining |

$180 |

|

Process |

$341 |

|

Site General & Administrative |

$54 |

|

Concentrate Transport to Port |

$40 |

|

Total Direct Costs (FOB Monrovia) |

$616 |

|

Sustaining Capital Costs |

$64 |

|

All-In Sustaining Costs |

$680 |

Note: Numbers may not add due to rounding

Table 4: Phase II: Anode Plant Operating Costs (US$ per tonne CSPG)

|

Operating Costs in US$ per tonne CSPG |

|

|

Spheroidization Plant |

$314 |

|

Purification Plant |

$829 |

|

Coating Plant |

$503 |

|

Waste Disposal |

$5 |

|

General & Administration |

$54 |

|

Sales & Marketing |

$36 |

|

Contingency |

$165 |

|

Direct Operating Costs |

$1,907 |

|

Concentrate Purchase Costs |

$1,286 |

|

All-In Operating Costs |

$3,193 |

Economic Analysis

The combined Mine and Anode Plant is projected to yield annual revenues of approximately US$314 million and an operating cash flow of US$213 million at consensus concentrate and CSPG pricing. The Company expects a 24-month construction period for the Mine and a 9-month detail engineering and design period followed by a 15-month construction and commissioning period Anode Plant.

Table 5: Pre- and Post-Tax Preliminary Economic Assessment Results

Investors are cautioned to solely make an investment decision based on the full Integrated Development Plan preliminary economic assessment (as detailed in the column on the righthand side) and not base their investment decisions on either the Phase I (Mine) or Phase II (Anode Plant) economic assessment.

|

Pre- and Post-Tax Results |

|||

|

Project Life |

25 years |

||

|

Phase I: Mine |

Phase II: Anode Plant |

Combined |

|

|

Pre-development Capital |

$185M |

$73M |

$258M |

|

Expansion Capital |

-- |

$33M (1) |

$33M |

|

Direct Operating Costs |

$616 / t conc. |

$1,907 / t CSPG |

-- |

|

All-in Costs |

$680 / t conc. |

$3,193 / t CSPG (2) |

$3,193 / t CSPG (2) |

|

Pre-Tax NPV8% (3) |

$329M |

$1,259M |

$1,584M (4) |

|

Pre-Tax IRR (%) |

27% |

87% |

47% |

|

Post-Tax NPV8% (3) |

$176M |

$1,149M |

$1,321M (4) |

|

Post-Tax IRR (%) |

20% |

82% |

$43% |

|

Payback (Years) |

3.9 |

1.0 |

2.6 |

-

Incurred in year 2 of production to expand the coating line from 5ktpa to 25ktpa

-

Includes graphite concentrate purchase costs (US$754 per tonne CIF Tanger)

-

Assuming long-term weighted average US$1,237 per tonne of concentrate and US$9,000 per tonne CSPG pricing

-

Combined Pre-Tax NPV and Post-Tax NPV is lower than respective sum of Phase I and Phase II NPVs due to stockpiling and rounding

Next Steps

Based on the results of the PEA, Falcon, Anzaplan and Hensen are evaluating the possibility of advancing the IDP to a feasibility level study. If the Company decides to proceed with such a study, it is anticipated that it would be completed in the first half of 2025. A feasibility study for the IDP would also form the basis for the environment impact analysis and is required to complete the permitting process for the Anode Plant in Morocco.

Data Verification and Quality Assurance and Control

A technical report pertaining to the PEA (the “Technical Report”) will be prepared in accordance with the requirements of NI 43-101 and filed within 45 days of the date of this press release. The Technical Report will be available on Falcon's website and on SEDAR+ www.sedarplus.ca. For readers to fully understand the information in this press release, they should read the Technical Report in its entirety when it is available on SEDAR+, including all qualifications, assumptions, and exclusions that relate to the information to be set out in the Technical Report. The Technical Report is intended to be read as a whole, and sections should not be read or relied upon out of context.

The technical information contained in this news release has been reviewed and approved by Derick R. de Wit, B-Tech. (Chem Eng), FSAIMM, FAusIMM, an independent qualified person (“QP”, as defined in NI 43-101) from Anzaplan, responsible for the overall PEA of the IDP (except the sections covered by Patrick Moryoussef and Marc-Antoine Audet); Pr Tech Eng, Patrick Moryoussef (P Eng), CIM, OIQ, the COO of the Company and a non-independent QP, responsible for the mining methods and mine production schedule; and Marc-Antoine Audet (P Geo), OGQ, PGO, an advisor to the Company and a non-independent QP responsible for Mineral Resource estimate and associated chapters.

About Anzaplan

Anzaplan specializes in process design and engineering services for graphite beneficiation projects. The Company offers advanced graphite evaluation services for high value applications including strongly growing markets such as anode materials in lithium-ion batteries. Starting with the initial characterization of the graphite ore through development of a beneficiation process to obtain a high- quality flake graphite concentrate, shaping and purification into battery grade spherical graphite, characterization of electrochemical performance and testing of lithium-ion cells.

