All-time highs are sweeping across major markets. Have we seen anything like this before? Not quite. Time to take a closer look.

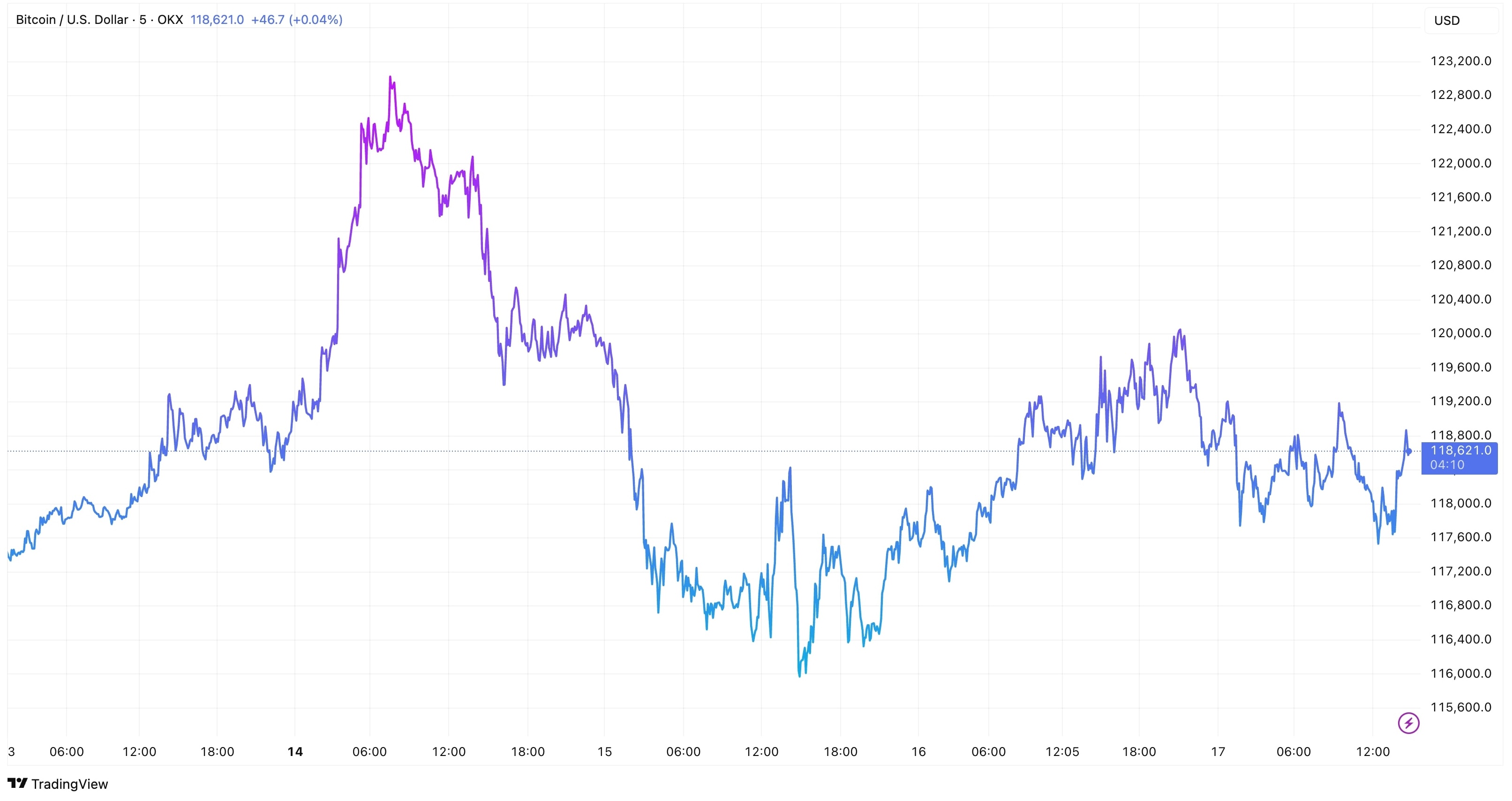

BTCUSD smashed through $122,000 on Monday — a rally that made plenty of traders ask themselves: Why didn’t I invest back in 2009? Yes, you were five — so what? The OG coin now boasts a market cap above $2.3 trillion — enough to make gold bugs sweat.

Speaking of gold, XAUUSD did a complete U‑turn, sliding 1.5% to $3,320 on Thursday after spiking nearly $60 the day before on rumors that Trump might fire Fed Chair Jay Powell. Turns out, it was just noise. Powell stays… for now. Gold gave back the gains… for now.

Let’s get back to Bitcoin. What’s fueling its rally? Institutional FOMO plus macro tailwinds — a weaker dollar, persistent inflationary pressures that could influence the Fed’s decision on rate cuts. Market participants are now speculating whether $125,000 is the next threshold.

