(TheNewswire)

| |||||||||

|  | ||||||||

Montréal, QC - TheNewswire - July 31, 2023 - ZeU Technologies, Inc. (CSE:ZEU) (OTC:ZEUCF) would like to inform its shareholders that it has posted its Audited Financial Statements for the year ended March 31, 2023 and the fifteen month period ended March 31, 2022, and the corresponding Management Discussion & Analysis on SEDAR.

Since the withdrawal of the proposed transaction with a Chinese entity in August 2018, Management has been forced to operate with limited capabilities. From having to define from scratch, finance and develop a new business model to the upcoming deployment of some of its products, the Company has been limited in its capacity to conclude acquisitions and see to its financing needs due to the existence of a significant debt related and inherited from the proposed founding transaction.

Attempts to mitigate the situation and renegotiate the last important block of debts owed since the maturation of the 2018 debentures in 2020 have failed.

No compensation is currently paid to directors, management, consultants, or employees. Important amounts accrued and related to compensation to management and consultants have been eliminated via mutual agreements with the creditors.

On March 31, 2023, the largest group of creditors agreed to convert almost $10,000,000 of debt against the issuance of 4,130,000 shares of the Company and a promissory note of $175,000 with a payment schedule spread over 2 years. The initial payment has been met but the Company has failed to meet its payment obligation on June 15, 2023.

Current design and development are severely hindered as all external developers have been furloughed for more than 3 quarters and the Company must rely on directors who volunteer to advance the development and negotiations with no financial resources being available.

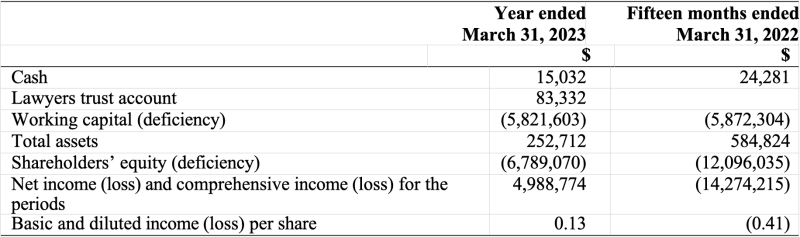

Summary of the Results of Operation

For the year ended March 31, 2023, the Company recorded a net gain of $4,988,774 (2022 – $14,274,215 loss), and had accumulative deficit of $26,227,388 (2022 - $31,216,162).

The following table provides a summary of the Company’s financial operations for the prior two fiscal years.

Twelve months ended March 31, 2023

The Company incurred a net gain of $4,988,774 in the year. Operating expenses were $2,699,541, and the Company recorded a gain of $8,020,949 in the debt settlements and recognized a loss of $446,400 in the impairment of intangible assets.

Fifteen months ended March 31, 2022

The Company incurred a net loss of $14,274,215 in the fifteen months. Operating expenses were $5,790,195, and the Company recognized a loss of $23,755 upon the sale of certain marketable securities. The Company also recorded a recognized gain of $4,491,806 on the repayment of $3,917,000 Kamari convertible debentures plus accrued interest by transferring 18,705,115 Kamari tokens to the debenture holder. The Company recognized a loss of $13,320,813 on the impairment of goodwill in a subsidiary.

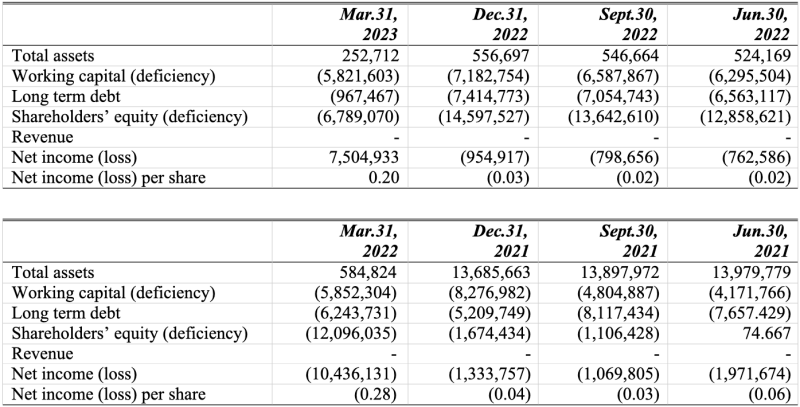

Summary of the Quarterly Results

The following table outlines selected unaudited financial information of the Company for the last eight quarters.

The main factors contributing to variances to the quarters up to March 31, 2023, were a gain of $8,020,949 in the debt settlement on March 31, 2023, a gain on Kamari convertible debt settlement in March 2022 of $3,391,988, a loss of $13,320,813 on impairment of goodwill in March 2022, a loss of $23,874 on sale of marketable securities in September 30, 2021, and stock-based compensation of $727,630 in June 30, 2021.

ON BEHALF OF THE BOARD OF DIRECTORS

“Mark Billings”

Mark Billings, CFO

ZeU is a forward-thinking Canadian technology company that has developed a state-of-the-art DLT

protocol, providing the foundation for the next generation of encrypted and distributed networks. Thanks

to its high level of sophistication, ZeU’s technology maximizes transparency, security and scalability as

well as big data management. ZeU’s strategy is to monetize DLT transactions in diverse sectors such as

payment, gaming, data, and healthcare.

The Canadian Securities Exchange (CSE) has not reviewed and does not accept responsibility for the adequacy or the accuracy of the contents of this release.

Copyright (c) 2023 TheNewswire - All rights reserved.