About Falcon

Falcon is focused on developing the Lola Graphite Project located in the Republic of Guinea, West Africa. Falcon aims to develop a fully integrated source of battery anode material to supply the European lithium-ion and fuel cell markets. With attractive operating costs, proximity to European end-markets and strong ESG credentials, the Company is poised to become a reliable supplier while promoting sustainability and supply chain transparency. Falcon is committed to generating sustainable, long-term benefits that are shared with the host countries and communities where it operates.

For additional information, please visit Falcon’s website at www.falconem.net.

Contact:

Matthieu Bos Matt Johnston

President & CEO IR Advisor

Email: m.bos@falconem.net Email: m.johnston@falconem.net

Telephone: +971 2307 4013

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

This press release contains "forward-looking information" within the meaning of Canadian securities legislation and other statements that are not historical facts. Forward-looking statements are included to provide information about management’s current expectations and plans that allows investors and others to have a better understanding of the Company’s business plans and financial performance and condition. All information contained herein that is not clearly historical in nature may constitute forward-looking information. Generally, such forward-looking information can be identified by the use of forward-looking terminology such as “potential”, “vision”, “affirm”, “advance”, “ensure”, “expect”, “deliver”, “anticipate”, or variations of such words and phrases or state that certain actions, events or results "may", "could", “will”, "would" or "might". Forward-looking information are included to provide information about management’s current expectations and plans that allows investors and others to have a better understanding of the Company’s business plans and financial performance and condition. Statements containing forward-looking information are made as of the date of this press release and include, but are not limited to, statements with respect to the IDP, the results of a PEA, the Technical Report, and the results and release of a Feasibility Study.

Forward-looking information is based upon certain assumptions and other important factors that, if untrue, could cause the actual results, performance or achievements of the Company to be materially different from future results, performance or achievements expressed or implied by such information or statements. There can be no assurance that such information or statements will prove to be accurate. Key assumptions upon which the Company’s forward-looking information is based include, without limitation, that proposed development of the IDP will continue as expected, the accuracy of reserve and resource estimates, the classification of resources between inferred and the assumptions on which the reserve and resource estimates are based, long-term demand for CDPG, and that exploration and development results continue to support management’s current plans for the development of the IDP.

Readers are cautioned that the foregoing list is not exhaustive of all factors and assumptions which may have been used. Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking information, including but not limited to: (i) volatile stock price; (ii) the general global markets and economic conditions; (iii) the possibility of write-downs and impairments; (iv) the risk associated with exploration, development and operations of mineral deposits and mine plans for the Company’s mining operations; (v) the risk associated with establishing title to mineral properties and assets including permitting, development, operations and production from the Company’s operations being consistent with expectations and projections; (vi) fluctuations in commodity prices, finding offtake takers and potential clients or enforcing such agreements against same, (vii) prices for diesel, process reagents, fuel oil, electricity and other key supplies being approximately consistent with current levels; (viii) production and cost of sales forecasts meeting expectations; (ix) the accuracy of the mineral reserve and mineral resource estimates of the Company; (x) labour and materials costs increasing on a basis consistent with the Company's current expectations; (xi) there being no significant disruptions affecting the operations of the Company whether due to artisanal miners, access to water, extreme weather events and other or related natural disasters, labour disruptions, supply disruptions, power disruptions, damage to equipment or otherwise; (xii) asset impairment (or reversal) potential, being consistent with the Company's current expectations; (xiii) the risk that the Company will not complete any of the PEA, the Feasibility Study or the IDP on the terms and conditions set forth herein; (xiv) risks associated to the accuracy of projections provided in a preliminary economic study which are preliminary in nature and which include significant of uncertainties; and (xv) other risks and uncertainties described or referred to in the section entitled “Risk and Uncertainties” in the Company’s management’s discussion and analysis for the year ended December 31, 2023, as updated from time to time in the Company’s interim management’s discussion and analysis for its quarterly financial periods, each of which is filed on SEDAR+ at www.sedarplus.ca.

Although the Company believes its expectations are based upon reasonable assumptions and has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that such forward-looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such forward-looking information, including notably the capacity of Falcon execute its vision to produce CSPG anode material in Morocco at industry leading operating costs, Falcon’s capacity to execute the projections provided for in the PEA and the Company’s capacity to become a key CSPG supplier to Western markets or to ensure a reliable source of high-quality, sustainable battery materials. Such forward-looking information has been provided for the purpose of assisting investors in understanding the Company's business, operations and exploration plans and may not be appropriate for other purposes. Accordingly, readers should not place undue reliance on forward-looking information. Forward-looking information is given as of the date of this press release, and the Company does not undertake to update such forward-looking information except in accordance with applicable securities laws. The Company qualifies all of its forward-looking statements by these cautionary statements.

1 Phase II Anode Plant pre-production initial capital costs (US$73 million) does not include the capital required to expand the coating plant (US$33 million), which is deferred until after full product qualification.

Copyright (c) 2024 TheNewswire - All rights reserved.