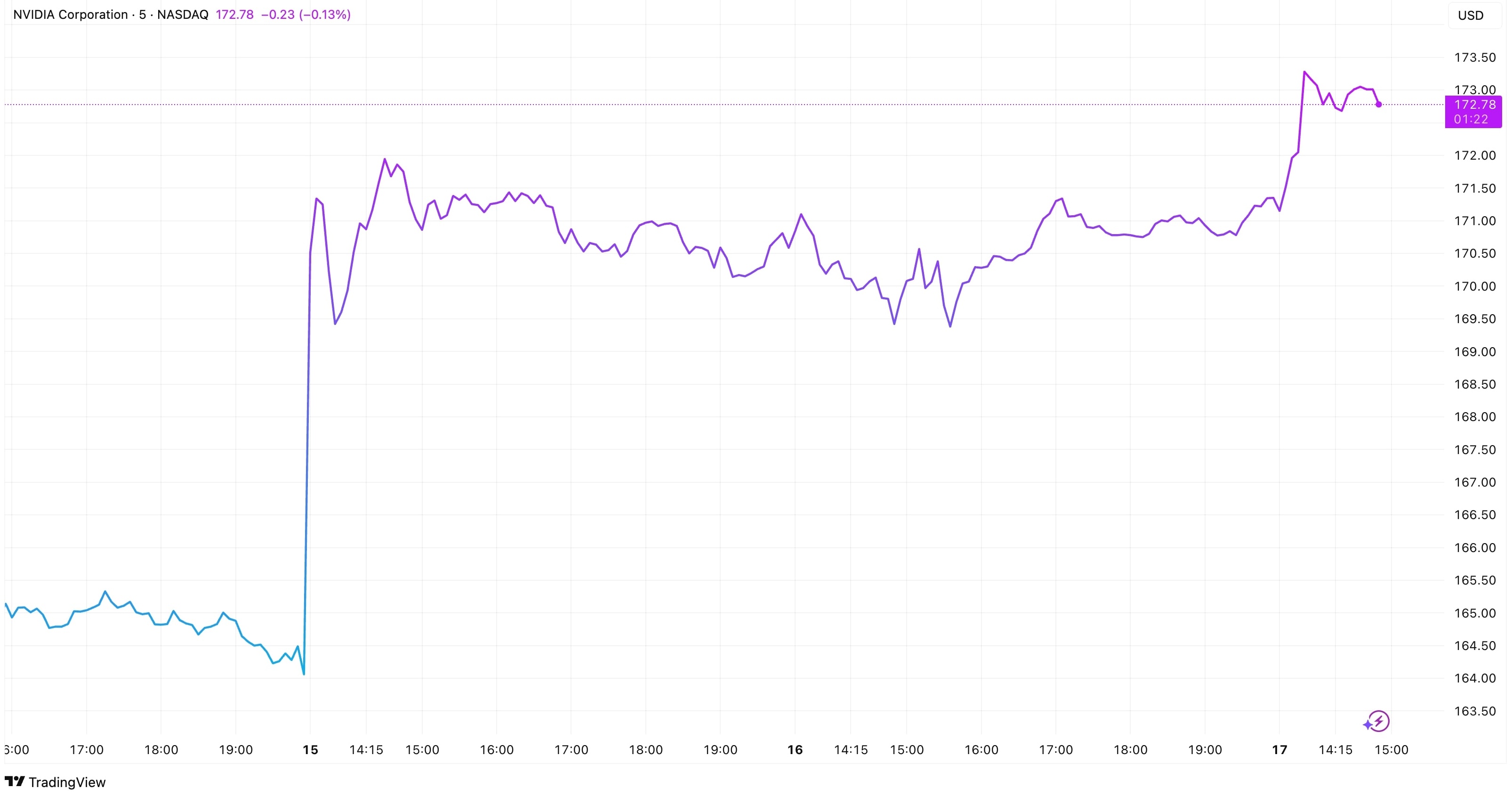

Equity markets also delivered notable developments. Nvidia became the first company to surpass a $4 trillion market capitalization, reinforcing its position as the world’s most valuable company and a dominant force in the AI-driven semiconductor sector. Governments, hyperscalers, and cloud titans throw billions at Huang’s AI chips.

The company’s performance has contributed to a record close for the Nasdaq Composite, up about 7.5% year-to-date despite earlier concerns about trade war threats, tariffs and sticky inflation.

What about the S&P 500? The Wall Street darling exhibited less dramatic growth than tech-packed Nasdaq. But it remains resilient, advancing nearly 7% year-to-date and up 26% from its April lows when tariff-related uncertainties weighed on sentiment.

Trade policy remains a key risk factor. With stocks hitting record highs and the U.S. economy staying resilient, Trump shows no signs of easing his trade war stance. The U.S. administration has announced potential 30% tariffs on imports from Mexico and the European Union, effective August 1. Both regions have criticized the proposed measures as disruptive and signaled continued engagement in negotiations to avoid escalation.

In addition, similar notices were sent to 23 other U.S. trading partners, including Canada, Japan, and Brazil, with potential tariffs ranging from 20% to 50%. This spate of letters shows Trump is back to the aggressive trade posture he took in April.

Some investors and economists note Trump's pattern of backing off tariff threats. For now, markets are calling the bluff.